How to Apply a Discount to an Invoice

A good discount is what your customer likes and expects from your business. They can drive sales, boost your earnings, and also reflect very favorably on your company’s reputation, encouraging repeat business. If you decide to extend a discount to your customer, make sure it is displayed accurately and correctly on your invoice to prevent confusion, frustration, and misunderstandings.

Continue reading to learn why a company like yours needs to offer discounts to its customers. We’ll also explore the difference between various discount types and share practical tips for effectively calculating, applying, and communicating price reductions.

3 Types of Discounts

Discounts are a great tactic to use when trying to grow your customer base, but you need to be sure you are using the best one and doing it right to get the results you expect from it. Here are some popular types of discounts on invoices that small businesses offer to their clients:

Cash discount

A cash discount is a reward for when you pay your bill early. Instead of reducing the item’s price, cash discounts take a small percentage off the total bill if you pay within a specific time, for example, in 7 days after receiving the invoice.

Trade discount

A trade discount is a special offer from the seller that reduces the price of an item or the total bill by a specified amount or percentage. A good example is a bulk purchase deal, where buying a large quantity of something results in a lower per-item cost.

BOGO offers

BOGO, or “buy one, get one” deals are a popular marketing technique that works well on customers who simply cannot say “no” to a good bargain. It is a sales promotion, usually limited in time, where customers pay for one item or service and get a second one for free or at a significantly reduced price.

As a business owner, it is entirely up to you to choose which price cut type to offer to incentivize your customers. The choice will ultimately depend on your business model, goals, customer preferences, and the desired impact on sales. In the section below, we will explain how to apply cash and trade discounts to invoices correctly.

Applying Discounts

It is crucial to make sure that any price reduction you offer on a purchase is clearly stated on the invoice. By doing this, both you and your customer can easily understand and appreciate the resulting savings. It helps keep things transparent between the two parties and ensures a smooth and trust-based transaction.

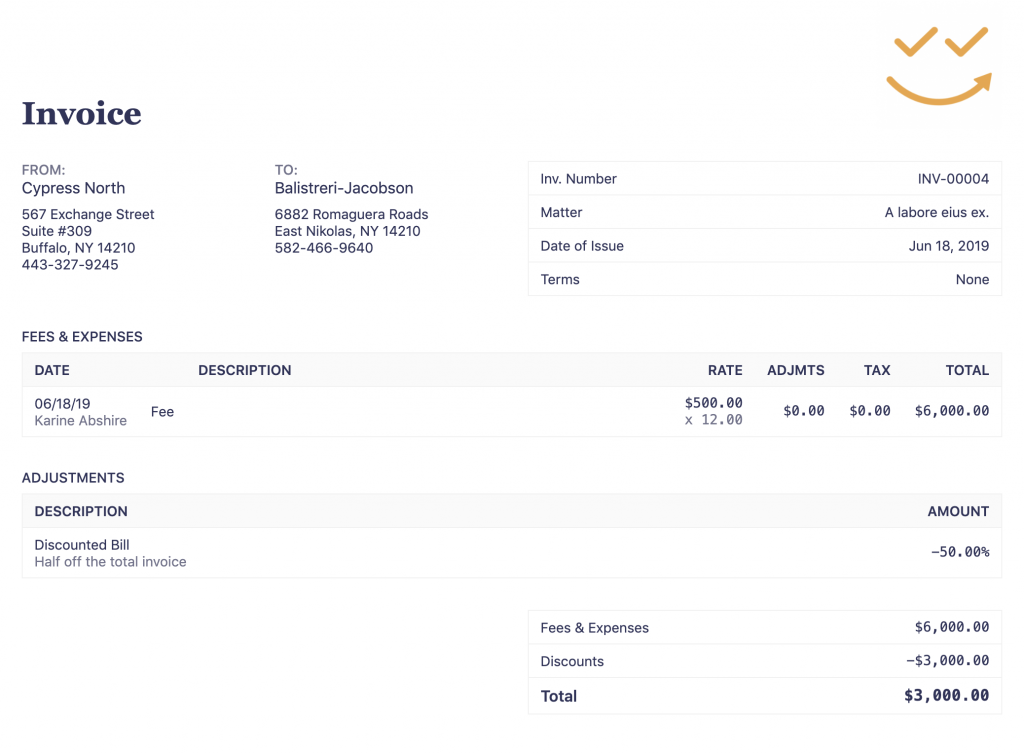

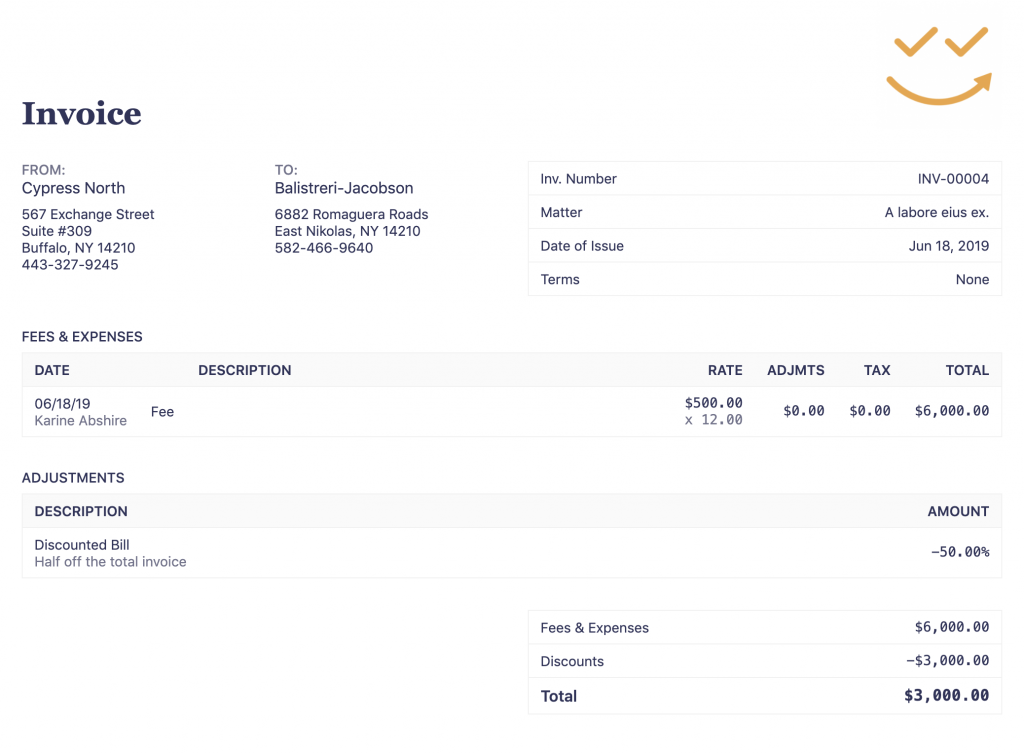

Here is a quick instruction on how to calculate and apply trade discounts to invoices:

- Calculate. To figure out a trade discount, multiply the list price by the discount percentage expressed as a decimal.

- Apply. There are two ways to do this:

- by stating it as either a single-line discount (a reduction in a single item price)

- or an overall discount (a reduction of the invoice total).

A similar two-step procedure is used for calculating and applying cash discounts to invoices:

- Calculate. This one is determined by multiplying the total amount by the percentage off.

- Apply. It is customary to state cash discounts on your invoice in the following format: “2/10, net 30.” While it might look confusing, it simply means the payment is due within 30 days, but the customer can get a 2% cost reduction if they pay within the first 10 days of receiving the invoice.

A Quick Word About Taxes

Tax-registered businesses must issue tax invoices to customers. Discounts apply to the subtotal, then the tax is added to the reduced amount. So, if a product that costs $50 is discounted to $30, with a 10% tax, the customer will pay a total of $33.

How to Simplify and Automate Calculations?

Using modern invoicing software like Invoice Maker by Saldo Apps makes it easy to generate accurate and precise invoices in a few clicks. The platform contains hundreds of ready-made professional invoice templates for any business scenario, such as

e-commerce invoice templates,

real estate invoices,

restaurant invoice templates, and more.

Simply pick the type of template you need in the format you prefer, input all essential details, including a percentage discount, and customize the bill to your liking before sending it to the client.

Communication With Clients

Any business wants to get paid promptly for the goods or services provided. These invoice communication tips will help you build strong and professional relationships with clients, set clear expectations toward each other, and enhance the overall transparency of your interactions:

- Have a brief phone call with your client to understand their needs and goals before taking on a new order.

- Clearly define the scope and set realistic expectations to avoid misunderstandings and ensure timely payments.

- Keep the customer informed about any changes within your business that might impact your cooperation.

- Establish specific payment terms and conditions from the start to avoid surprising your client when the bill arrives.

- Avoid jargon and professional slang in your invoices to keep the document clear and easy to understand.

- Respond promptly whenever the customer tries to reach you.

Following the above recommendations should ultimately contribute to faster payments for your business.

Discounts in Invoices & How They Drive Positive Customer Interactions

Offering discounts can bring about numerous benefits for small businesses, significantly enhancing their relationships with customers, stimulating sales, elevating earnings, and cultivating a positive company image. Clear communication through accurate invoices ensures transparency and builds trust. By employing modern invoicing software such as Invoice Maker by Saldo Apps, calculating taxes and discounts on your invoices can be simplified, and the overall invoicing process expedited.

Gleb Piankov

Product Designer. The one, who develops and improves Invoice Maker. He creates and maintains the design system of Saldo Apps products.

Learn more

As a business owner, it is entirely up to you to choose which price cut type to offer to incentivize your customers. The choice will ultimately depend on your business model, goals, customer preferences, and the desired impact on sales. In the section below, we will explain how to apply cash and trade discounts to invoices correctly.

As a business owner, it is entirely up to you to choose which price cut type to offer to incentivize your customers. The choice will ultimately depend on your business model, goals, customer preferences, and the desired impact on sales. In the section below, we will explain how to apply cash and trade discounts to invoices correctly.