Canada Receipt Template

Do you need more Invoice Designs?

Customise your Invoice Template

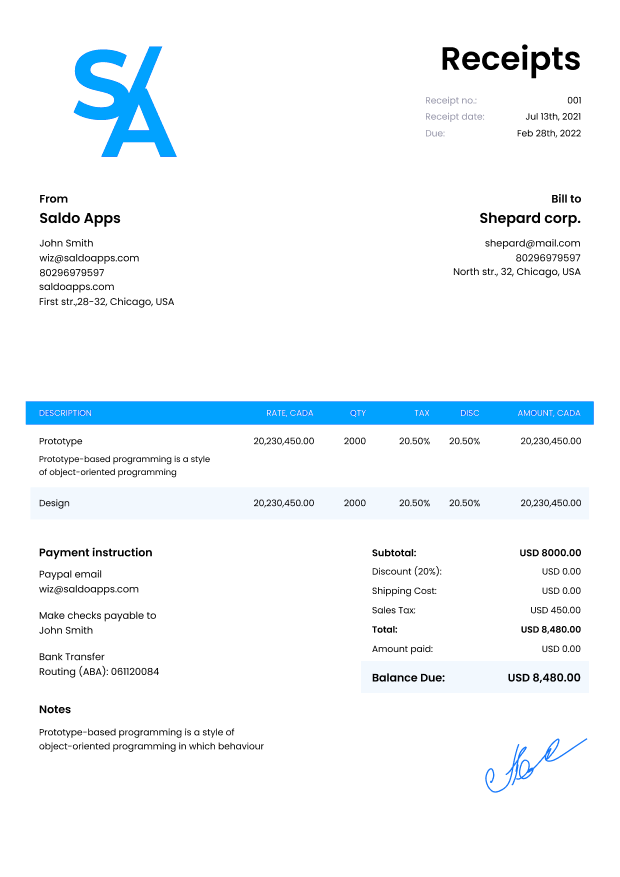

About our Canada Receipt Template

Receipts are a very important part of the business world, and they have to be issued in a specific manner. The Canada Revenue Agency (CRA) has provided some guidelines for the creation of receipts, which are outlined below. A receipt template Canada can be used by all businesses because it contains all the necessary information that must appear on an original receipt.-

What not to miss when creating Receipt Template Canada

A receipt is a document that contains information about the transaction between two parties. It can be used as proof of payment for goods or services, and it can also be used as a warranty. Receipts have many uses, but they all share one thing in common: they are documents that contain information about a transaction between two parties.

What to include in Receipt Template Canada

To become a Tax Filer in Canada, you must register with the Canada Revenue Agency (CRA). This is also known as registering for a GST/HST account. When you get this registration number, you will be able to use it online and offline to file your tax returns and make payments on time.

Once registered as a tax filer, you can also start preparing tax returns for others to receive money from them as payments or reimbursements.

When you create a receipt template Canada, make sure to include all the following details:

- The name of your business.

- The address where your business is located.

- Date of purchase or sale.

- Receipt number (if applicable).

This information will help you keep track of what items were sold and how much was spent on each item as well as provide proof that sales tax was paid on these goods or services when necessary.

The information on the receipt must be readable and legible.

For example, if you write the number zero with a line through it, this will be difficult to read when it is printed out on paper. The name and address of your business should also be included on receipts so that customers can verify that they are receiving services from an authorized business.

The date and time of sale or service should always be included as well as how much money was collected in exchange for those services. These details may seem obvious but there are many businesses that neglect them when creating their own custom printed receipts Canada wide.

-

Create Your Receipt by Filling In our Canada Tax Receipt Template

If you want to create your own receipt template in Canada, we have a helpful guide that will get you started. You can also use our online service to create your own customized tax receipt template Canada and print it right away.

Just fill in all the required information

The format should include important information such as the customer’s name, date of purchase, type of purchase, product description, the price paid and the amount due at the time of payment.

Make sure to include all these details when creating a receipt template Canada.

Then download the file and save your receipt as a PDF file on your computer before printing it out. This will ensure that you won’t lose any data while printing or storing it in your office.