Mileage Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

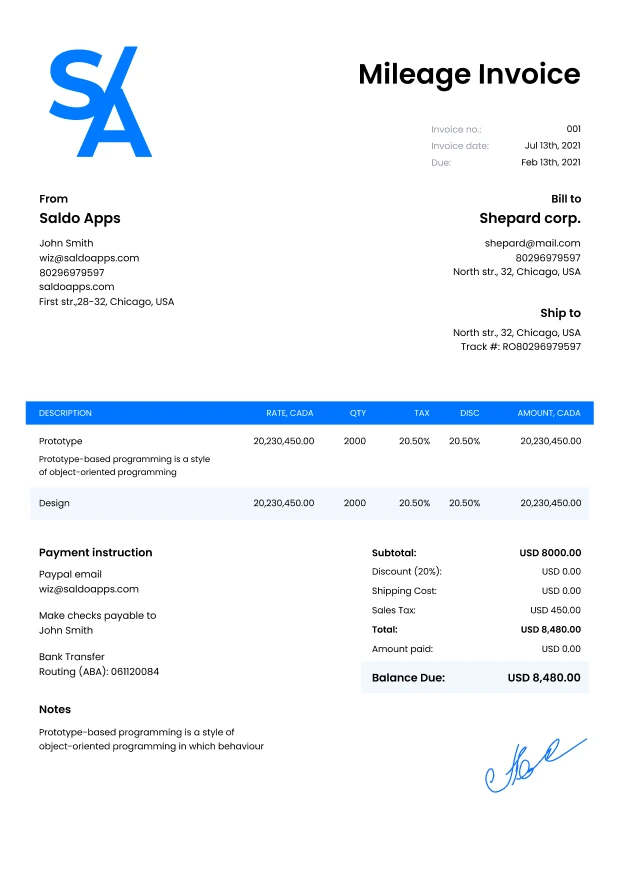

About our Mileage Invoice Template

An invoice for mileage is a formal document that contains the driver’s details, vehicle details, destination details and miles given. It is an important document for both parties involved in the business transaction. Invoice Makers’ template can be saved as a PDF, so it’s easy to send your customers.-

Ways of Using Mileage Invoice Template

Businesses of all sizes should have the right tools to handle administrative and accounting tasks. In the case of freelancers, contractors, and vendors, it should be as compact and easy to use as possible software that allows them to quickly create and fill mileage invoices wherever they are.

With the help of our service, you can generate payment papers on any available device and at any time in a matter of seconds. Customize a sample as you need at the moment, enter all the necessary information into it, and pass it on to a client. Be sure that you will not miss anything important when completing our mileage reimbursement invoice template. Fillable fields will tell you what is missing. You can also change the file format and choose one of the popular ones: Word, PDF, Excel, etc.

We offer the opportunity to specify as many payment methods as you need in an invoice for mileage. By providing customers with multiple options, you will get paid faster for the work done. Orderers can pay by card (you need Stripe for that), make bank transfers, use PayPal or checks. You can specify any other method manually. Don’t forget to add payment guidelines and instructions to make the process easier for customers.

-

Download Mileage Invoice Template Easy With Saldo Invoice

All created bills are saved in your profile library, and they can also be downloaded to your device. Based on them, you get reports that make it easy to track the funds received, the expected amounts, and overdue invoices.

-

FAQ

What key information should be included in a Mileage Invoice Template?

A comprehensive Mileage Invoice Template should include details such as the date of travel, starting and ending locations, total miles traveled, the purpose of the trip, and the reimbursement rate per mile.

Is it necessary to provide supporting documentation along with a Mileage Invoice?

Yes, it’s advisable to attach supporting documentation, such as a mileage log or map, to validate the accuracy of the mileage claimed in the invoice. This helps in maintaining transparency and reducing the risk of disputes.

How does the reimbursement rate for mileage affect the amount invoiced?

The reimbursement rate per mile directly influences the total amount invoiced. It’s essential to clearly state the agreed-upon rate in the Mileage Invoice Template to avoid any misunderstandings between the parties involved.

Can a Mileage Invoice Template be used for tax purposes?

Yes, a Mileage Invoice Template can serve as a valuable record for tax purposes. It provides a documented history of business-related travel, which can be important for tax deductions. However, it’s recommended to consult with a tax professional to ensure compliance with tax regulations.

Are there specific considerations for international travel when using a Mileage Invoice Template?

Yes, for international travel, it’s important to specify the units of measurement for distance (e.g., kilometers instead of miles) and consider any additional factors such as currency conversion rates if reimbursement is in a different currency. The template should also comply with relevant tax and legal regulations in the respective countries involved in the travel.