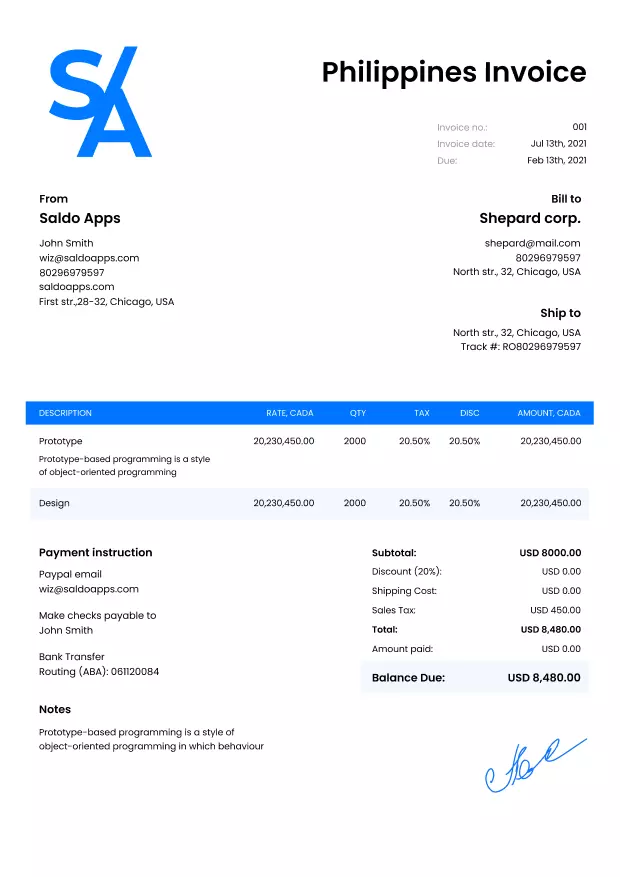

Philippines Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

-

How to Create a Philippines Invoice?

Doing business in the Philippines means your business must meet specific criteria to apply for VAT. The need for bookkeeping and timely issuance of sales invoice Philippines applies to all companies doing business locally, no matter whether you have an office in this country or not.

If you schedule to apply for VAT, you must provide detailed financial statements of all transactions. Therefore, successful business people actively utilize the invoice financing Philippines system to avoid irrevocable mistakes and fines that may follow them.

Free templates are an opportunity to automate the invoicing approach, edit and add the required number of fields and specify all the necessary details to ensure that you can refund VAT on time. More importantly, the free digital invoice template that you can locate on this website allows you to issue invoices in local and foreign currencies.

If you are a VAT payer in the Philippines, you should take into account that the tax invoice Philippines paper must fit specific details and comply with clear rules, namely:

- Every item sold and service rendered must be invoiced

- Your company must report the exact amount of VAT on each sale

- Local and international businesses are responsible for bookkeeping and financial reporting

Using the invoice template Philippines is the perfect way to go if you want to make it easy to follow all the above points. Organizing the billing procedure will allow you to be sure that you will not miss anything important. Moreover, the free billing invoice sample Philippines is great for adding a list of eligible payment methods. Thus, your customers can make payments quickly and on time.

-

Download Philippines Invoices Easy With Saldo Invoice

While on this site, you have a unique opportunity to download a free invoice template for Australia by Saldo Invoice. Our invoice generator will help you find the right paper under your business type. Feel free to download and edit any number of invoices right away!

-

FAQ

What are the specific requirements for an invoice template in the Philippines?

In the Philippines, an invoice template should include details such as the seller’s name and address, Tax Identification Number (TIN), buyer’s name and address, invoice number, date, itemized list of goods or services, prices, and applicable taxes.

How does the Philippines invoice template differ from generic invoice templates?

The Philippines invoice template includes specific fields required by the Philippines Bureau of Internal Revenue (BIR), such as the TIN, and follows the format mandated by the country’s tax regulations.

Why is it important for businesses in the Philippines to use a compliant invoice template?

Using a compliant invoice template ensures that businesses meet the legal requirements set by the Philippines BIR, which is essential for tax compliance and avoiding penalties.

How can a Philippines invoice template be customized for different types of businesses?

A Philippines invoice template can be customized to include additional fields specific to different types of businesses, such as those related to industry-specific regulations or invoicing requirements.

In what ways can a Philippines invoice template help businesses maintain accurate financial records?

By providing a standardized format for documenting sales transactions, a Philippines invoice template helps businesses maintain accurate financial records, which is crucial for accounting, tax reporting, and financial analysis.