How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

However, receiving payment from foreign company or customer bears the risks related to currency volatility. Inexperienced exporters can lose income and make plenty of mistakes due to exchange rate fluctuations. This article explains how to generate an invoice euro or other foreign currencies and how international sellers benefit from multi currency invoicing.

Let’s agree that sending an invoice in US dollars is the easiest way for an international supplier. However, this approach is not always convenient for a customer. Many may not have a dollar bank account, so they may lose money due to double currency conversions. In such a case, it is reasonable for exporters to start billing in the consumer’s local currency. Usually, if you send an invoice in a foreign currency, you will also provide a similar price list.

Before invoicing abroad, it is worth ensuring that you have an actual exchange rate. Invoice currency definition helps to set competitive prices, so they are not understated or overstated. How to correctly calculate the exchange rate for an invoice? The first way is to choose the average market rate. You need to calculate the arithmetic average between the purchase and sale rates. For this purpose, use a simple formula: (buy rate + sell rate) / 2 = average rate. Alternatively, you can focus on the periodic exchange rate.

Don’t forget to convert the shipping cost, tax, and other expenses associated with the transaction. This will protect your customers from any inconveniences while paying international invoices.

B2B and B2C exporters can win from invoicing in foreign currency and increase their profits. How? With straightforward pricing, the potential customer will be more likely to purchase. Moreover, when receiving invoices in the local currency, the client has fewer questions about how to pay an international invoice. If you provide understandable pricing, it will be easier for foreign customers to make a payment.

Another essential benefit of multi currency billing is faster receipt of payments. With the ability to settle the local currency, customers are less likely to miss the invoice deadline. With timely payments, you can adjust a steady cash flow for your company and set long-term growth goals.

In addition, currency conversion will help you get new loyal customers. The problem with international trade is that clients may distrust a foreign seller. They may not understand or even be afraid of paying invoices in foreign currency. By providing transparent prices to the customer, you show your respect. The less stress and questions the buyers have during shopping, the more likely they will repeat the purchase and recommend your company to others.

For the convenience of the customer, example invoice template may be helpful.| Benefits Of Invoicing In Foreign Currencies | |

|---|---|

| Diversification | Invoicing in foreign currencies allows businesses to diversify their revenue streams and reduce their exposure to currency risk in their home country. |

| Access to new markets | Invoicing in foreign currencies allows businesses to access new markets and reach customers who prefer to pay in their local currency. |

| Competitive pricing | Invoicing in foreign currencies can help businesses price their products and services competitively in different markets, which can lead to increased sales and revenue. |

| Currency hedging | Invoicing in foreign currencies allows businesses to use currency hedging strategies to mitigate currency risk and protect their profits. |

| Improved cash flow | Invoicing in foreign currencies can help businesses improve their cash flow by reducing the time it takes to receive payment from international customers. |

| Increased credibility | Invoicing in foreign currencies can help businesses establish credibility with international customers and show that they are familiar with and sensitive to the local business practices and cultural norms. |

International invoicing has many pitfalls. To avoid losing income and gaining a share of the foreign market, you should keep a few things in mind. Before you start trading abroad, make sure that your country’s legislation allows you to receive income in foreign currencies. If so, consider the current exchange rate and post prices for foreign buyers in your catalog.

Remember that the cost of goods on the site should be the same as in the invoice. Pay attention to the fact that each private bank sets the rate at its discretion. It might be different from the official rate, so we recommend referring to the state bank of the country you are invoicing.

Do not forget to update the exchange rates regularly. If you do not keep track of the actual market rate, you run the risk of losing income. Remember that any gains or losses caused by differences in the exchange rate should also be recorded into accounting entities. If you received less than the amount shown on the invoice, you should mark the difference as an “Expense”. Conversely, if you were overpaid for goods, such profits should be categorized as “Other Income.

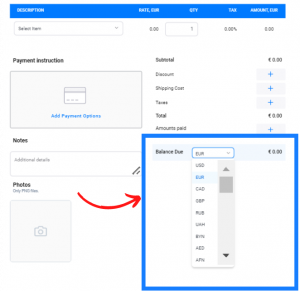

If you prefer paper invoicing, you can manually fill out every copy. But this is time-consuming and could lead to errors. An alternative solution could be using a multi currency invoicing software such as Saldo Invoice. The automated assistant allows you to select over a hundred currencies for your invoice. On request, you can fill out a ready-made template for a specific country, such as the UK invoice template or a sample of invoice Malaysia.

Templates will not only help you create a professional invoice but also allow you to customize them to your needs. Impress your customers by adding a digital signature, logo, and a quick payment form. After you fill in the invoice, download a PDF copy and send it to the recipient. Such an invoice can be displayed on any device and quickly recorded in the balance sheet.

Templates will not only help you create a professional invoice but also allow you to customize them to your needs. Impress your customers by adding a digital signature, logo, and a quick payment form. After you fill in the invoice, download a PDF copy and send it to the recipient. Such an invoice can be displayed on any device and quickly recorded in the balance sheet.

How to change currency on Excel invoice? If your customers prefer to receive invoices in Excel, you can download the receipt template from the website and manually change the currency settings.

The reality shows that international exporters must be flexible and willing to accommodate their consumers. Invoicing in a foreign currency will help open up new markets and win loyal clients. Stop doubting and take your international business to the next level by following our guide on how to invoice international clients.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…