Financial Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

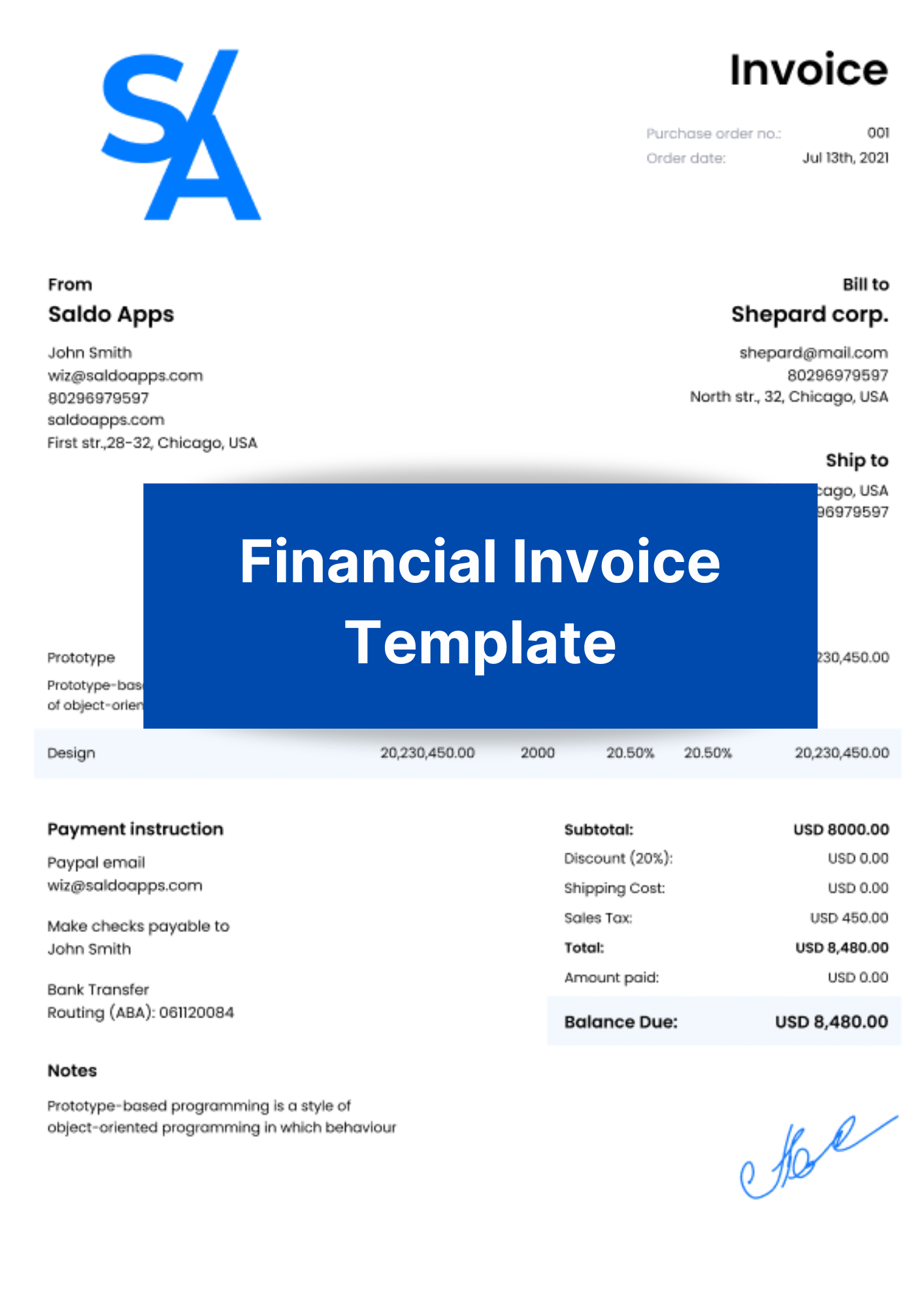

About our Financial Invoice Template

When you create finance invoices, you must be very attentive to filling in all your commerce information. To save your time and give a simple solution, we offer to use our financial services invoice template. Save like a sample, then just fill it!-

Ways of Using Financial Invoice Template

In business, there are many tools that help entrepreneurs to establish a turnover of money and not interrupt their activities. These tools include finance invoicing. With it, companies, especially start-ups or small firms, can quickly get most of the amount that a client owes them by turning to third parties. Below we explain what it is and how to use it.

A standard invoice template for service or products is issued and sent to a customer upon completion of work. After receiving the document, the orderer has some time (the period should be agreed in advance), during which they should pay. They have the right to do so even on the last day. All this time you will have to wait. However, in some cases, it can result in downtime in production. If your company needs this money, you can turn to services that offer financing invoices.

In this case, a third party appears in your relationship with a client, a factoring company, or a finance provider. This intermediary side turns unpaid bills into real money. The amount can reach up to 90% of the principal debt, depending on the agreement. Typically, the American invoice process looks like this:

- You complete a task, create a financial advisor invoice template, and send it both to an orderer and finance provider.

- After that, you get the agreed percentage of the transaction in a short time and can continue to work on other projects.

- Your debtor makes payment within the specified period. This amount goes to the provider account, and you get the rest of the money.

Of course, finance providers require fees for such services. However, sometimes getting most of the debt quickly is more important than accrued interests. Depending on the characteristics of your business, there are two options for using such invoices: factoring and discounting. In the first case, a company will control the payment from an orderer instead of you. The second option is more suitable for large businesses that can exercise control themselves.

-

Download Finance Invoice Easy With Saldo Invoice

Our library provides customizable templates for different occasions. You can fill them out on any device (smartphone, tablet, laptop, or computer) and send them to recipients by email or messenger. You can also download a template for an invoice in Excel, PDF, or Word to your device or print invoice if your clients prefer physical papers.

-

FAQ

What types of financial services can I invoice for using the financial invoice template?

The financial invoice template can be used to invoice for various financial services, such as accounting, financial consulting, or tax preparation.

Are there predefined categories for different financial services in the template?

The template may have predefined categories or sections for different financial services, but you can customize it to your needs.

Can I add a breakdown of hours worked or tasks performed for clients in the financial invoice?

Yes, you can typically add a breakdown of hours worked or tasks performed for clients in the template.

Is there space to include detailed descriptions of financial recommendations or services rendered?

You can often include detailed descriptions of financial recommendations or services rendered in the template.

Can I add my business’s banking or payment information for client reference?

Yes, you can typically add your business’s banking or payment information to facilitate payments from clients.