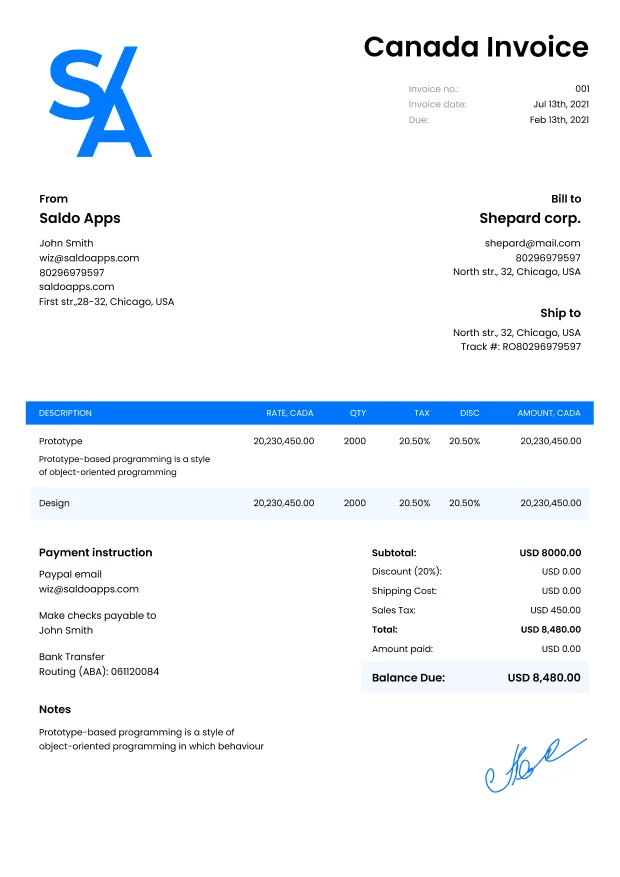

Canada Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

About our Canada Invoice Template

If you were looking for a perfect Canadian invoice template with GST taxes, so you found it! in our template, you can add all the information, that you need, and every specific tax will be included in your invoice in Canada!

-

What Fields Must Invoice Template Canada Have?

Businesses that operate internationally should be aware of the invoicing features of each region and send digital or printed invoices to customers filled out in accordance with local requirements. If you have clients in Canada, you should know that this country is part of the GST tax system (in Europe, it is better known as VAT), which means you need to consider this tax when filling out the Canada invoice template.

Be sure to check local laws to make sure you enter all the information correctly. The fact is that the amount of Harmonized Sales Tax (HST) varies depending on the specific area since it combines provincial sales tax and GST (the maximum amount does not exceed 15% but can be lower). It is essential not to make a mistake when entering information on the Canadian invoice form.

Keep in mind that under the HST system, there are some goods and services that are considered zero-rated (certain food, medical devices, etc.) or completely exempt from taxes (health or educational services). Our free invoice template Canada allows you to enter both taxable and exempt items no matter what your company does.

In addition to a correctly calculated HST, any Canada invoice example also contains the following data:

- information about the service provider;

- contact details of clients;

- a list of services performed and goods provided their quantity and cost, and the total sum payable in the currency of the region (Canadian Dollar);

- payment methods and terms;

- fees, delivery costs, and discounts.

Add tips and notes to your Canadian invoice template to help customers make payments as soon as possible and without any issues.

-

Download Canadian Invoices Easy With Saldo Invoice

Local guidelines require that all such records be kept for at least six years. When using our invoice generator Canada, all your files are stored in the cloud, which means that you do not have to create an additional archive for the filled payment papers.

Thanks to our platform, you can arrange online invoicing Canada from any device available and suitable: smartphone, tablet, laptop, or PC. Download the form to your device in the format you need or fill out the Canada, India, or USA invoice template (or form for any other country or category) online on the spot. Many businesses have switched to a paperless workflow, so you can send the completed form to a recipient using a link or by email to the email address listed in the contacts. If necessary, the finished file can be printed or saved locally.

-

FAQ

Is the Canada invoice template compliant with Canadian tax regulations?

Yes, the Canada invoice template is designed to meet the invoicing requirements and tax regulations specific to Canada, making it suitable for businesses operating there.What are the essential elements of the Canada invoice template?

The Canada invoice template includes fields for the seller’s and buyer’s information, item descriptions, quantities, unit prices, taxes, and the total amount.Can I use the Canada invoice template for international transactions?

While the Canada invoice template is tailored for Canadian transactions, you can modify it to include relevant information for international deals.