How to Make a Business Invoice and Tips for Faster Payment

Prompt payments for goods provided and services rendered are the fuel that feeds any modern smallbusiness. A failure on the client’s part to uphold their side of the deal and pay you what is owed in a timely manner can disrupt your business’s vital flow, creating unnecessary financial roadblocks and hindering its overall growth. One of the simplest and most effective ways to ensure that payments from your clients come in on time is to request these through well-crafted, professional business invoices.

Keep reading this post to learn about what components a professional business invoice must include and how technology helps streamline the invoicing process. We will also go over some effective strategies that can facilitate collecting payments from your clients, ensuring your cashflow is hitch-free.

Components of a Business Invoice

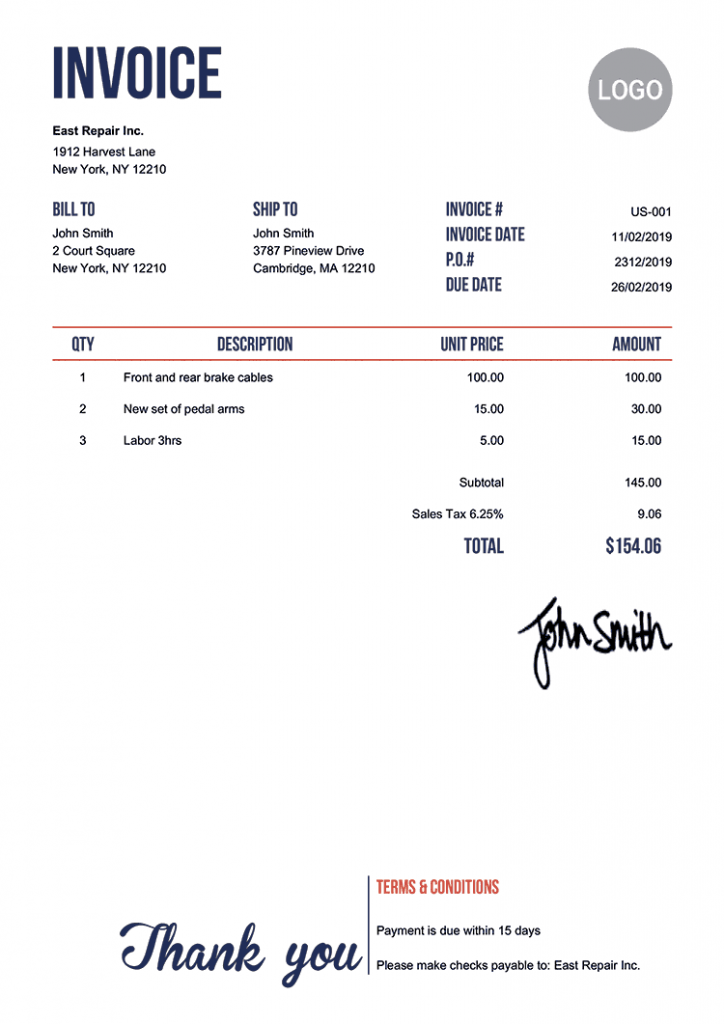

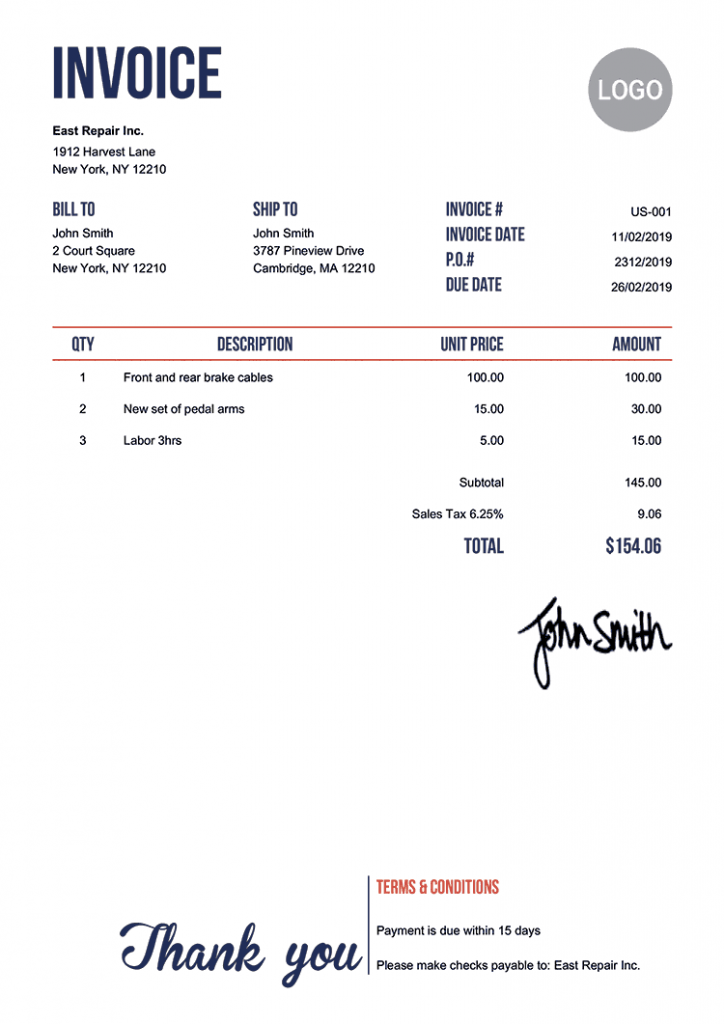

An invoice is a crucial business document that the seller issues to the buyer to indicate how much money is owed to them for providing specific products or services. When preparing such a document, precision and a good sense of balance are everything. It has to be meticulous enough to include all the information the client needs to make the transaction, yet not so much so that it overwhelms the recipient with details and confuses them. Here is the minimum information to include in the payment request and the approximate order it should appear on the document:

- Your company logo and branding in the header;

- A unique document number;

- Dates for when the invoice is issued and the payment is due;

- Your business info and the contact details of both you and your client (names, addresses, phone numbers, and email addresses);

- An itemized list of the goods/services provided (a brief description of each item, details about their quantity and unit price, and the subtotal of charges for each);

- The total amount due;

- Your payment terms (methods of payment available to your clients and instructions on how to use these; information about late fees and on-time discounts if applicable);

- A sincere and friendly thank-you note to show your appreciation and encourage the repeated business.

While elements such as branding in the header and a closing expression of gratitude might not seem overly significant, they contribute to a good-looking, precise, and professional invoice. This, in turn, helps create a smoother and faster cash flow for your small business by enabling seamless transactions.

Strategies for Faster Payments

To create an effective payment request is just one aspect of this multifaceted process. You will also need to apply the following tips and strategies to ensure your small business gets paid faster:

- Be proactive about managing expectations. Always discuss your billing and payment expectations with the client before starting to work on their order. Doing so will help avoid misunderstandings and disagreements regarding finances once the job is done/products are provided.

- Establish your invoicing routine. Do not just put off sending bills to clients until there is more time for that. Procrastination isn’t going to help your business grow and thrive. Make it your habit to prepare and send your invoices once a week or every ten days. If you can afford to be more flexible with your time, try to send a payment request to the client as soon as you have fulfilled their order.

- Don’t be shy to charge late fees. While not many business owners like to resort to this practice since it may create unnecessary discomfort and complicate collaboration, charging late fees might incentivize reluctant payers to take action and settle their bills with you faster. Just inform your clients upfront about this before your working relationship begins.

- Diversify your payment methods. Sometimes, they do not pay because they have no easy and convenient way of doing so. Specify your preferred payment method and add more options to let your clients choose what works best for them, thus showing your flexibility and care for their comfort.

- Leverage templates/invoice maker software. There is no better way to save your precious time and encourage faster payments than to delegate the invoicing process to specialized software like Invoice Maker by Saldo Apps. The solution contains ready-made templates crafted to perfection for all occasions and needs, includingsmall business invoices, B2B invoicing templates, and restaurant invoice templates. With some customization, your payment request will be professional, polished, and inviting the right action.

The combination of effectively crafted payment requests, proactive communication, a dependable invoicing routine, a sensible late fee approach, and the availability of diverse payment methods is how your small business can facilitate getting paid.

Automation and Technology

Because of its repetitive and highly detail-oriented nature, invoicing is one business process that agrees favorably with a bit of automation. Here are the three types of technology solutions that can help optimize your invoice management routine, making it simpler and more efficient:

Specialized invoice generation software

Advanced software such as Invoice Maker by Saldo Apps allows users to generate and customize top-notch, professional invoices in every popular format within seconds and send them automatically, thus eliminating the manual hassle and ensuring great accuracy and timely delivery.

Online payment systems

Integration of multiple payment gateways into your invoicing process is a serious bid for success. It provides your clients with the convenience to conduct their payments faster and more securely, contributing to a seamless cash flow for your business.

Cloud-based solutions

Integrating cloud solutions into your invoicing process can enhance the efficiency and accuracy of the latter, provide a centralized approach to invoice management and real-time data access, automate daunting tasks, and reduce the risk of human errors. Despite the cost, it is a wise investment for more mature businesses prioritizing sustainable growth over immediate savings.

Business Invoicing for Small Businesses Simplified

To be successful in business, you must nail your invoicing game and optimize it in every way possible. This includes, among other things, learning to create professional invoices, embracing efficient payment-encouragement strategies, and leveraging modern technology like Invoice Maker by Saldo Apps to streamline the entire invoicing process. With efficient invoicing, your business runs smoothly like a well-oiled machine, achieving success through fast and seamless transactions.

Radomir Novkovich

Co-founder of Saldo Apps. His core competencies include product management, mobile app marketing, financial advertising, and app store optimization.

Learn more