How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

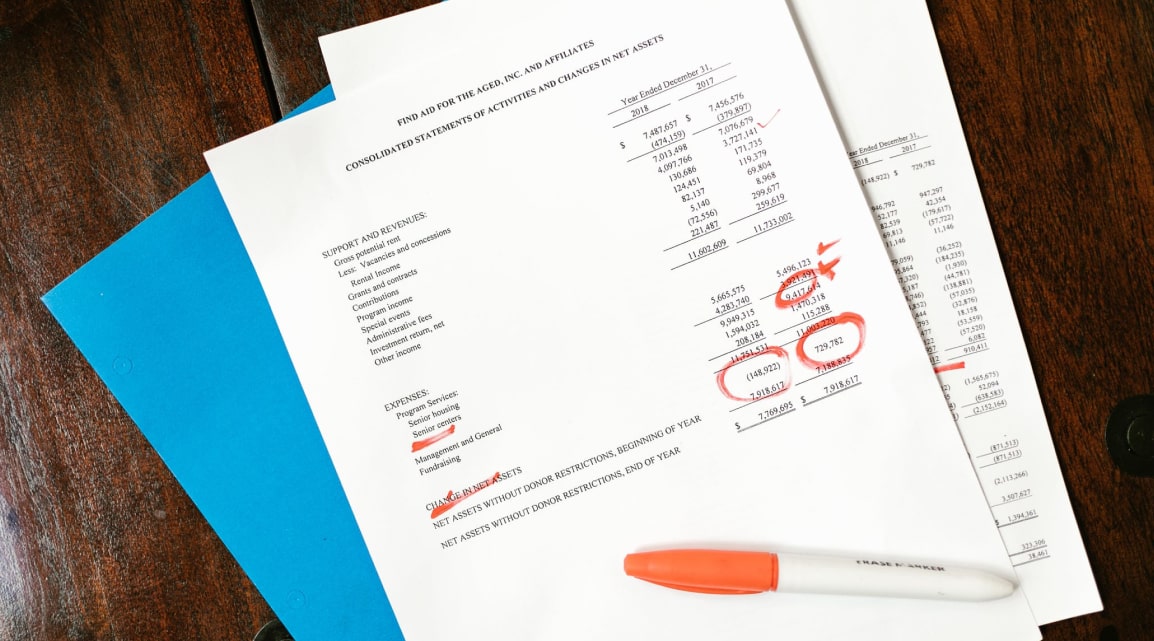

As a business owner, you are interested in getting paid for your job on time. That is why payment terms are used to declare your expectations and inform a client when they need to transfer money to your account. To insulate yourself from possible misunderstandings and avoid differences in interpretation, you should mark a net amount on an invoice.

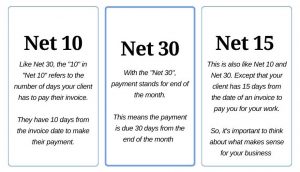

What does Net 30 mean? By including this term in your file, you notify a recipient that payment must be made within thirty days. If the agreed amount is not credited to your account by the appointed time, the issued check is considered overdue. It is a reason to remind a payer of the need to make a payment and apply penalties. It is recommended to think over an action plan for such a case and warn your customer about the possible consequences. Create invoices instantly with our free Net 30 invoice example.

In billing, the term “Net D” is used, where “D” means the number of days a client should pay for the tasks performed. This period might differ depending on the agreement with an orderer and your business specifics. Applying the same terms to all customers is unnecessary; adjust them when working with different purchasers.

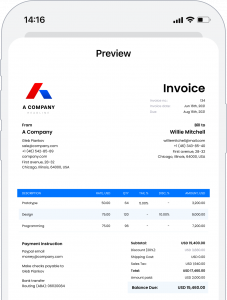

What are the standard payment terms on an invoice? When creating forms using our service, you can indicate 7 and 30 days, payment upon receipt or the next day, and manually set the date. Experts do not recommend small businesses to provide too big periods. With an insufficiently stable flow of orders, they risk being left without money. However, if you cooperate with regular customers, you can offer Net 60 and even 90.

What does an outstanding invoice mean? It is the name of papers that have already been sent to a recipient but have not yet been paid. It is recommended that you send the documents to the orderers in advance so that they have enough time to sort out the payment and deposit money into your account. Submitting bills a few days or weeks before the deadline increases the likelihood that the agreed sum will arrive on time.

To encourage clients to pay faster, freelancers and vendors offer discounts that are valid within a few days of the allotted period. For example, in your Excel, Word, or PDF fillable invoice, you can write “2/10 Net 60.” It will be interpreted as follows: the invoice must be paid within 60 days, but if the money arrives within ten days, you’ll give a 2% discount on the total amount.

When processing payment forms, you also come across the terms “Cash on delivery” and “Cash in advance.” The first means that payment should be made as soon as a person or company receives products. The second indicates that a customer should pay beforehand. Both methods pose particular risks for orderers. However, as a rule, both cashless and cash invoices mean payment after the task completion.

The due date is an essential component of any printable generic invoice. If you don’t specify it, a client won’t know when the money should be credited. When working with unreliable people or companies, it might even lead to finding yourself without compensation for the tasks completed. Our templates have a separate line where you need to specify the desired date. It can be Net 30, or any other period you wish.

Please also note that it is necessary to agree with a client on which day the countdown begins. Your invoice payment terms definitions might differ, so they should be indicated right away. The starting point can be considered the moment of job completion, delivery of goods, or transfer of papers to a customer. Be sure to discuss this moment with an orderer, and don’t forget to leave a reminder in the “Notes” section when filling out the form at the Saldo Invoice app.

In the below example, net 30 can be placed in the column due date at the top that makes clear what day payment is due. Saldo Invoice has online invoicing software that easily lets you enter payment terms and send reminders.

You’ve likely seen terms like Net 30 payment or Net 10 scribbled at the bottom of an invoice. But what do they mean? It’s easy: if you see Net 30 on a bill, the sender expects the payment within 30 days. Net 10? You guessed it—the money should be in within 10 days. These payment terms make everyone’s life easier by setting clear expectations. They’re the ABCs of payment agreements, spelling out exactly how long you have for the payment duration. No fuss, no misunderstandings.

So, when do you choose Net 30, Net 10, or something else entirely? It depends on what you’re selling or buying. Here’s a quick guide to help you decide:

The idea is to tailor payment periods to the transaction type, ensuring they’re a snug fit for you and your client.

Money today is worth more than tomorrow—this is the basic principle behind cash flow. Shorter payment periods can mean quicker cash in hand. On the flip side, offering more extended time frames to your clients can foster better relationships. It’s like a see-saw; you have to find the right balance. Payment flexibility is often the secret ingredient here. You could offer early invoice payment perks to get your money faster while providing more generous time frames for those needing it. In this way, you juggle both cash flow and client relations successfully.

Let’s talk about how to make the game’s rules—your payment terms—work for everyone involved. Payment negotiation is like a dance where you and your client must find the rhythm. Be clear about your needs; ask openly about theirs. Mutual understanding is critical to setting up favorable invoice terms. Once you’ve hashed it out, put it in writing to solidify your payment agreements and clarify your payment scheduling expectations.

Invoicing isn’t just a tedious task you have to slog through; it’s a pivotal part of your business that, if done right, can make everything run like clockwork. By understanding and wisely selecting payment terms, you improve your cash flow and build a transparent and efficient relationship with your clients.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…