How to convert PDF invoice to Excel – Your Ultimate Guide

By 2025, global e-commerce retail sales are expected to grow 50% over 2021, surpassing 7.4 trillion U.S. dollars. As technology advances and E-commerce share increases, digital invoices become routine. They are easily generated, delivered in seconds, and, compared with paper invoices, more convenient for auditing and accounting.

Modern businesses often collect invoices in different formats. Using Invoice Maker you can quickly generate one in Excel, Google Sheets, PDF, Word, or Google Docs. But what if you need to save PDF as Excel file? How can you export data from PDF to Excel? Are there any benefits of each format? Our Ultimate Guide will shed light on these questions.

What is a PDF invoice?

Developed almost 30 years ago, Adobe’s Portable Document Format is still one of the most popular for invoicing. All modern computers and smartphones run by different operating systems support PDF invoices. They are usually sent by email or offered for download. Optionally entrepreneurs can export data from PDF to Excel to add information to the accounting database.

How to make a PDF invoice?

PDF sample

You can easily generate a new invoice using a ready-made PDF invoice template. Just fill in the required information about the invoice date and payment terms, the list of provided services or goods, and the billing conditions in the form. Don’t forget to include the customer’s data and assign a unique number for the invoice. When the blanks are filled, download an invoice and mail the customer.

Keep in mind that Invoice Maker helps you create different kinds of web-development invoices for over 100 industries and significantly simplifies your financial management. Real-time generated reports can also be easily uploaded and used by request.

Why choose a PDF invoice?

Over the years PDF has made a reputation for being an excellent format for invoice mailing. And here are just few of the PDF benefits:

- Compatible with any operating system. The same display regardless of the device;

- Delivered much faster than paper invoices;

- Accelerated payment terms. Speeds up the payment receipt;

PDF invoices are easy to fill out. This format allows you to customize an invoice and build in the payment tools. Such documents are easy to store, print, and export invoice format in Excel.

What is an Excel invoice?

Designed 35 years ago by Microsoft Corporation, Excel remains one of the primary formats for freelance and small business bookkeeping. If you use Excel for calculations, you should try Excel invoices. With the Invoice Maker template, you will quickly learn how to make bill in Excel.

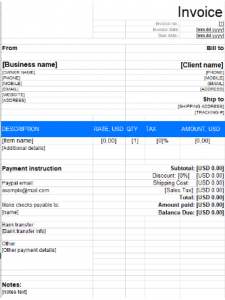

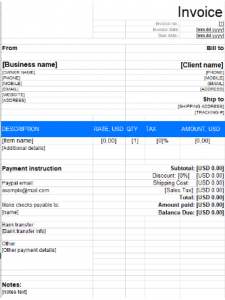

How to use Excel invoice template?

-

- Download our ready-made template.

- Open the saved copy, fill in the blanks and edit it according to the requirements.

- Assign the unique invoice number and save the changes.

- Send the invoice to the recipient.

Excel sample

Why choose an Excel invoice?

Excel format might appeal to entrepreneurs who are just starting their businesses. It is also suitable for those who deal with accounting and sales manually. Here are some reasons to try Excel invoicing:

- Easy access. The format does not need to be converted to enter into an Excel database;

- Automatic formulas. Ability to customize calculation formulas;

- Low cost. No need for additional software or extra expenses;

One should keep in mind some disadvantages of this format. First of all, it is a manual input. In this case, the processing and accounting of invoices will be much more durable. You also need to learn special formulas to keep accounts in Excel. In addition, this format is not always displayed correctly on smartphones and tablets, which can cause problems for your clients.

How to convert a PDF invoice to an Excel spreadsheet

PDF invoices have earned a good reputation among entrepreneurs across the U. S. and worldwide. Unfortunately, this format is not suited for Excel calculations. Let’s see how to extract data from PDF to Excel.

Manual transfer

This approach is pretty time-consuming but not trustworthy. As the business expands and transactions increase, the risk of errors increases significantly.

Special software

If you are not a great fan of manual input or coping, try some PDF editing programs. They transfer data to Excel straight from the PDF file, reducing the risk of errors. Sometimes it can happen that the invoice can not be processed correctly. When this occurs, you have to correct the spreadsheet manually.

Online converters

These tools can also be handy in case you need to save PDF as Excel file without downloading extra software. Modern online converters can be based on a simple data conversion or use an Optical Character Recognition technology. OCR provides more accurate and faster document conversion, which is especially useful when working with many invoices.

So, which method to choose? Our team recommends using special conversion tools. Copying and manual transfer can be helpful for novice entrepreneurs but do not show decent performance in everyday use.

Best tools to convert PDF invoices to Excel online

Choose a converter that matches your requirements. Below we have compiled a list of the most used services for document formatting.

- I love PDF quickly exports PDF files to Excel. Notice that its free version operates only one document per request.

- Small PDF allows converting, processing, and editing documents in PDF, Excel, PowerPoint, and JPG formats. The tool also allows processing multiple files at once.

- Free PDF. Good app, but takes up to 40 minutes per session with a free version of a service.

- Soda PDF is a multitasking helper that works both online and via the Desktop version.

When choosing a converter, each tool has its own advantages. We recommend testing them separately to realize which is really up to you.

Ready-made templates from Invoice Maker

Already sick of converting invoices? Start using Invoice Maker from Saldoinvoice. It has over 100 design options and supports the most common formats, including:

Our samples support auto-completion and pre-save a list of items or services. Using the built-in payment form will speed up the checkout process.

Try a new level of invoice management efficiency. Invoice Maker automatically records transactions and calculates the revenue and the number of overdue checkouts. With this helpful tool, you’ll always know your income. Don’t hesitate and learn how to make a bill in Excel, PDF, and other forms in seconds.

Preparing for Conversion

Before you proceed with the actual conversion, it’s crucial to prepare your PDF invoices for successful conversion. One of the first things you can do is ensure the use of specialized tools and software.

Modern technology provides us with a variety of tools and software that simplify the automating conversion process. When preparing for conversion, select the right PDF reading software that offers streamlining invoice management and an easy PDF to Excel converter function.

Preparing your PDF invoices for conversion is critical. Ensure that the invoices are not password protected and have clear, legible text. Some software even offers the capability of extracting data and converting invoices from scanned or image-based PDF files using Optical Character Recognition technology.

Convert PDF invoice to Excel

After choosing your PDF to Excel converter and preparing your PDFs, start the conversion process. Open the software, select the PDF file to be converted, choose the output as Excel format, and initiate the conversion process. Note that some software might require you to define specific areas from where the data should be extracted, this helps in improving accuracy and integrating conversion into your workflow.

Using Excel Features and Tools to Optimize Data

Excel has powerful tools that can significantly enhance data analysis. After converting invoices, utilize Excel’s built-in features such as formulas, filters, conditional formatting, and pivot tables for easy management. This not only enables you to analyze it but also makes the analysis process efficient, leading to significant cost savings and time savings.

Edit and Analyze Data in Excel

Excel, as an effective tool for data editing and formatting, can be your best ally when dealing with invoice data. To transform it according to your needs, you can:

- Rename columns

- Delete unnecessary entries

- Reorganize the invoice to match your preferred style

But that’s not all, the power of Excel functions allows you to conduct complex calculations on your invoice data. You can sum up total invoice amounts, calculate taxes, and even explore more advanced statistical functions with Excel’s data analysis toolpak.

Saving and managing converted accounts

After conversion and data analysis, save your work. You can save it as an Excel workbook for future edits or export it to a PDF or CSV format for sharing or archiving.

With these tips for efficient conversion, converting PDF invoices to Excel becomes a walk in the park. It improves your business’s financial management, enabling you to focus more on growth and less on administrative tasks.