How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

There are situations in business when you need to reimburse some expenses. For example, when an employee purchases a product with their own money for the company’s purposes. Such costs must be compensated and clearly documented, like any other transaction. Businesses use invoices for it. In this article, we will discuss reimbursement meaning and the features of such bill creation in detail.

Before jumping directly to invoices, let’s deal with the question, “What is reimbursement?” It is such a format of company expenses that reimburses the costs incurred by other people to resolve business-related issues. Suppose that an employee buys some product with their own money, which will be used for work purposes only. Compensation allows those individuals who spent personal funds to return them and companies to record this format of expenses correctly in their accounting papers. In addition to the situations described, reimbursement might apply to hotel and flight bookings for business purposes, medical expenses, and other things.

Accounting for expense reimbursement and filing the correct paperwork is also necessary so that employees who spent their funds do not have to pay income tax. The IRS can regard this kind of compensation as income. Therefore, the company should have an active accounting system/plan that uses invoices to define reimbursement. At the same time, there are some expenses that the employer can legally refuse to compensate for.

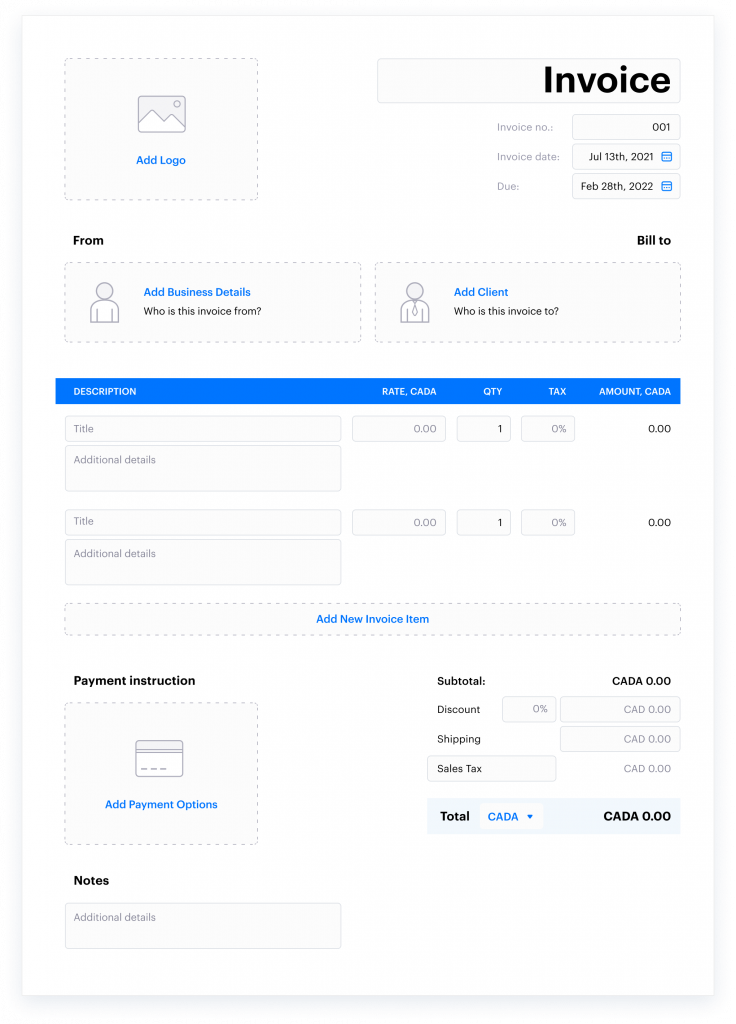

The importance of business expense reimbursement invoices should not be underestimated; therefore, you need to learn how to create them. Luckily, with Invoice Maker, you have all the tools you need at your fingertips. In terms of their content, such invoices do not differ from ordinary ones, so you can use any template from our website, for example, an invoice for mileage. Compared to creating documents from scratch, it helps you save time and avoid errors.

To receive compensation from your employer, you, as an employee, need to enter the following information into the template:It is best to create invoices using templates and save them electronically in PDF format. It allows you to protect sensitive data in the file from outside interference, save space in the device’s memory, and quickly exchange information. You can also print one of our templates after filling it out or beforehand to enter the data manually. You can also create the necessary invoice from scratch using examples from the Internet. This method is subject to possible errors, due to which you might be denied compensation.

Expense management is an essential part of dealing with the company’s finances. To understand how to track costs and reimbursements, you first need to find the answer to the question, “How does reimbursement work?” After purchasing any item (-s) with their own money but for business use, employees must issue an invoice and attach evidence of their expenses to it.

These are usually checks and consignment notes since they contain information about the purchased goods or services, the exact amount, and the date and time of the transaction. They must transfer this set of documents to the responsible person or department, who will make the payment on time after processing the papers.

You can use the same Invoice Maker app which you used to create and send invoices to recipients to track invoice processing and receipt of funds. It will allow you to automate processes, which is important if you have to go through this compensation procedure regularly.

The terms during which the reimbursement process is completed and the employee receives compensation can greatly vary depending on the region and company. Statistics show that, on average, it takes about nine business days.

It usually happens along with the payment of salaries or manually, depending on the enterprise’s size. Besides, the rules regarding this kind of compensation differ.

For example, the law requires companies to pay all compensation and file reimbursement expenses in California. In other US states, employers might waive such payments in certain situations, even if the cost was related to business purposes.

A typical example of tax invoice would include the details of the person or company requesting the refund and the businesses from which the refund is being requested. The list of items can greatly vary, but it must contain the name of a product or service, rate, quantity/hours, cost, and tax percentage due. The document should also include information about payment methods. Typically, workers receive such compensation on the same bank cards that they get their salaries.

Reimbursement invoices are a vital part of the company’s workflow and a tool for employees to get compensation. Invoice Maker simplifies the process of creating these invoices, freeing you from having to make them from scratch and fill them out manually.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…