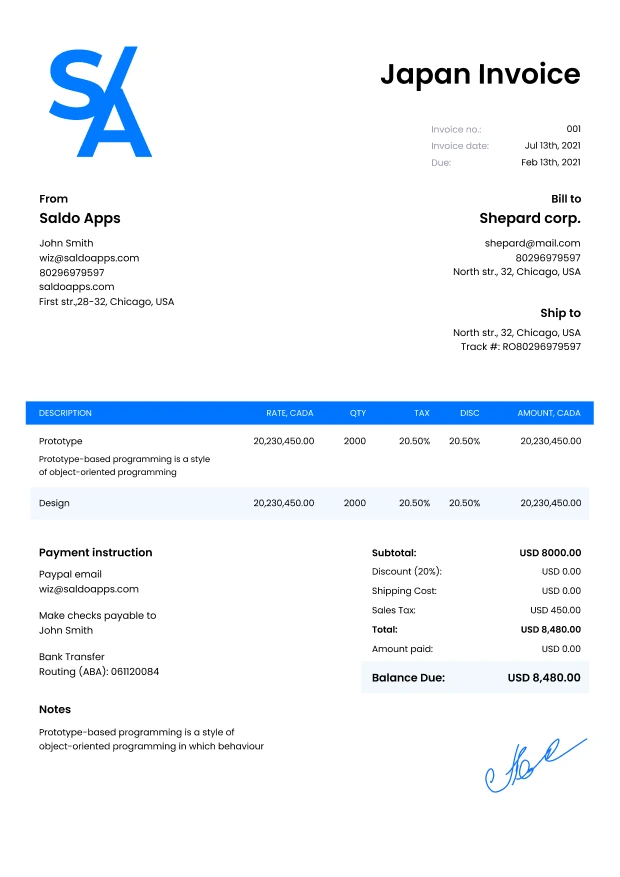

Japan Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

-

How Do I Use Invoices in Japan?

When doing business in Japan, you must consider several factors, including mandatory VAT provisions and Japan invoice specifics. Compliance with all the standards and requirements of tax legislation looks much more manageable if a company uses custom Japanese invoice samples. This is a great way to homogenize your invoicing process, fill in all the required details, and keep your payment on time.

Just like in the case with invoice Arabic, you will need to consider the compulsory list of information included in the invoice Japan document. It involves the invoice date, a detailed list of services rendered or goods sold, and customer details.

Please note that starting October 1, 2023, the Japanese Consumption Tax (JCT) will require businesses to use the updated invoicing system for local and international companies. The new system means innovations in issuing an invoice in Japanese and additional requirements for certain types of financial records.

Therefore, using the Japanese invoice template will allow you not to miss even the smallest detail and always meet the necessary provisions of JCT. Try downloading and customizing your free invoice spreadsheet right away. In turn, you will ensure that the entire billing process takes no more than 2 minutes.

Remember that an invoice must contain information for each transaction. Therefore, the invoice system that your business uses must be standardized. A free prepayment invoice template or rent a car invoice available will allow you to create and store invoices in a convenient setup and print them in one click (if necessary).

-

Download Japanese Invoice Easy with Saldo Invoice

If your business frequently issues recurring invoices, switch to autopilot invoice editing mode, and the thing is as good as done. Automating recurring payment transactions with Saldo Invoice means you can generate payment reports on any available device with just one tap.

No matter what size business you have, billing administration and control ensure that you file your tax returns on time with the Japanese tax authorities and avoid too much red tape.