Tax Compliance in Electronic Invoicing: What You Need to Know

In today’s digital shift, invoicing hasn’t been left behind. The challenge? Ensuring those electronic invoices are also tax-compliant. As electronic invoices gain popularity, it’s essential to grasp their tax specifics. The good news is that handling these matters becomes less daunting with a solid grasp.

Understanding Tax Rules in Electronic Invoicing

E-invoicing has brought about a fresh set of tax rules. These are designed specifically for digital dealings, different from usual rules. As more business activities turn digital, it’s important to know these nuances.

Moreover, while at a glance, e-invoices might seem like digitized paper bills, they offer much more. They contain necessary tax data, crucial for businesses and tax authorities. They go beyond simply noting services or items and cover percentages, exceptions, and other vital points. Knowing the significance of tax in electronic invoices helps businesses adhere to rules and optimize advantages.

But understanding the content of e-invoices is just the start. There’s a blueprint to follow with e-invoicing to guarantee compliance. It’s not solely about ticking the box for the right tax rates. This method covers the whole path of an electronic invoice—from its creation and distribution to its preservation. Maintaining a focus on compliance during these stages ensures efficient workflows and reduces later issues.

VAT Compliance Requirements for Digital Invoices

When we discuss the purpose and scope of e-invoicing, a major component that can’t be overlooked is VAT (Value Added Tax). VAT has been around, but its handling in digital dealings has subtle differences that businesses should note.

To start, VAT is a consumption tax levied on the value added at each stage of a product or service’s production or distribution. Within electronic invoices, it holds significance as it influences pricing and, consequently, business earnings.

Key Components of VAT in E-Invoicing:

- Taxable Person: An individual or entity must register for VAT and be accountable for collecting and remitting it.

- Place of Supply: Determines the country where VAT should be paid. This is especially important for cross-border digital services.

- Tax Rate: The percentage of VAT to be charged; it can vary depending on the country or the nature of goods and services.

- VAT Exemptions: Certain products or services are exempt from VAT or attract a zero rate.

- Input and Output VAT: ‘Input’ VAT is the tax paid on purchases, and ‘Output’ VAT is the tax charged on sales. The difference between the two is what businesses remit to authorities.

For companies offering services such as website design, it’s important to understand these elements. Check out the

Web Design Invoice Template by Saldo to get an idea of how VAT is seamlessly integrated into digital invoices.

International Tax Considerations When Dealing With E-Invoices

Crossing borders with your business isn’t just about understanding different cultures and languages; there’s also the intricate web of international rules to be aware of.

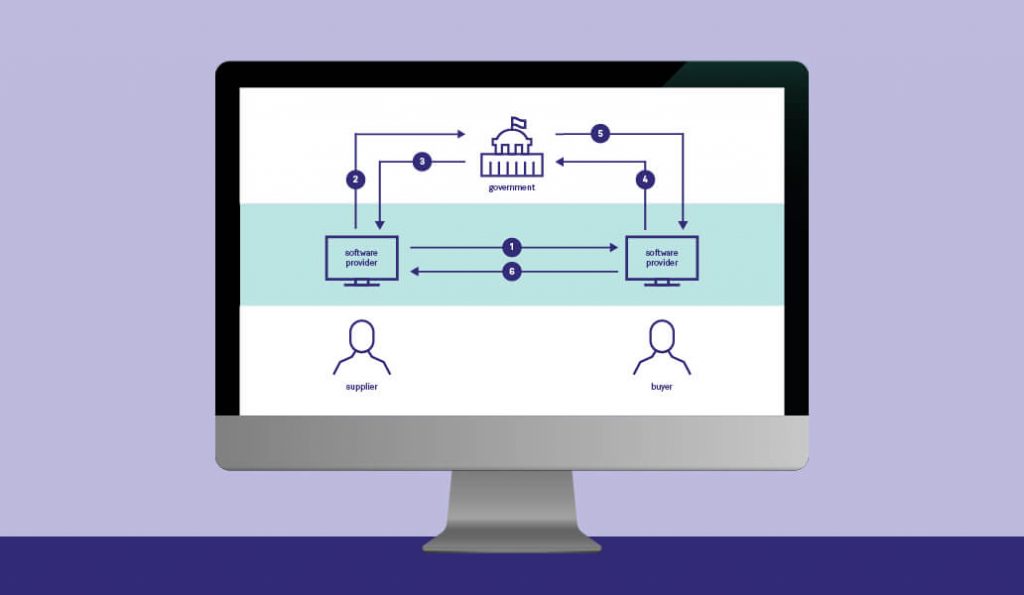

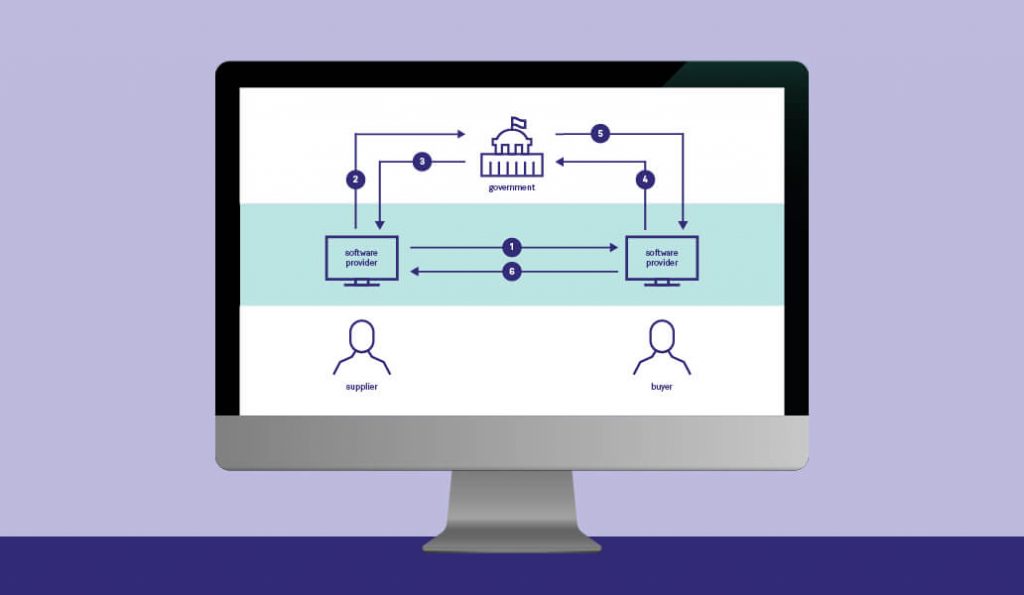

International tax dynamics

With its global reach and essential documentation, E-invoicing means companies need to understand not just their local tax regulations but also those of other countries they’re dealing with. The importance is in identifying the variances in regulations and then adjusting your electronic invoices to fit.

Factors Affecting International Tax Considerations:

- Domicile of the Business: Where a company is based can significantly impact its tax obligations.

- Nature of Goods or Services: Some products or services might have specific tax treatments in certain countries.

- Double Taxation Agreements: These are treaties between countries to avoid taxing the same income twice.

- Local Tax Regulations: Each country has its rules, and it’s essential to be familiar with them.

- Currency Considerations: Exchange rates and currency conversion play a role in e-invoice tax calculations.

For those in the electronics business, global dealings are common. Have a look at this

Electronics Invoice Template by Saldo to see how international tax considerations can be factored into e-invoices.

Potential implications for businesses

Managing global taxes affects more than just meeting rules; it also touches the financial health of a business. Overlooking these norms could lead to fines, penalties, or even legal actions in some jurisdictions. Additionally, it might tarnish a business’s image, causing skepticism among associates and clientele. Therefore, being well-informed and proactive in understanding and integrating international tax considerations in e-invoices is good practice and a prudent business move.

Strategies for Accurate Tax Reporting With Electronic Invoicing

Correct tax reporting in e-invoicing is essential. It keeps businesses from unwanted financial setbacks and builds trust with consumers and regulators. More than just accurate figures, it’s about clear, open, and timely communication.

Using software for precise reporting

Online tools make tax reporting a lot easier. With the right software, once tedious tasks become more manageable. These solutions can quickly determine taxes at prevailing rates, identify errors, and produce comprehensive reports. Their goal? Minimizing mistakes and speeding up tax-related tasks.

Desirable Features in Tax Reporting Software:

- Automated calculations based on the latest rates.

- Real-time error detection and alerts.

- Integration with other financial systems or tools.

- Detailed reporting capabilities with customizable parameters.

- Secure storage and backup of all invoice data.

- User-friendly interface for easy operation.

For those looking for a tool that offers these features, check out the

Web Developing Invoice by Saldo. This tool is crafted to fit modern business needs, making handling e-invoicing tax details simpler.

Preparing for audit scenarios

Even with top-notch tools, businesses should gear up for possible audits. Audits check if all financial dealings, including e-invoices, meet set benchmarks. This means all invoices should be accurate, thorough, and stored appropriately. Regular internal reviews, maintaining clear digital records, and training staff on the latest tax regulations can go a long way in ensuring that businesses are well-prepared for any audit scenario. The idea is to be ahead of the game, setting up a solid system that holds up under close examination.

Steps Businesses Should Take to Ensure Tax Compliance in Their Invoicing Processes

Tax compliance in electronic invoicing isn’t just about ticking boxes. It’s about building confidence and making sure things run without a hitch. Here are some steps and proactive approaches businesses can adopt:

Prioritizing understanding and preparedness

Being well-informed is a game-changer, especially about tax rules. As these can frequently change, businesses must stay updated. This might mean investing in regular training sessions or having a dedicated person or team to track these updates. When you’re in the know, making compliant decisions becomes second nature.

Regular account evaluations

Consistency matters in business tasks. Regularly reviewing invoicing practices allows companies to spot and rectify any inconsistencies early on. It’s also an opportunity to tweak and enhance procedures for better results.

The Look Ahead

Tax compliance in e-invoicing reflects a business’s dedication to transparent and honest operations. As online tools evolve, tax reporting will have its complexities. It’s crucial for companies to stay updated and adaptable. With tools like

Saldo Invoice, e-invoicing becomes less daunting and more manageable. With a focus on ongoing education and the right tools, companies can look ahead with assurance.

Elizabeth Kvasha

Content Manager, who creates the articles and visually transforms the websites of SaldoApps production.

Learn more