501 C 3 Donation Receipt Template

Do you need more Invoice Designs?

Customise your Invoice Template

About our 501 C 3 Donation Receipt Template

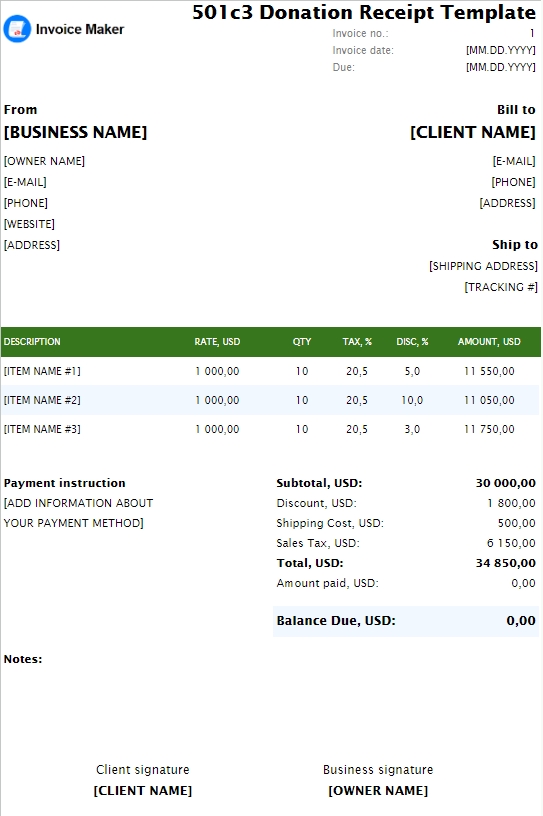

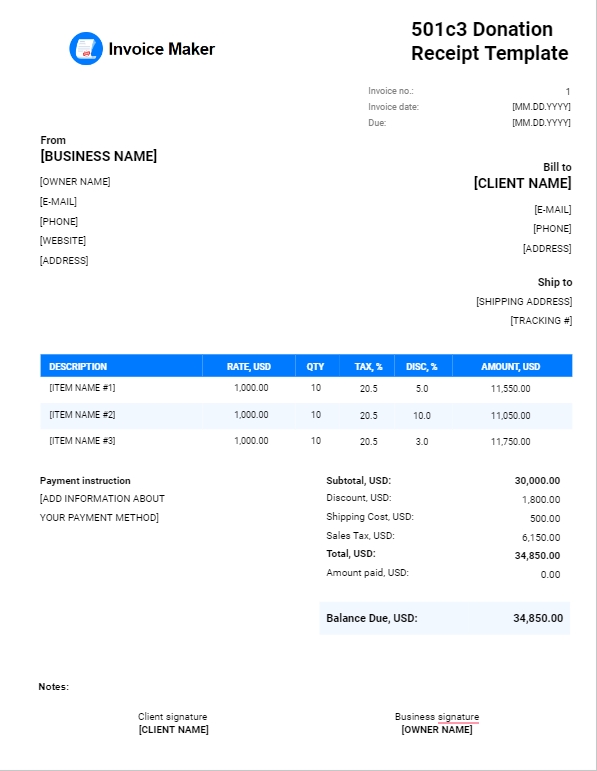

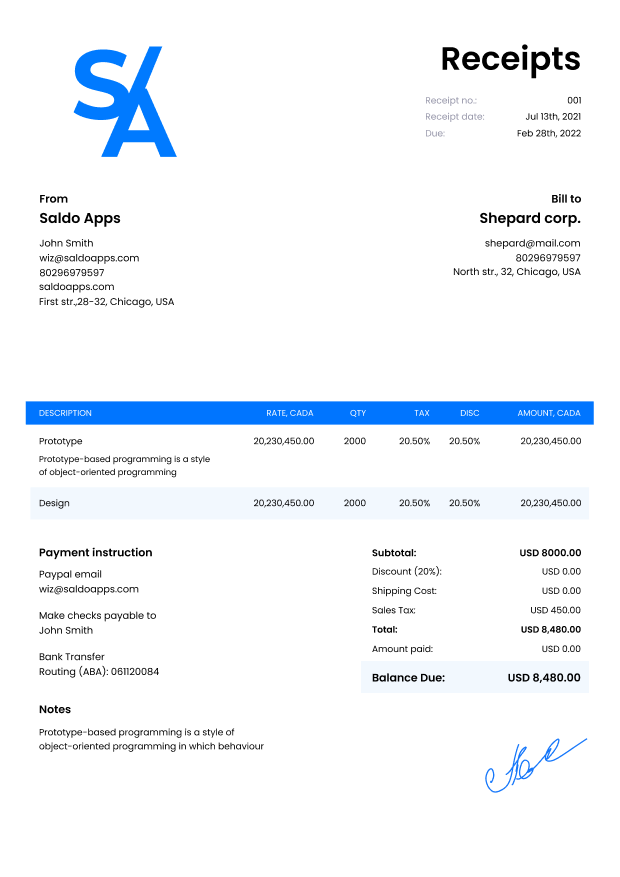

Here’s a sample 501c3 donation receipt to download for free. It’s a clean and easy to-read format that can be customized to fit your organization. This free 501c3 donation receipt template is a sample document that can be used by non-profit organizations to thank donors for their contributions.Download 501c3 Donation Receipt Template

-

When Do You Need a 501 C 3 Donation Receipt?

If you run a nonprofit organization or foundation, you’ve probably faced a receipt for a donation to 501 C 3. These are usually sent out to contributors after each gift that exceeds $250. Such prescriptions are essential to givers because they later use the 501 C 3 form for tax returns and deductions.

According to the IRS, a receipt for a 501 C 3 nonprofit organization donation receipt can only be written by a certified nonprofit organization that serves the public interest. Generally, these are charities, corporations, and foundations that help vulnerable citizens, engage in educational programs, scientific, religious, cultural, and so on.

The proper 501 C 3 receipt example includes the appropriate label, details of the nonprofit organization, donor contacts, the amount of the donation or its description (for real estate, vehicles, other things), and the date of the receipt. Note that a contributor is allowed to attach a tax deductions form strictly before the close of the tax year.

-

Download 501 C 3 Receipts Easy With Saldo Invoice

Complete your sample 501 C 3 tax donation receipt quickly with our step-by-step instructions. To start, open a ready-made template on your phone, tablet, or computer and fill in the blank fields. Remember to give your prescription a unique number, enter your organization and donor information correctly, and include the amount and type of donation. Add your organization’s logo and save the document.

Complete your sample 501 C 3 tax donation receipt quickly with our step-by-step instructions. To start, open a ready-made template on your phone, tablet, or computer and fill in the blank fields. Remember to give your prescription a unique number, enter your organization and donor information correctly, and include the amount and type of donation. Add your organization’s logo and save the document. Once you have completed all the previous steps, download the 501 C 3 nonprofit organization donation receipt form as a PDF and send it to the recipient as an email attachment. Optionally, you can print a copy and send it in the post mail. Don’t forget to duplicate a record of the prescription in your ledger. These entries are official proof of your nonprofit’s source of income.

Saldo Invoice is the best tool for managing prescriptions, estimates, and invoices. Get a perfect online assistant to generate, send and track your financial document. Explore more templates for nonprofits and create receipts for different scenarios. Learn how to fill out a donation receipt template. Or generate a professional looking invoice for personal services in seconds. Get rid of grueling paperwork and help your community more efficiently with our all-in-one invoice-generating app.

-

FAQ

What is a 501(c)(3) donation receipt template?

A 501(c)(3) donation receipt template is a document used by nonprofit organizations to provide donors with a receipt for their charitable contributions. It includes important information such as the organization’s name, donor’s details, donation amount, and the tax-exempt status of the organization.How do I use the 501(c)(3) donation receipt template?

To use the 501(c)(3) donation receipt template, download the template from our website and open it in a compatible program like Microsoft Word or Excel. Customize the template by adding your organization’s name, logo, donor information, donation details, and any other required information. Save the modified template and provide it to donors when they make contributions.Are 501(c)(3) donation receipts necessary for tax purposes?

Yes, 501(c)(3) donation receipts are essential for tax purposes. Donors who contribute to eligible nonprofit organizations can use the receipt as proof of their charitable donations when filing their taxes. The receipt helps substantiate the deduction and ensures compliance with IRS regulations.Can I customize the 501(c)(3) donation receipt template to match my organization’s branding?

Absolutely! You can customize the 501(c)(3) donation receipt template to align with your organization’s branding. Add your logo, choose appropriate colors, and modify the layout to reflect your nonprofit’s visual identity. This customization adds a professional touch and reinforces your brand recognition.