Payments built on trust.

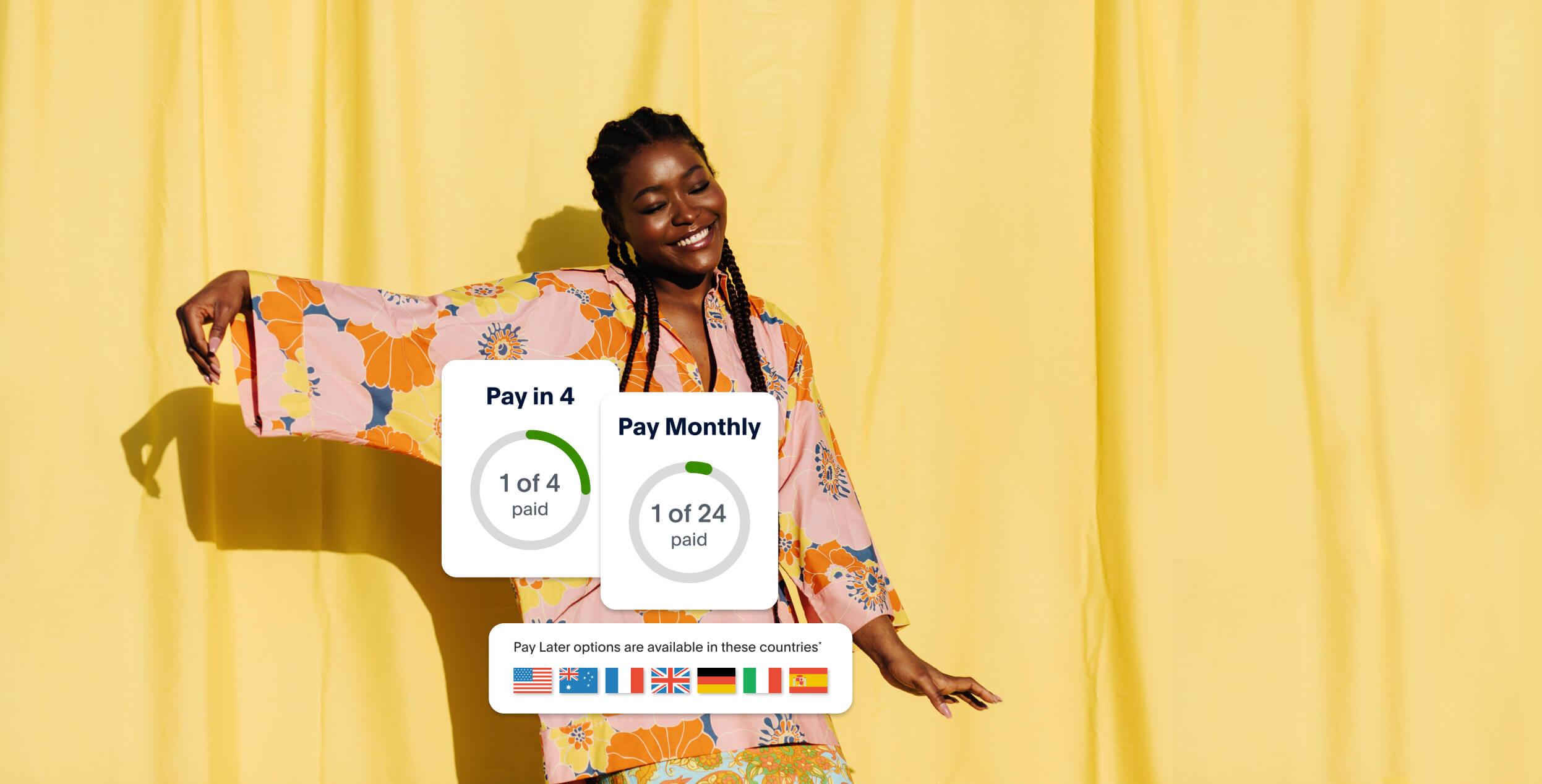

Help drive sales with Pay Later.

Tap into over 92 million active Venmo accounts.6

More reasons to offer PayPal.

$1.36 trillion

20+ billion

400+ million

35 million

#1

200+

130+

#1

Designed with your business in mind.

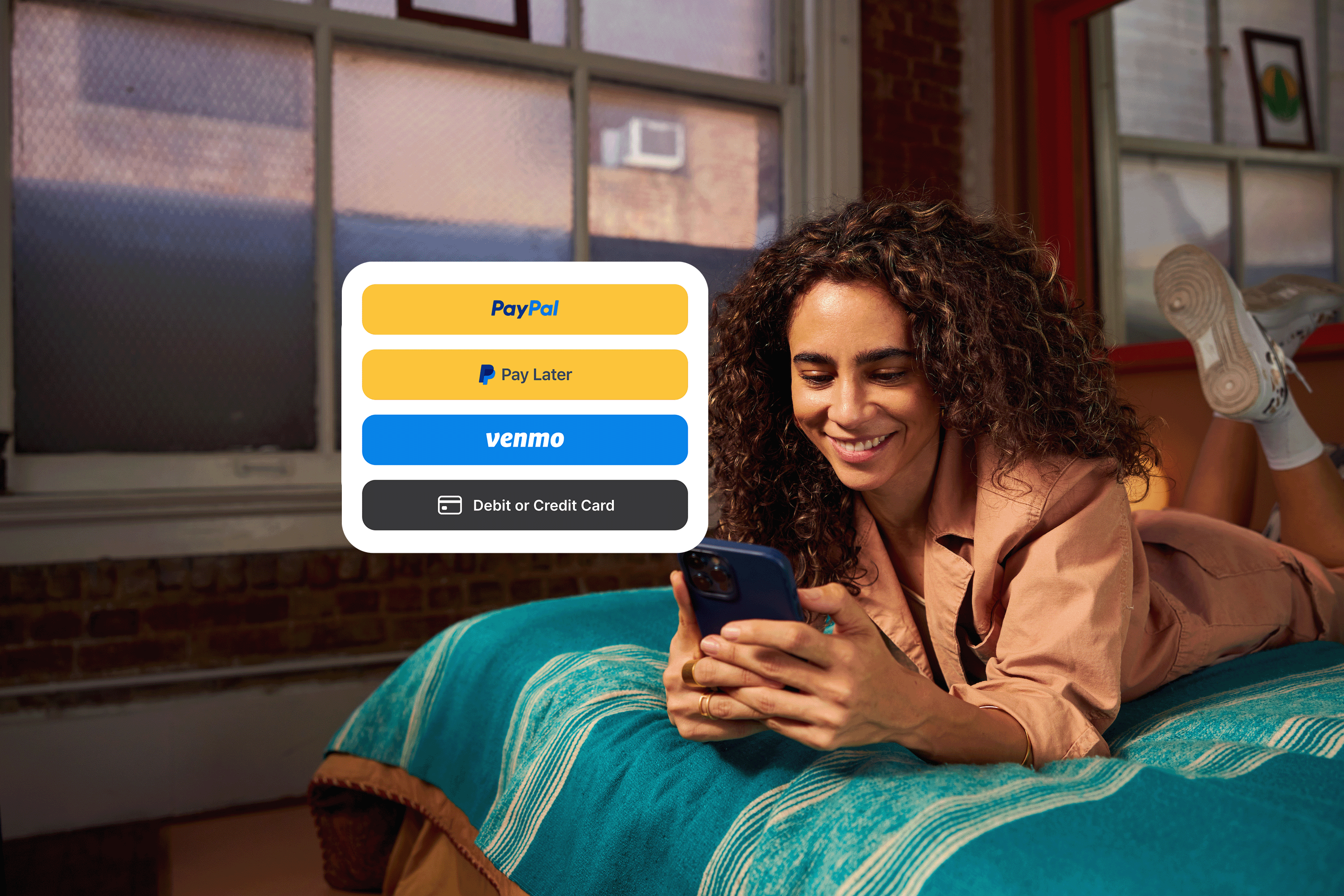

Payment methods

- PayPal, Venmo, and Pay Later options

- Funds credit immediately into your PayPal business account while payments process

- Easy to add or upgrade in just a few steps

Flexible features

- Save customer billing info for fast, convenient checkout

- Mobile-friendly so customers can easily shop on any device

- Drive authorization rates, reduce declines, and help capture every sale

- Track all your transactions from one dashboard

- Help drive authentication and fast checkout rates by saving customer card and billing info with card vaulting

- Real-time account updater automatically updates lost, stolen, or expired card details to help boost conversion

- Add transparency for your card processing expenses with IC++ (Interchange Plus Plus)

Peace of mind

- PayPal helps you handle the risk of fraudulent purchases

- AI-powered fraud detection monitors all transactions

- PayPal Seller Protection on eligible transactions safeguards PayPal Checkout9

- PayPal solutions help you meet global compliance standards

- Additional security offers insights with Fraud Protection on eligible transactions10

- Optional Chargeback Protection to help reduce fraud-related costs11

How to Activate PayPal Payments

Pricing with no surprises.

No monthly or setup fees. Only pay when you get paid.12

Fees applyVenmo is available only in the US.

* Pay Later is available in US, UK, DE, FR, IT, ES, AU. Product availability subject to local requirements. Merchant and consumer eligibility varies depending on status. Credit checks, fees and other requirements apply and vary depending on product and jurisdiction. See product-specific terms for details.

1 Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

2 PayPal is the most popular BNPL provider with 43% of BNPL users naming PayPal as their preferred provider. J.P. Morgan Research, "Buy Now Pay Later (BNPL) Report", October 2022.

3 About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. Term lengths and fixed APR of 9.99-35.99% vary based on the customer’s creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): RI Loan Broker Licensee. VT Loan Solicitation Licensee.

4 Based on PayPal internal data from Jan 2022 - Dec 2022.

5 Globally, Pay Later AOVs are 35%+ higher than standard PayPal AOVs for SMBs. Internal Data Analysis of 68,374 SMB across integrated partners and non integrated partners, November 2022. Data inclusive of PayPal Pay Later product use across 7 markets.

6 PayPal Internal Data - 2023.

7 In July 2022, PayPal was recognized as the #1 most downloaded finance and banking app globally. **Apptopia, Top 10 Finance & Banking apps, H1 2022. July 13, 2022.

8 CR (Consumer Reports), "Buy Now, Pay Later Apps Are Popular, but Are They Safe?" Consumer Reports , May 25, 2023.

9 Available for eligible transactions. Limits apply.

10 Available on eligible purchases.

11 Chargebacks that are not related to fraud or item not received (INR), such as broken Item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not protected by Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

12 Our standard rate pricing listed herein is for US transactions only in USD and is effective starting on August 2, 2021.

MRF-93931