How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

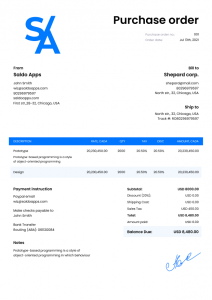

Business document flow consists of a variety of papers. The most important for self-employed and independent suppliers are invoices. However, some inexperienced entrepreneurs often confuse them with purchase orders (PO), which is fundamentally wrong. The latter are pre-order forms that a buyer fills out and hands over to a seller. That is, they precede the provision of goods and services and, accordingly, the issuance of bills. Depending on whether you received a PO for an invoice from a client or not, the document processing is slightly different. Let’s consider all the nuances in more detail.

As you understood from the introduction, purchase order and invoice processing go precisely in this sequence. First, you get a preliminary list of products that a customer would like to order, provide them with everything they need, and, based on it, issue a bill demanding compensation for the work performed. With this sequence, you should make an invoice, considering the data specified in the PO.

As you understood from the introduction, purchase order and invoice processing go precisely in this sequence. First, you get a preliminary list of products that a customer would like to order, provide them with everything they need, and, based on it, issue a bill demanding compensation for the work performed. With this sequence, you should make an invoice, considering the data specified in the PO.

What does a PO mean in a business? While purchase orders are not required forms, they do have certain benefits for your business and clients. They provide maximum accuracy, allowing you to manage inventory and budget more efficiently. You know what an orderer wants and can quickly assess whether you meet their requirements. With the information provided in POs, you can also optimize the packaging and delivery of goods. Moreover, this type of paper simplifies PO invoice processing since you already have all the necessary data. Purchase order template word is a solution that helps businesses streamline their procedures with amazing ease and speed.

What does a PO number mean on an invoice? It serves as a link between two documents. Thus, all papers generated and the data in them (including delivery info) will converge in accounting records. If we talk about compensation for work performed, PO payment terms should also be prescribed. However, it doesn’t mean you should expect to get money after receiving a purchase order. Payment always follows after the provision of goods, services, and invoices.

The non-purchase order definition implies a bill issued without a pre-provided PO. Items pre-ordering is optional, and some companies skip this step. Typically, it happens in businesses that provide services at an hourly rate. As a basis for creating such an invoice for payment, you take a contract and an invoice template printable. The form should include all information about the tasks performed, contact data of a customer and contractor, and payment terms and methods.

Non-PO and PO bills practically don’t differ in their content; the key fields remain the same. However, there is a difference in processing these types of documents. The presence of a PO means that a company or buyer has read your terms and conditions, agreed with them, and is ready to place an order. That is, a client approved a PO. Some view purchase orders as pre-approved invoices. After receiving the bill itself, customers pay within the agreed time.

In the case of non-PO bills, they still have to go through an approval process within the buying company. As soon as the accounting department makes sure that everything is in order, the invoice is transferred further for booking and the compensation for the services and products offered. In the case of large-scale and multi-stage projects, it’s fraught with errors and extra checks, which in turn delays the receipt of payment to your account. If you want to receive money for your work on time, it’s recommended to ask for purchase orders. Fortunately, modern business solutions like SaldoInvoice allow you to reduce all inaccuracies to a minimum.

| PO and Non PO Invoice Difference |

|

|---|---|

| PO associated with invoice raised | Non - PO associated with invoice raised |

| Used for Direct Purchase | Used for Indirect Purchase |

| Faster Invoice Processing | Slower Invoice Processing |

| Used for normal procurement | Emergency procurement of goods or services |

The approval and payment process for each type of invoice also vary. With a PO invoice, there is a sense of streamlining the payment process. The purchase order represents pre-approved terms, which speeds up payment as there’s already a mutual understanding of the transaction’s parameters. However, with non-PO invoices, additional checks and challenges can occur within the managing processes of the buyer’s accounting department, potentially slowing down payment.

The approval and payment process for each type of invoice also vary. With a PO invoice, there is a sense of streamlining the payment process. The purchase order represents pre-approved terms, which speeds up payment as there’s already a mutual understanding of the transaction’s parameters. However, with non-PO invoices, additional checks and challenges can occur within the managing processes of the buyer’s accounting department, potentially slowing down payment.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…