How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

You have decided to start working for yourself and open your own business. In this case, you need to understand how customer interaction works and what documents are used at each stage. This article will help you figure out the difference between invoice and estimate and understand how to work with both documents to get paid for your work right on schedule.

The process of ordering a product or service occurs in several stages. One of the first is evaluating the project’s scale and cost. What does it mean to estimate? Within the business framework, it means an approximate assessment of the upcoming work, depending on the client’s requirements and wishes. Based on it, you draw up a document that bears the same title and transmit it to a recipient.

How do you estimate? It depends on what exactly you do. For example, if you have a construction or renovation business, you can come to a site to understand the type of work ahead, its volume, and the materials that will be needed for it. Within the framework of one project, both services with an hourly payment and goods with a fixed cost can be provided to customers.

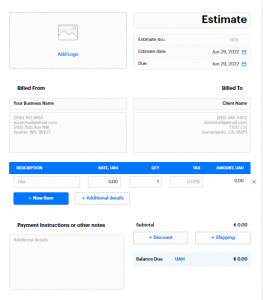

All this information should be reflected when filling out an estimate template and passed on to clients for consideration. They, in turn, may agree or disagree with the conditions put forward.

What does estimate the product mean? You’re required to understand how many items a customer needs and the cost of each and calculate an approximate total sum. If you produce goods yourself, when evaluating, you need to consider the resources spent on its creation (time, efforts, and so on). As a rule, you get a rounded amount, not an exact sum, which means that during the order fulfillment, it may change.

The definition of an estimate implies an approximate calculation of the cost. It means that this type of document isn’t legally binding, doesn’t oblige you to supply the listed items or the customers to provide compensation, and shouldn’t be entered on ledgers. They cannot be used to calculate and pay taxes as well.

Now that you understand the basic estimation meaning, let’s talk about the different types of such forms. Experts distinguish four types:

Other formats may be used in each industry as well, which are based on different project parameters. All of them are united because they’re provided to customers before starting work and serve to familiarize themselves with the estimate terms and requirements. They can be edited depending on the orderer’s needs. Once you get consent from a client, you can get to work.

Understanding how to create an estimate isn’t difficult, as the name speaks for itself. As a business owner, you need to give a rough assessment of the cost of a project.

For example, a catering company sends a customer a detailed list of ingredients used to prepare a dinner for ten people, as well as an estimate of what activities will be required and how long it will take to cook all the dishes. The best option is to offer a client several scenarios to choose from, for example, taking into account desserts and beverages.

What does an invoice mean? The main difference between invoices and estimates is that the first ones are sent to customers after their orders have been completed. They represent an official confirmation of a transaction and the requirement to pay for your services within the agreed time. While they may be based on estimates or quotes previously submitted, the details and amounts may vary. In the process of fulfilling an order, a project can be reduced or, conversely, expanded, for example, if a client has got extra requirements. Use the Google Sheets invoice template to simplify even the most complicated invoice.

You can use data from estimates for creating invoices, but the information should be updated. Professional payment documents contain the following details:

It isn’t easy to foresee all the details in advance when working with large projects. That is why invoices might be more detailed and contain additional lines and items.

Entrepreneurs use different types of invoices in accounting, and their number is much larger than estimates:

Although the main essence of each of these types remains the same — to confirm the completion of an order and demand payment — their content may differ slightly. In negotiations between artists and clients, a pro forma invoice is frequently used to specify the list of works, their duration or quantity, their cost, and other specifics. For example, if a client requested a refund for any reason, you would need to issue a credit memo and include relevant information regarding the customer’s balance. Similar to that, you can use a format like a word invoice template for the client’s conveniens.

If we compare an invoice and an estimate in terms of legal force, the former is a document that obliges an orderer to pay since the requested work has already been completed. They’re an integral part of any business because they legally bind you and a client and should be used to pay taxes and be entered on accounting records.

An invoice and estimates are two different documents used at various stages of interaction with customers and serve different purposes. They distinguish from each other in many ways:

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…