How to Add Taxable and Non-Taxable Items on One Invoice

Invoicing is never as straightforward as you might think, especially when you need to create a document that contains both taxable and non-taxable items. When that happens, many business owners find themselves in a predicament as to what to do. Should they prepare a separate payment request for taxable items and then generate a similar one for the non-taxable services? Or can they just put them all on one invoice and be done with it?

Handling taxable and non-taxable items correctly on a single invoice is crucial to ensure legal compliance and financial accuracy. Failing to distinguish between the two will likely lead to legal complications, tax errors, and fines. At the same time, doing things right will help keep your financial records clear, your tax reporting accurate, and your relationships with the customer and tax authority trust-based and transparent.

Below, we provide a clear definition for each of these two item types on your invoice and look closely at what they both mean in the context of effective business operations. We also discuss how to create a professional and polished invoice containing both.

Differentiating Taxable and Non-Taxable Items

When your payment request to customers is a mix of taxable and non-taxable items, the invoicing process might get tricky. Without proper differentiation and categorization, the chance of making errors that will cost your business money and reputation is a substantial one.

Below, you’ll find a definition of taxable and non-taxable items on your invoice and learn to identify and categorize both for the purpose of accurate taxation.

- Taxable items on an invoice are goods or services subject to taxation by governmental authorities. These usually include products or services for which a sales tax, VAT, or similar taxes apply (furniture, house appliances, clothing, some labor works, etc.).

- Non-taxable items are goods or services exempt from the collection of a sales tax, value-added tax (VAT), or other applicable taxes. What products or services constitute non-taxable items is determined by government and local tax regulations and can vary based on the jurisdiction. Examples of non-taxable items may include certain essential foods, prescription meds, educational services, etc.

When you have to prepare an invoice featuring both taxable and non-taxable items, you need to categorize and differentiate these very carefully. Review local tax laws and regulations and clearly label each item, specifying whether it is subject to taxation or comes under a tax-exempt category.

Practical Application

When drafting a payment request with a mix of taxable and non-taxable items, you’d want to follow the steps outlined below to ensure accuracy in calculations and legal compliance:

Step 1: Identify items.

Identify each item as either taxable or non-taxable. Specific descriptions help avoid confusion.

Step 2: Create taxable and non-taxable sections.

Create separate sections for taxable and non-taxable items on your invoice. Proper organization helps both you and your customer understand the different categories.

Step 3: Specify an applicable tax rate for each taxable item.

State the accurate tax rate for each taxable item. Being thorough in this step enhances the transparency of the transaction and helps all those involved understand the specific elements that constitute the overall cost breakdown.

Step 4: Calculate totals separately.

Always tally the totals for taxable and non-taxable items separately to offer your customers a clear and comprehensive overview of the overall costs.

Step 5: Summarize.

Finally, offer your customers a concise summary that breaks down the contents of the document into taxable and non-taxable subtotals, followed by the overall total.

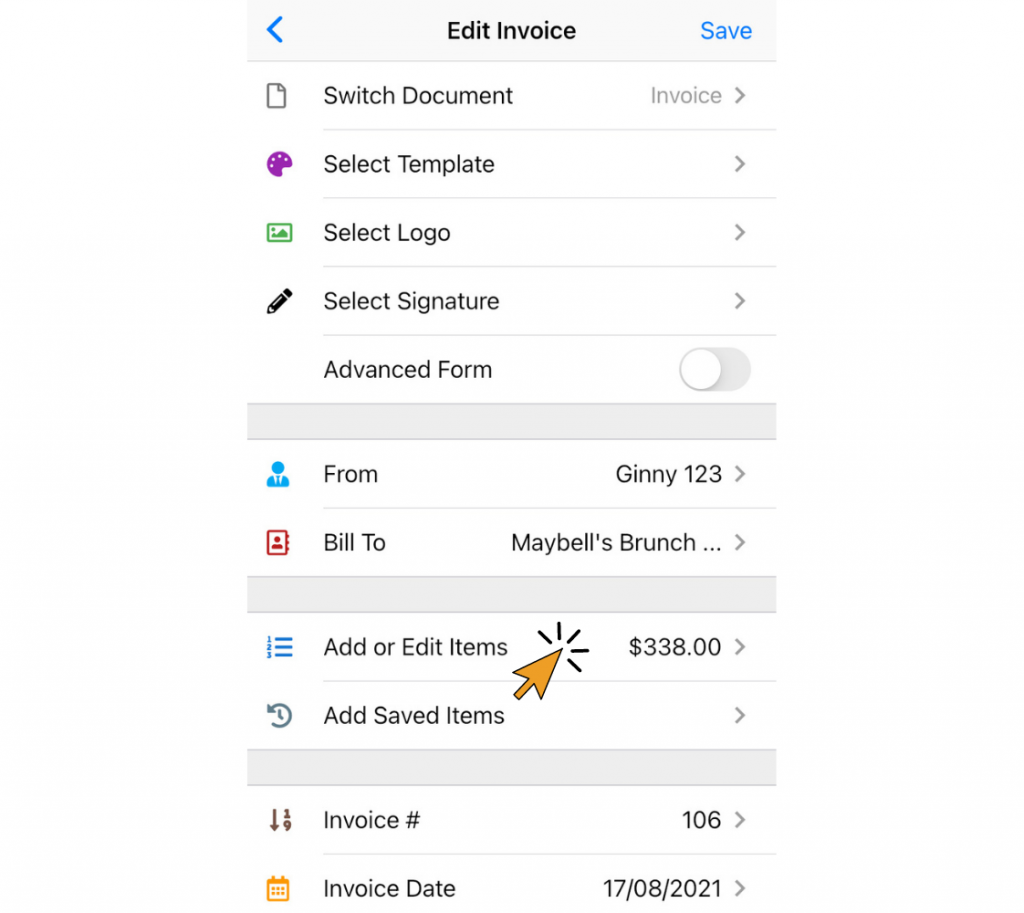

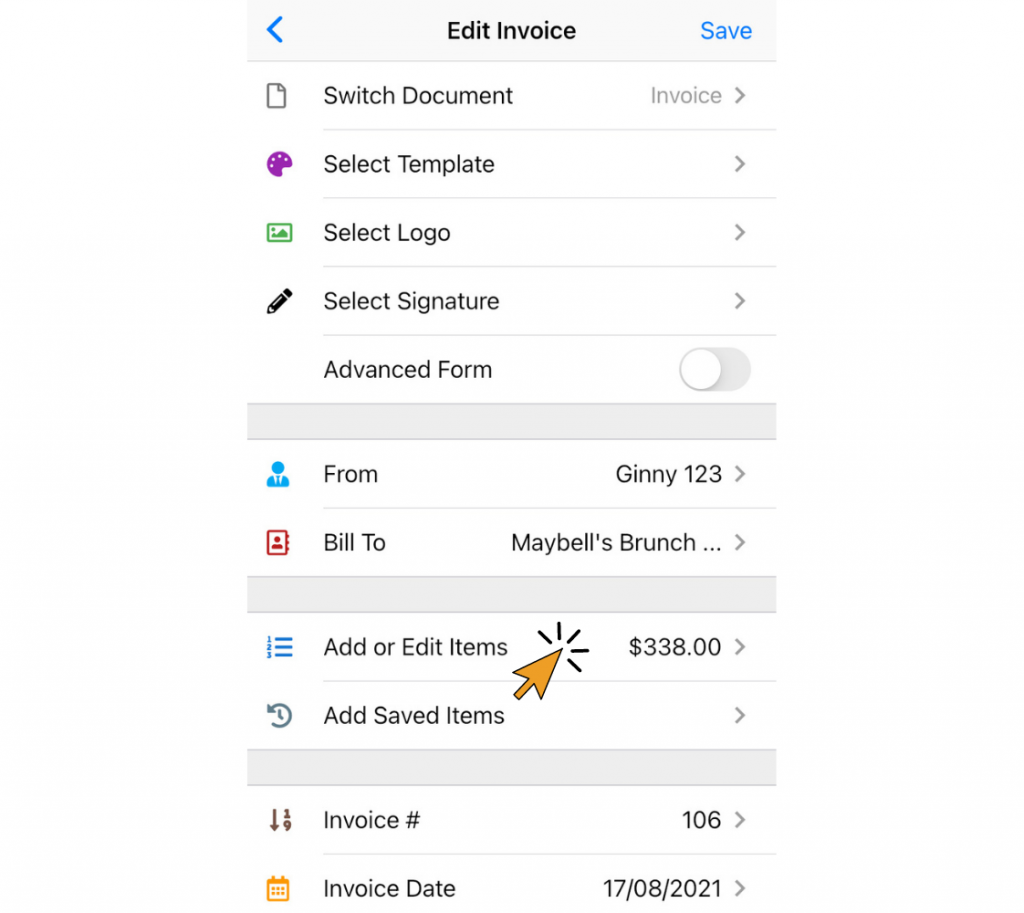

If creating invoices from scratch takes too much time, consider using specialized invoice-generating software like Invoice Maker by Saldo Apps. This robust tool offers hundreds of ready-made, customizable documents, including

business invoice templates,

e-commerce invoice templates, and

restaurant invoice templates. The platform allows users to create clear and well-organized payment requests within minutes, introducing efficiency and precision into the invoicing process.

Compliance and Legal Considerations

In today’s business, one must accurately navigate the legalities of invoicing. Mixing taxable and non-taxable items on a single invoice, if done incorrectly, can mean legal headaches, fines, and reputational damage. Here are some tips for staying on the right side of the law with your invoices:

- Be prepared for an audit: keep records of invoices accurate, well-organized, and easily accessible, ready for potential audits.

- Seek legal consultation: use the services of legal pros to ensure that your practices fully align with current regulations.

- Conduct compliance checks regularly: perform routine internal audits to ensure ongoing compliance with tax laws.

- Be adaptable to changes: regularly review and update your business’s invoicing procedures to align with the latest legal requirements.

Confidently Managing Taxable Items in Invoices

Handling taxable and non-taxable items on invoices requires precision and attention to detail. A single wrong move, one tax rate stated incorrectly, or a misstep in categorization, and your business risks legal complications and financial troubles. We hope the recommendations in this post will help you write an organized and transparent invoice that clarifies things for the customer, complies with tax regulations, and promotes your company’s professional image.

Elizabeth Cherepyna

Product Manager, she is analytic of the behavior of users in the application, communicates with them, to better understand what we need to improve, and sets tasks for her team.

Learn more