Goodwill Donation Receipt Template

Do you need more Invoice Designs?

Customise your Invoice Template

-

What Is Goodwill Receipt Donation Used For?

Unlike many tax and business forms, a receipt for donations to Goodwill records the fact of receipt, not of payment (money), but of things and equipment that you can transfer to the organization as donations. People often donate clothes and shoes to this company, but you can also provide household items, vehicles, furniture, toys, and so on. Since you bought all these things, you most likely, paid the appropriate tax on them. With the help of Goodwill receipts for taxes, you can get a deduction and get back part of the money spent.

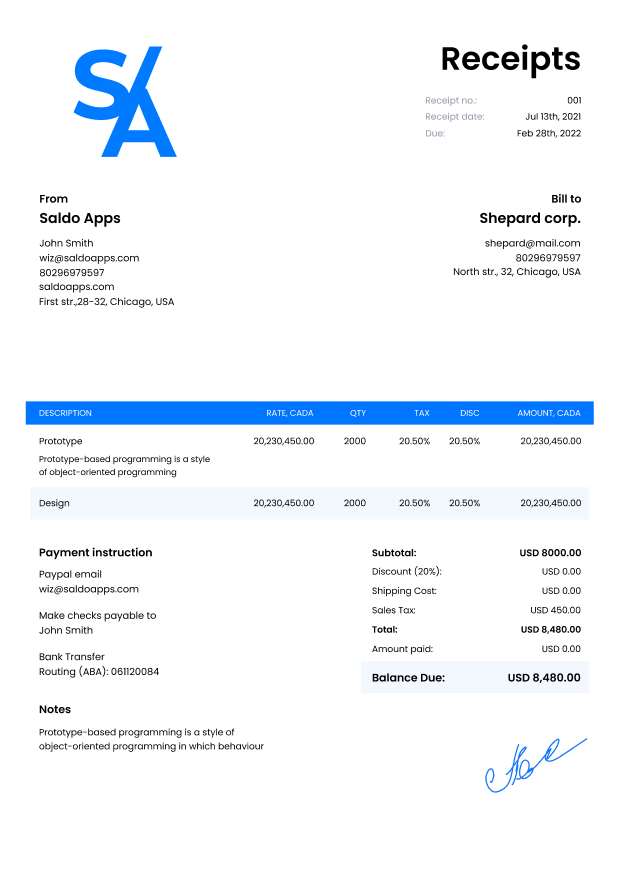

Often, standard receipts are considered by businesses as an optional document to fill out, although experts recommend using them when working with clients. However, since you need the Goodwill donor receipt for the tax deduction, you need to make sure it contains all the necessary, and most importantly, correct information:

- file ID and the date you made the donation (including tax year);

- your contact details and information about the department where you applied;

- donation details: a complete list of goods, their quantity, cost, and the total sum.

An important point is the calculation of your items’ cost. Unlike the PDF invoice sample, you should put fair market value in this document. Of course, it is lower than the price you purchased clothing or equipment. For pricing, please refer to the Goodwill guide, which lists the costs of the main products. Also, Publication 561, issued by the IRS and containing information on pricing donated property, can be helpful in this task. It is important to carefully approach these calculations and indicate accurate data so that the tax service does not have any questions when generating a deduction based on the completed blank Goodwill donation receipt.

You, as a donor, should fill out the document yourself, but the person who received your things needs to sign the Goodwill online donation receipt. The signature of the employee confirms the accuracy of the information provided. According to Goodwill’s guidelines, they do not require a copy of this paper; it is only necessary for you to apply to the tax office.

-

Download Goodwill Receipt Easy With Saldo Invoice

As you can see, this document format is quite different from the standard money receipt or example of a purchase order or invoice. However, there is nothing tricky in filling it out. You can download the template and put the required information in advance, or use our online Goodwill receipt generator and fill out the document on the spot.

The main thing is to make sure that you have entered all the information correctly. You can immediately send the file to the responsible party for signature via email or using a link. If possible, print out the form so the company’s employee can sign it at the office. When using our Goodwill receipt builder, all your documents are kept in a profile, but you can save them locally if needed.

-

FAQ

What organizations or businesses can use the Goodwill donation receipt template?

The Goodwill donation receipt template is suitable for non-profit organizations, charities, and businesses that accept donations for tax-deductible purposes.

Can I itemize donated items and their estimated values in the receipt?

Yes, you can typically itemize donated items, including descriptions and estimated values, in the template.

Is there space for including the donor’s name, address, and contact information?

You can often include sections for specifying the donor’s name, address, and contact details in the template.

Can I provide information about the organization’s tax-exempt status on the receipt?

Yes, the template usually allows you to specify information about the organization’s tax-exempt status for donor reference.

Can I customize the Goodwill donation receipt template with the organization’s information and branding?

Yes, you can often customize the template with the organization’s information and branding to make it unique to your organization.