Invoice Tracking and Payment Reminders: Best Practices

Managing invoices and keeping up with payment reminders is not just routine; it’s vital to your business’s financial well-being. It keeps your cash flow healthy and spares you headaches in the future. Are you looking for extra help? Head over to

Saldo Invoice for more insights and tools.

Why Tracking Payments and Reminders Matters for Business

Sure, you send invoices, but do you keep track of them? What about those payment reminders? Managing these well can make a big difference to your bottom line. Neglecting this can lead to payment delays, which no one wants to deal with. Moreover, consistent tracking can improve your relationships with your customers.

Getting payments on time doesn’t just boost your bank balance. It helps your cash flow and improves your accounts receivable, which are crucial for any business. Better numbers often mean better opportunities like loans or investments. And when things go well financially, it also sets a positive tone for other aspects of your business.

On the other hand, if you aren’t tracking payments or sending reminders, you might spend more time and resources on collection. Letting payments slide for too long could also result in some losses you must write off. Beyond that, this negligence can distract you from your primary business goals. A lax payment approach could also harm your reputation in the long run.

Approaches for Effective Invoice Tracking and Reminders

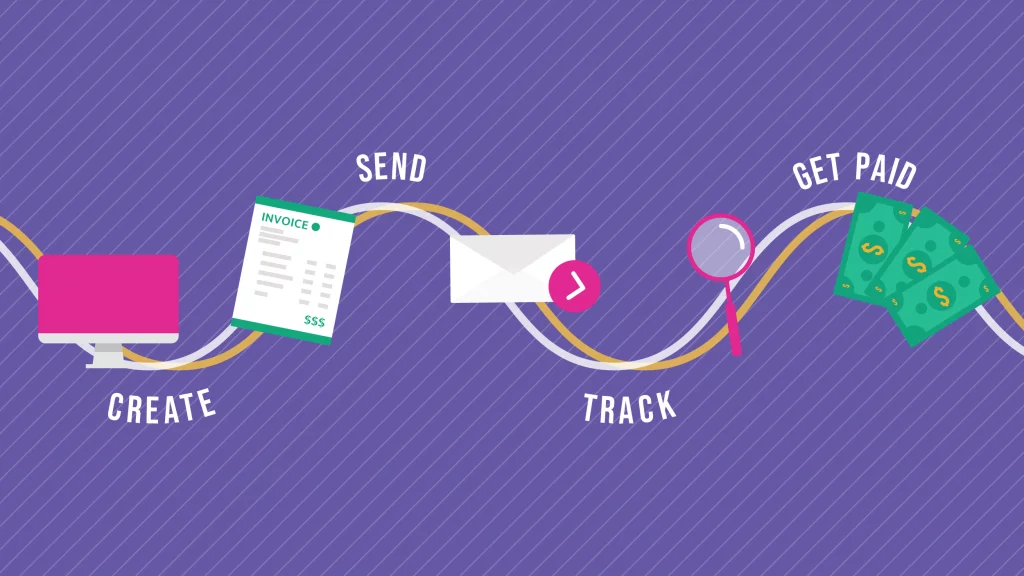

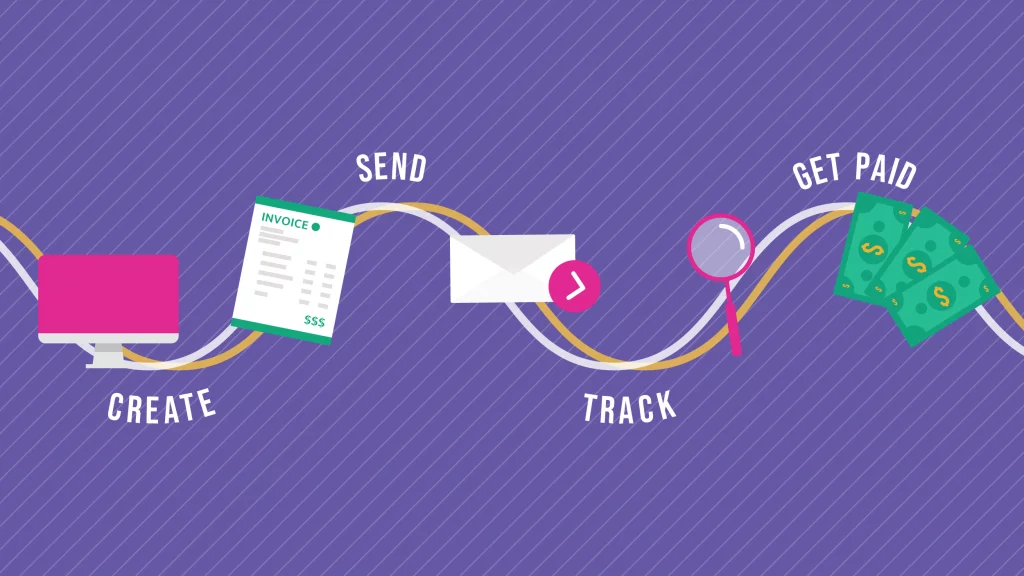

Let’s get into the how-to part. Having a solid plan for tracking invoices and sending reminders is like having a roadmap; it helps you reach your destination faster and with fewer detours. So, what are the options?

Manual vs. automated tracking

You could go old-school and track everything manually, jotting down details in a ledger or spreadsheet. That gives you total control but eats up your time. Conversely, you could use automated systems to do the heavy lifting. They’re fast and efficient but might cost you a bit upfront. Let’s remember you need to trust the software to get it right. Either way, it’s a trade-off between time and control.

Setting up follow-up procedures

Next up, reminders. Don’t just send a bill and forget about it. Following up is key. And it’s not just about the money; it’s about keeping the lines of communication open with your customers.

Follow-up procedures to consider:

- Immediate Reminder: It is A thank-you email after an invoice is received to confirm they got it.

- Midway Reminder: It is a polite nudge about halfway to the due date.

- Last Call: It is a more urgent reminder as the due date approaches.

You have options when setting up these procedures, whether simple emails or more formal letters. What’s important is consistency. Once you set a procedure, stick to it. It makes you look professional and keeps customers aware of their commitments.

Automating Tracking and Reminder Process to Reduce Debt

So, we’ve talked about how important tracking and reminders are. But what if we told you there’s a way to make it easier and more efficient? Yep, that’s where automation comes in.

Benefits of automation

Let’s get real: Manual tracking works but is time-consuming and prone to errors. Automating the process can make your life easier. Automated systems can track payments, send reminders, and even flag late payments for you. It means less time spent on admin tasks and more time focusing on other parts of your business. And the biggest perk? Automation helps reduce debt by making sure everyone pays on time.

How we can help

Automation sounds great, but where do you start? That’s where we can assist. Check out our

Notary Invoice Template as a solid example. Our solutions take the pain out of the tracking and payment reminders process. Our software is designed to help businesses like yours become more efficient in accounts receivable management and collection strategies. Trust us; we’ve thought of everything to make it easier.

By leaning into automation, you’re not just making a one-time improvement. You’re setting up a system that keeps paying off down the line. It’s a win-win: You save time, and your business stays financially fit.

Best Practices and Software Solutions

Alright, you’re sold on tracking invoices and sending reminders. You even like the idea of automation. Now, let’s talk about the best ways to do it and the tools to help.

Top invoice tracking software

There are plenty of options out there for invoice tracking software. Here are some worth checking out:

- QuickBooks: Widely used, integrates with other accounting features.

- FreshBooks: Outstanding for small businesses, user-friendly.

- Zoho Invoice: Affordable and feature-rich, especially good for freelancers.

Having the right software can save you time and keep you organized. But remember, the best software is the one that fits your needs and is easy for you to use.

Our software solutions

If you’re looking for tailored solutions, we’ve got you covered. Take a look at our

Software Invoice Template and

Digital Invoice Template. These templates aren’t just about making invoices look pretty. They’re designed to help you with efficient tracking and payment management. Whether you’re into tech or want a streamlined digital option, we have something to meet your needs.

Choosing the right software and sticking to industry best practices can make all the difference. You’ll spend less time worrying about invoices and more time growing your business. And who doesn’t want that?

Improving Financial Health Through Better Payment Management

Now that we’ve discussed how-to’s, let’s focus on the big picture. Managing payments effectively isn’t just good for reducing stress; it’s a big boost to your business’s financial health.

What can you do to improve payment management? Here are some strategies to consider:

- Prompt Billing: The sooner you bill, the sooner you get paid.

- Clear Terms: Make sure payment terms are clear and visible.

- Early Payment Incentives: Offer small discounts for early payments.

So there you go, a few simple but effective ideas. You’d be surprised how small changes can make a big difference in getting paid on time.

Take Control of Your Cash Flow

Alright, let’s wrap this up. Tracking invoices and sending reminders isn’t just busy work—it’s essential for the financial health of your business. You can make the whole process easier and more effective with the right strategies and tools. So why not take the next step and check what we can offer?

Elizabeth Kvasha

Content Manager, who creates the articles and visually transforms the websites of SaldoApps production.

Learn more