Insurance Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

About our Insurance Invoice Template

To create invoice protection insurance you need a good sample. In Saldo Invoice you will find many invoice templates for all types of businesses. Save time with these invoice templates and create professional insurance invoice forms in minutes.-

Efficiently Manage Your Insurance Billing with a Professional Invoice Template

The process of creating an invoice can be more challenging than it sounds. If you’re a business owner, you know that there are many different kinds of invoices and forms that may be required depending on your industry and business model.

For instance, if you’re an insurance agent there are specific guidelines that must be followed when creating and sending out invoices to customers. This is because they contain sensitive information such as policy numbers and details about the services provided during each billing cycle.

However, with an insurance invoice form that has been carefully designed by experts, this process becomes simple for anyone who wants to create professional invoices in no time at all!

Invoices are one of the most common business forms. They’re used by all types of companies, from small businesses to large corporations, and they have many different uses.

Here are benefits of using an insurance invoices template:

- Saves time and effort: A medical insurance invoice template can save time and effort that would otherwise be spent creating invoices from scratch. The template already has all the necessary information fields and formatting, which makes the process faster and more efficient.

- Reduces errors: A sample invoice for insurance claim can reduce the likelihood of errors, as it provides a consistent structure and layout that ensures that all necessary information is included.

- Consistency: With a template, all invoices will have a consistent look and feel, making it easier for customers to recognize and understand them.

- Professionalism: A well-designed invoice template can help portray a professional image of your business, which can help build customer trust and loyalty.

- Compliance: Insurance invoice templates are designed to meet industry-specific guidelines and standards, ensuring that you comply with regulatory requirements.

- Customizability: Many templates can be customized to meet your specific needs, such as adding your business logo or adjusting the layout to suit your preferences.

- Cost-effective: Using a template is often less expensive than hiring a professional designer to create custom invoices. This can help businesses save money while still presenting a professional image to their customers.

-

Simplify Your Insurance Invoicing with a Free and Easy-to-Use Template

If you’re an insurance agent, however, the process can be a bit more complex because you’ll need to generate multiple invoices for each policy sold.

Luckily, there is an insurance invoice sample that can streamline this process for you and help improve efficiency. The invoice template can be used for multiple purposes including invoices, estimates and quotes. It’s easy to use as well as customizable so you can personalize it with your company’s logo or other information if desired. And lastly, it’s free!

The best part about this template is that it’s so simple to use. You can either fill out the fields manually. You’ll also find that the layout is designed specifically to make sure there are no mistakes when creating an invoice from scratch so that everything looks professional from start to finish!

-

FAQ

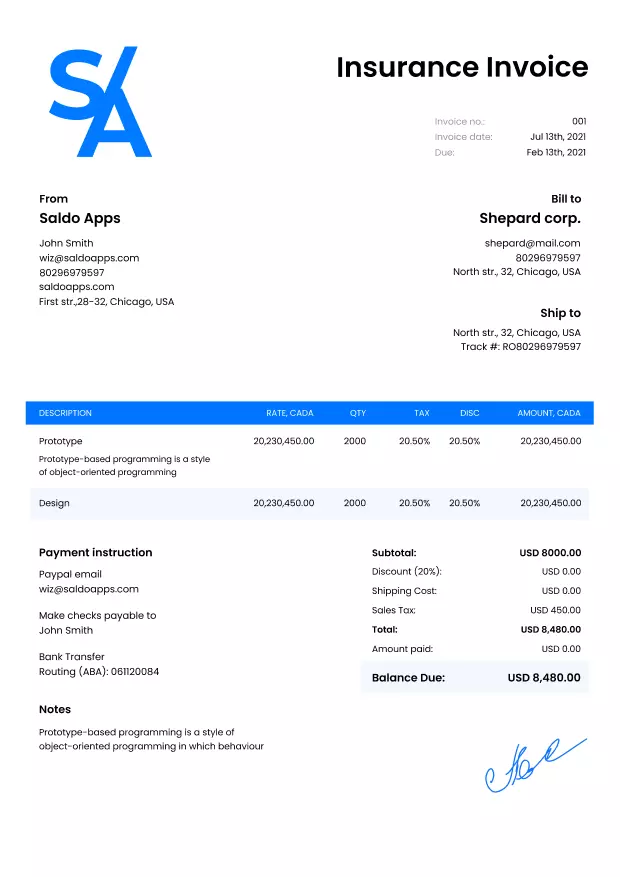

What information should be included in an insurance invoice template?

An insurance invoice template should include details such as the policyholder’s name and contact information, policy number, coverage details, premium amount, and payment due date.

How can an insurance company customize an invoice template to suit specific policies or coverage plans?

Insurance companies can customize an invoice template by adding or removing fields based on the specific information relevant to each policy. This may include endorsements, deductibles, and additional coverage details.

Why is it important for an insurance invoice template to clearly outline the terms of payment?

Clear payment terms on an insurance invoice template help avoid misunderstandings and ensure timely payments. Including details such as the due date, accepted payment methods, and any applicable late fees helps streamline the payment process.

In what ways can technology be integrated into insurance invoice templates for more efficient billing processes?

Technology can be integrated by using electronic invoicing systems, allowing for online payments, automated reminders, and real-time tracking of invoice status. This enhances efficiency, reduces errors, and improves overall billing transparency.

How does an insurance invoice template contribute to regulatory compliance for insurance companies?

An insurance invoice template that includes all the necessary regulatory information, such as legal disclaimers, tax details, and compliance statements, helps insurance companies adhere to industry regulations. This ensures transparency and legal compliance in billing practices.