How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

In accounting, there are many techniques and mechanics that help streamline the workflow. You can make billing your customers faster and more convenient with recurring invoices. There are certain businesses and industries where such a document format effectively optimizes the solution of many issues. In this article, you will find detailed information on the recurring billing definition, its benefits, and useful features. So what are recurring invoices ?

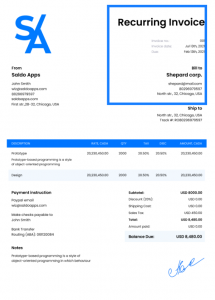

The recurring invoice meaning is clear from the name. This document is a payment form filled out and set once and sent to a client at regular intervals, depending on the specifics of work or order. You can set up scheduled file shipping based on any fillable form, no matter what kind of business you have. You can use bakery, law, medical, construction invoice templates, and so on.

What is a recurring charge? It is an invoice-based regular payment request. The period is determined by an agreement with customers at the stage of signing contracts. It may vary depending on the specific project or orderer. What is a monthly invoice? It is a payment document with a list of works completed within 30 days, sent to a recipient once a month, usually at the end of the period.

Annual, weekly, and monthly invoice payment requests have many undeniable advantages:

Even though recurring charge meaning for business convenience can hardly be overestimated, it still has drawbacks. It can be difficult to track down errors and inaccuracies with such a system for sending regular bills. When using recurring bills, funds are usually automatically debited from the attached card. In this case, both you and your client can notice a mistake after making payment. It is essential to pay attention to it on time and request a resubmission.

It can also be tricky if a transaction is rejected. If a customer ignores it, their subscription or membership will not be renewed. Besides, some users do not keep track of debits and forget to cancel a subscription if they no longer need it. You can’t do anything with these clients. Perhaps, after a while, they will notice unnecessary spending and begin to figure out what’s what. However, everything was done legally on your part.

The recurring invoice format is unsuitable for every industry, as some clients may request a one-time service. However, there are businesses for which this approach is really useful and even indispensable. You can see a typical recurring invoice example when buying, for example, anti-virus software, the payment for which is automatically deducted at regular intervals. Other areas, in which this format is suitable, include the following:

A sample consultant invoice, which is sent at regular intervals, is no different in content from a standard one-time bill. It also contains information about customers and contractors, a list of goods and services, their cost and quantity, payment terms, and methods. SaldoInvoice makes it easy and convenient to create documents for any business and client right on the go.

Imagine not having to pull out your credit card every month to pay the identical old bills. What if you could just set it and forget it? That’s exactly what recurring invoices offer. Less paperwork means businesses have more time for stuff that matters. Meanwhile, customers love the no-surprise nature of regular invoicing, knowing exactly when and how much they’ll be charged.

When money comes in like clockwork, it’s more than keeping the lights on. You’ve got room to think big—maybe bring in that fancy new software you’ve had your eye on or even expand your team. That’s the power of predictable revenue via recurring payments. It opens up new doors because you can count on that regular income.

Juggling subscription services is no walk in the park. You’re in a balancing act, tracking sign-ups, cancellations, and renewals, not to mention delivering a top-notch service. It’s a good thing that recurring invoices are the stress reducer you didn’t know you needed. Billing automation takes the busywork out of keeping tabs on payments and renewals, leaving you free to concentrate on your services and customers.

Having cash flow stability is like a financial safety net for your business. When you know what’s coming in and when it helps with everything—the day-to-day stuff and planning. It’s not just about beefing up your bottom line; you’re also simplifying things for your customers. They can set their budget around a known charge, making the financial aspect of life a bit easier for all involved.

So, why not give recurring invoices a shot? They offer a bunch of perks for both sides of the billing equation. Whether you’re running a subscription service or just want a more predictable revenue flow, this invoicing style can be a game changer. While it’s not the cure-all for every business challenge, the invoicing benefits often make it a no-brainer if you’re looking for a hassle-free way to manage payments.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…