UK Receipt Template

Do you need more Invoice Designs?

Customise your Invoice Template

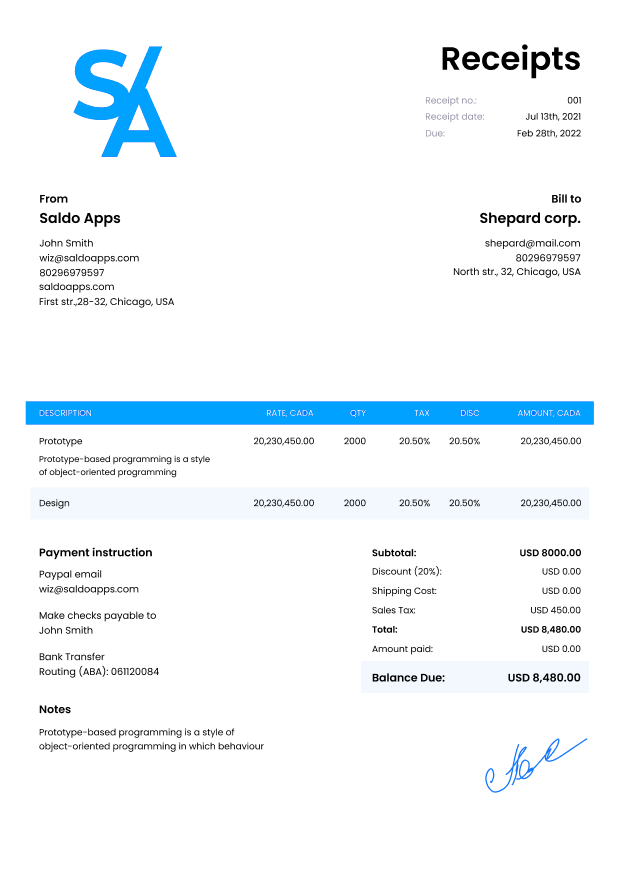

About our UK Receipt Template

This is a complete, print-ready, UK VAT-compliant invoice template. This invoice download can be accessed and downloaded immediately from this page. All you have to do is add your details. This template has been designed in order to easily complete the necessary information required on your invoice.-

Start Your Business with UK Receipt Template

Whether you’re planning to start your own business or become an independent contractor, you have to have a professional receipt template. In fact, in some parts of the world, you’re legally obliged to use a registered receipt template. This UK Receipt Template has been designed to suit most types of businesses but can be easily customized for your specific purposes.

It’s a simple and easy-to-use design, so you can create professional-looking receipts in just minutes. All you have to do is add the information, and then print out the template on plain paper or use it as an invoice template for PDF.

The format of a receipt is simple, but it contains a lot of information that must be completed in order to be valid. The following are some examples of obligatory information for completing the receipt:

– The date of the transaction

– The name and address of the seller

– The name and address of the buyer

– A description of the goods (or services) sold, including quantity, price and VAT (if applicable)

– A description of any discounts or special offers applied to the sale

– The amount paid for each item, including any applicable taxes.

After, just download the filled UK Receipt Template by Invoice Maker and send or print it.

Using the VAT receipt template UK can be a great opportunity for business owners, who have small or large businesses, to save a considerable amount of money. Many different types of businesses can benefit from using a UK receipt template. The most advantageous thing about using it is that it provides 100% guarantee that all money due will be paid by the client.

-

Pros and Cons of UK Receipt Template

The UK receipt template is a document that is used as proof of purchase. It can be used as proof of payment, or it can be used as an invoice when you sell goods or services to another person.

Here are some pros and cons of using a UK receipt template:

Pros:

It’s easy to create and edit. In a few minutes, you can create a perfect one. Also, you can create receipts on any device PC, tablet, or right in phone.

You save time and money by using this template. Instead of having to spend hours creating a whole new document from scratch, every time you sell something, you can simply choose this template, fill out the necessary fields and print it out for your customer right away!

Cons:

Many stores in the UK won’t accept a handwritten receipt without a stamp or signature, but it doesn’t have to be that way.

Here the UK receipt template helps you avoid being denied after purchase and delay your return on credit by providing a record of what was purchased and when it was purchased.

-

FAQ

What information should be included in a UK receipt for business transactions?

A UK receipt should include details about the seller’s and buyer’s information, receipt number, date, item descriptions, prices, and any applicable taxes.

Can I specify different tax rates for various items on the UK receipt?

Yes, the template allows you to specify different tax rates for individual items or services, if applicable.

Is there space for recording the receipt in both pounds sterling (£) and other currencies?

Depending on the template, you can include sections for recording the receipt in multiple currencies if necessary.

Can I customize the UK receipt template to include my company’s logo and branding?

Yes, you can personalize the template with your UK business’s logo and contact information.

Is the UK receipt template compliant with tax regulations in the United Kingdom?

The template may provide a basic format for UK receipts, but you may need to customize it to comply with specific UK tax regulations.