Singapore Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

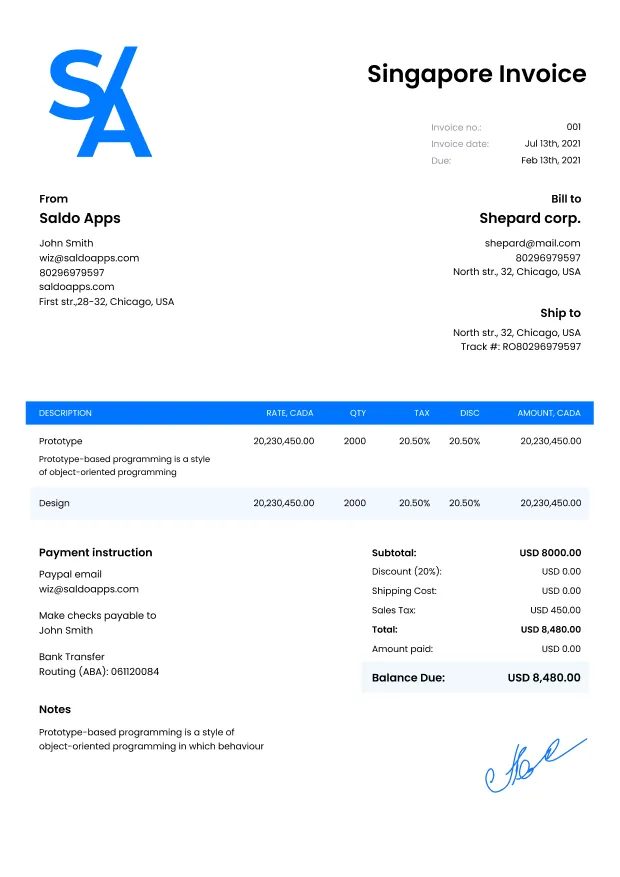

About our Singapore Invoice Template

When invoicing Singapore clients, it is vital to consider all the specific taxes and payment methods. Explore our article below to learn all about international invoicing. You can use the Singapore GST tax invoice format or fill in the form to complete the Singapore invoice template without GST. Also, use a fillable Singapore invoice sample by Saldo Apps.-

How to create an invoice in Singapore?

If you are looking to create an invoice for a Singapore business, you can use the following information to help you get started. You can find the Singapore invoice sample above on the page that you can use to create an invoice for your business.

GST is levied at a rate of 7% on supplies of goods and services made in Singapore by a taxpayer in the course of or in furtherance of its own business and the importation of goods into Singapore. In the budget for 2022, it was stated that this rate will be increased to 8% from January 1, 2023, and to 9% from January 1, 2024.

The invoice should include the following information:

- Your business name and address.

- The date of the invoice.

- The name and address of the person or company receiving the invoice.

- A list of items or services for which you are billing the client. The invoice total and payment due date.

- Taxes that apply in the territory.

You can make your invoice more professional by including your logo and by choosing the right font and layout. A logo on your invoice can help your business stand out and can also help clients identify who created the invoice. You can make your invoice more readable by using a font of adequate size and with a readable typeface. There are many fonts that you can choose from. However, the most important thing is to choose a font that is easy to read and one that matches the business type that you operate. You can also use design elements such as bold and italic text, bullets, and numbers.

Tips for creating better invoices for your business:

– Always be timely with your invoices. You don’t want your clients to wait too long to receive their invoices. It can be unprofessional and may make them question your abilities as a business owner.

– Make sure your invoice has correct information – Your invoice should include your business name, address, and phone number. It should also include the date that the invoice was created. Your invoice should also include the details necessary for the recipient to make payment, such as the method of payment, the amount, and the due date.

– Include a footer. A footer is a section at the bottom of your invoice that includes your company’s information, terms and conditions, and a disclaimer. This can help protect you in case a client disputes the invoice.

-

Download Singapore Invoice Template Easy With Saldo Invoice

The most obvious reason you should create a Singapore invoice for your business is that it can help you track your expenses and revenue. You can use invoice details to keep track of when and to whom you sent invoices, which can help you improve your cash flow. Use the Saldo Apps to track the payment terms agreed upon with your clients in Singapore. You can also use it as evidence if you need to file a dispute with a client. A professional-looking invoice can also help to build your business credibility. It can also help you keep track of your inventory by including details such as the product or service purchased and its cost.

Creating invoices can help you stay organized when you’re preparing your taxes. You can use the information in your Singapore tax invoice to determine your taxable income. You can also use it to write off certain business expenses. It is easy with invoice templates for Singapore’s companies.

-

FAQ

Is the Singapore invoice template compliant with Singaporean tax regulations?

Yes, the template is designed to accommodate the tax regulations and requirements in Singapore, including the Goods and Services Tax (GST).

Can I use this template for international transactions involving Singaporean businesses?

Yes, you can use the Singapore invoice template for international transactions with businesses based in Singapore.

Does the template support multiple currencies for invoicing?

Yes, you can customize the template to include multiple currencies if your business deals with various international clients.

Are there any predefined payment terms in the Singapore invoice template?

The template may include standard payment terms, but you can modify them to match your specific payment agreement with clients.

Is it possible to add a section for additional notes or comments on the invoice?

Yes, you can include a section for additional notes or comments on the Singapore invoice template to provide any necessary details.