Business Estimate Template

Do you need more Invoice Designs?

Customise your Invoice Template

About our Business Estimate Template

With these customizable business tax estimate templates, you can quickly create professional estimates for your customers. They are free to download and use, so there’s no reason not to give them a try!-

Streamline Your Business Estimates with These Customizable Templates

Estimating is an important part of doing business. It allows you to provide your customers with a realistic picture of what their project will cost without having to do a lot of research or analysis. You can then use this estimate as the basis for a contract between your company and the client.

What is an estimate?

An estimate is a calculated guess. It’s used to predict future outcomes, plan and budget, price projects and compare options. Estimates are also critical in order to make decisions.

Estimates can be used in any industry where there is uncertainty about what will happen in the future or how much something will cost today.

The Benefits of Using Business Estimates

- Estimates are a great tool for winning new customers.

- Estimates help you get paid faster.

- Estimates help you to get paid more often.

- And finally, estimates help you to get paid for the value of your work.

Getting Started with Estimates

Business tax estimates are an essential part of your business accounting software. They help you estimate the amount of taxes that will be due at year end, so that you can plan for them in advance and be prepared for any surprises when tax time rolls around.

-

What's Included in These Business Estimates Templates?

Business estimate templates typically include a variety of sections and components that are necessary to provide accurate and comprehensive estimates. Some of the key elements that may be included in these templates are:

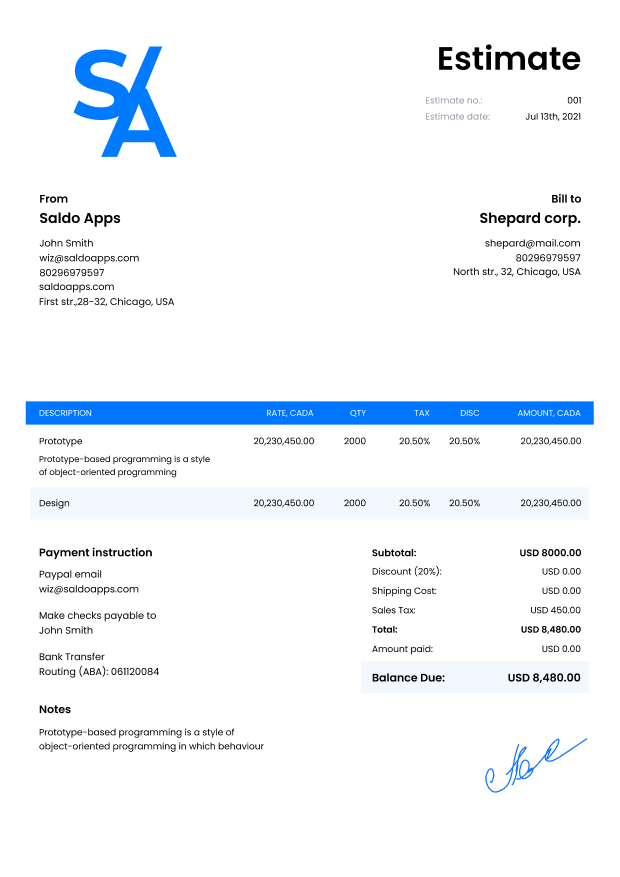

- Business and Client Information. This section typically includes details about the business providing the estimate, as well as the client receiving it. This may include company names, addresses, contact information, and other relevant details.

- Project Description. This section outlines the specific project or scope of work being estimated. It should be clear and detailed to ensure that the estimate accurately reflects the work required.

- Itemized Costs. A breakdown of costs is typically included in small business tax estimate, with line items for each expense associated with the project. This may include materials, labor, equipment, and other costs.

- Terms and Conditions. This section outlines the terms and conditions of the estimate, including payment terms, deadlines, and any other relevant details.

- Total Estimate. The final section of the template typically includes a summary of all costs and fees, as well as a total estimate for the project.

Overall, estimate templates for business are designed to provide businesses with a standardized and efficient way to create estimates for their clients, while ensuring accuracy and transparency throughout the process.

Use this template to help you create professional estimates for your customers.

It’s a great starting point, but they’re not meant to be used straight out of the box. Make sure you understand the requirements of your client before you start customizing them.

If you’re looking for an easy way to create professional estimates for your customers, these templates are just what you need!