How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

They may be responsible for conducting research, analysis, summing up, and finding options for solving a problem or ways for further business development. Whatever industry you work in, you need to know how to invoice as a consultant correctly to get paid on time. In this article, we will analyze the features of such an activity, as well as share professional tips about how does a consultant get paid.

How do consultants charge for their services? As a rule, an hourly payment is applied within service-based businesses, depending on how much time an expert spent on completing the assigned task. It is the best option when working on complex or large-scale orders when it is difficult for you to foresee all the details.

However, there are other professional services billing options. For example, there are cases of payment per project with a flat rate when you stipulate in advance how many hours it will take you to complete an order. In this case, the total amount is fixed. There is also a method when you negotiate with a customer on when and for how long you can be available for consultations. Such a freelancer is considered to be on a retainer and receives a fixed, predetermined monthly salary.

Of course, you should discuss the payment format with each client in advance, even when signing contracts early. This way, they’ll clearly understand how to pay a consultant they hire. The choice of the optimal option depends on what kind of services you provide and what result a customer wants to achieve from interacting with you. You should fill out consultation invoice forms based on the selected rate type.

Any consulting invoice examples involve receiving payment after certain services have been provided, or once a week, month, quarter, and so on (depending on your arrangements). Once you’ve sent a bill to clients, they have a certain amount of time to compensate you for the work done. You can specify the deadline with an exact date, or you can use the traditional term “Net …”, where instead of an ellipsis, you indicate the number of days (7, 30, 90, and so on) during which the money should be credited to your account.

You can also give customers a discount if they pay as early as possible. Such an option is indicated, for example, as follows: “2/10 Net 30”. This phrase means that a payer will receive a 2% discount if they transfer funds to you in the first ten days, and they have 30 days to do so. Giving discounts increases customer loyalty and the likelihood that they will return to you. At the same time, to protect yourself from possible delays, you can also set a late payment fee. Professional independent contractor invoice templates have a separate block where you can describe all your terms.

By the way, some how-to-bill-for-consulting-services sample tutorials suggest that professionals use the compensation method based on results. Under this approach, a portion of your payment is withheld until your work produces certain results. For example, profits will grow to certain levels, or the number of regular customers will increase. After that, you receive the remaining sum. The percentage of such a fee depends on what heights orderers can achieve thanks to your advice.

Also, your payment terms should include the ways in which customers can transfer money to you. The SaldoInvoice templates allow you not only to choose among the proposed options but also to add your own so that they are convenient for both you and your customers.

A variety of invoice formats are also available for the convenience of the client; a good example is the excel invoice template. Pick a template that is appropriate for your needs and has a look that matches the branding of your business.

Billing as a consultant means the ability to create and fill out payment papers correctly. An invoice is your main document for receiving compensation for completed orders. It should look professional, be well structured, and contain all the necessary data about a customer, contractor, and services. You can create it yourself, but it’s better to use invoicing software and ready-made templates to streamline the workflow.

A distinctive feature of your advisory activity is hourly payment (as a rule). It means that you should use a timer to keep track of the amount of time you spend working. It is recommended to discuss with a client whether it is possible to round results, for example, up to 15 minutes or half an hour. Instead of capturing data by hand, better use trackers and transfer records from them into templates. They will make your task much easier.

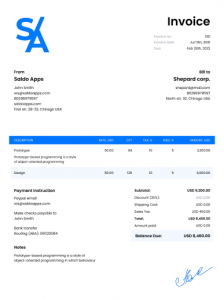

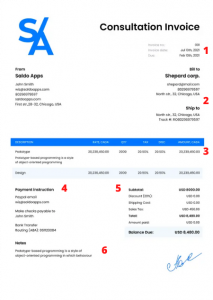

Please note that one professional may provide various services at different rates. It means you need to collect information on each of them separately. Each type of work (collection of information, analytics, and so on) should have a separate line in your invoice with the corresponding rate.

An invoice sample can be a useful tool for businesses and individuals when creating an invoice.

We hope our simple consultancy tips will help you figure out how to bill clients and create invoice when providing advisory services. Whatever industry you work in, we will supply you with all the necessary invoicing tools.

In any professional invoice for consulting, the identification and information about the consultant are necessary. These details include:

These details help establish legitimacy and provide your client with various ways to reach you if needed.

In addition to these basic contact details, other elements you should consider including are:

Including your professional profile and specialization gives a client context about your professional background and further establishes your credibility.

The invoice should concisely list the services provided, the areas of counseling covered, and any achievements. Include a brief statement of the expected deliverables from your project-based or hourly work.

Next, your invoice should clearly present the essentials, describing the cost of your services. This involves determining the pricing model or consulting fee, which could be hourly, project-based, retainer, or result-based, as described earlier in the article. Be clear and transparent about your rates.

Your invoice should also take into account additional charges or expenses incurred during the service delivery. For example, you might need to itemize travel expenses, materials used, or any sub-contractors hired. Remember to incorporate the milestones achieved during the consulting work, along with payment terms, to help in managing billing cycles.

Establish clear payment terms and deadlines, such as “Net 30.” Incorporate tips for efficient payment processes to enhance clarity. This clarity helps in promoting timely client communication and payments.

Conclude with your professional signature and reiterate your contact information for any follow-up inquiries or feedback from the client.

The objective is to streamline the payment process for clients by ensuring clear invoices and fostering prompt payment, effectively managing the cycles of your consulting business.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…