Receipt Template

Do you need more Invoice Designs?

Customise your Invoice Template

About Our Receipt Template

Welcome to our online receipt template hub. Here, we’ve crafted a vast collection of freeinvoice templates that can make your business life a whole lot easier. Whether you’re running a bustling bakery or a cozy coffee shop, we’ve got you covered.

Our free receipt templates come in a variety of formats: PDF, Word, Excel, Google Docs, and Google Sheets. With our user-friendly interface, generating personalized receipts for your customers is as easy as pie. Simply choose a template, fill in the details, and voila! You’re ready to send your customer a sleek, professional receipt in just a few clicks.

-

Application of Online Receipts Template

Below, you will explore how you can personalize your files, make your business look top-notch, and reach customers worldwide. In other words, we will be covering the application of online receipt templates.

- Professional Record-Keeping. Our online templates are your assistants when it comes to maintaining a professional record of payments received. They capture all the essential details e.g., date, amount, transaction method, project specifics, and recipient information. This guarantees that no details are overlooked.

- Streamlined Transaction Process. Unlike invoices, receipts are handed out after a payment is made. They seal the deal. Our templates simplify this process, as well as make it easy to generate and distribute docs swiftly. This, in turn, takes customer satisfaction and trust to the next level.

- Customization Freedom. No more bland, generic documents for you! With our templates, you have the creative freedom to customize every aspect. From adding payment links to incorporating your branding or even choosing a holiday-themed design, the possibilities are endless.

- Professional Image Boost. A well-designed receipt speaks volumes about your business’s professionalism. Make the most of our templates to leave a lasting impression on your customers, foster stronger connections, and increase repeat business.

- International Compatibility. Need to cater to clients from around the globe? No problem! Our free receipt templates guarantee smooth business transactions with clients worldwide, making your business truly global-ready.

-

How to Make a Receipt Using a Free Receipt Generator?

The process of creating a receipt doesn’t have to be hard. There’s a multitude of free receipt generators out there. Many of them will save heaps of your treasured time. Below, we’ve shared a simple guide to help you with this:

- Find the Right Receipt Maker. Start by searching for a reliable generator. It doesn’t even have to be a must-downloadapp. Give our online Invoice Maker a try. As a matter of fact, some business owners say it’s one of the best services out there. No need to even create an account straight away!

- Pick a Template. The SaldoInvoice platform offers a treasure trove of free receipt templates to fit different businesses and occasions. Just choose one that suits your needs and preferences.

- Fill in the Details. Specify the purchase amount, file number, sender and recipient info, payment method, as well as other important details.

- Customize It. Want to add a personal touch? Play around with colors, fonts, and logos to make it truly yours.

- Save and Share. When you’re happy with your masterpiece, save it to your device and share it with your client. That’s it! You’ve just easily coped with the create a receipt online task!

Boost Your Productivity With Professional Receipt Templates

-

Increase Efficiency with a Receipt Example

Ready to take your business to the next level? Let’s talk about professional receipt templates. They can truly make your work easier. Here’s how they can assist you in getting more done:

- Effortless Creation. With professional receipt templates like ours, making receipts is a piece of cake. No more fussing over formatting or design — just plug in the details, and you’re all set!

- Save Time and Effort. Time is money, that’s a fact. Our receipt templates are exceptionally time-saving. They speed up the whole receipt-making process, leaving you with more time to focus on what really matters: making money.

- Boost Your Brand Image. Consistency and uniformity are vital when it comes to branding. By using professional-looking receipts, you are both keeping things organized and showing the world that you mean business. Everyone loves a sleek, polished image!

- Impress Your Customers. Ever received a receipt that looked like it was slapped together in a hurry? Not a great feeling, right? By using top-notch templates like the ones offered by our invoicemaker, you’re sending a message to your customers that you care about all the little details — and that you’re serious about providing a truly professional experience.

- Stay Perfectly Organized. Receipts are the breadcrumbs of your business — they help you keep track of your transactions and expenses. With professional templates, everything is neat and tidy, making it a breeze to stay organized.

- Free and Easy. Best part? These templates won’t cost you a dime.

Learn more about receipt creator – What Is the Difference Between Invoiceand Receipt?

-

Main Elements of Receipt Maker

Let’s cover the basics of what makes a top-notch receipt maker. Below, we’ve provided the main elements:

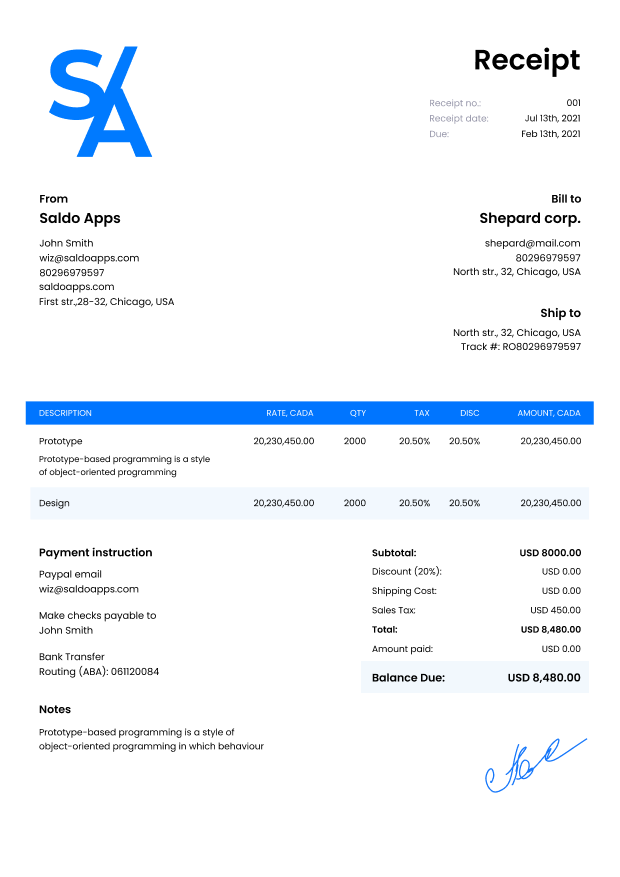

- Title That Stands Out. Your receipt’s title is its special name. Make it clear and attention-grabbing. This will prevent the document from getting lost among other not-so-vital papers.

- Detailed File Info. Your receipt needs its own ID card. Indicate vital stats e.g., the document ID, invoice number, creation date, and payment received date.

- Party Time. No, not the kind with balloons. Your receipt needs info on the parties involved: names, addresses, and contact details.

- Order Breakdown. This is where you cover what was bought. List all goods and services in detail.

- Payment Method. Your receipt needs to show how the payment was made. Make sure you cover that in detail, too.

- Sum It Up. Tell the customer exactly how much they’ve shelled out. This clarity helps them monitor their spending and also helps achieve transparency in transactions.

- Notes of Gratitude or Guidance. This is your chance to shine. Thank your customer, give them a useful tip on storing their goodies, or nudge them towards their next purchase. They’ll love this personal touch to your digital handshake.

These elements in your arsenal will help you make receipt examples like a pro in no time. The best part is that you can do it all for free with our service! So go ahead and create free receipt samples that dazzle and delight (and boost your revenue, too!)

Main Elements of Receipt Maker 1. Title Your document should have a clear title such as “new receipt”. This way, the recipient can quickly distinguish your file from dozens of others. 2. File Details They include the document ID, the invoice number, the date the file was created, and the date the payment was received. 3. Parties' Data Your receipt for a customer should contain personal or business details of both the payer and payee: names, contact details, addresses, etc. 4. Order Description List all goods and services which the customer has paid for. Do a detailed breakdown describing the items, amounts, and costs. 5. Payment Method A real receipt should also include the method by which the transaction was made. 6. Total Sum Specify how much the customer has deposited into your account. It can be the total cost of the order or part of it (depending on your agreement). 7. Notes Use this field at your discretion. Thank the customer for contacting you, add comments about the use or storage of the items, offer a discount on the next order, or enter the remaining amount due if the payer sent only a part of the total order amount. What to Consider When Filling Out a Blank Receipt

Below, we will talk about what you need to keep in mind when you make receipt samples:

- Logo Love. Adding your logo might seem like a small detail, but it packs a punch. It boosts brand recognition and makes your docs pop into a sea of paperwork.

- Repeat for Clarity. Don’t be shy about reiterating the order details on your receipt. Clarity is paramount for both you and your customer.

- Linking Invoices and Receipts. Make sure your receipts are besties with your invoices by linking them together. This way, everyone’s on the same page, and there’s no confusion about what’s what.

- Error-Free Zone. Mistakes happen, but they’re best avoided on official files. Using tools like Invoice Maker can help, but always give your entries a double-check. After all, you don’t want typos causing chaos in your accounting world.

- Keep Copies Handy. Don’t toss those file copies aside like yesterday’s news. Keep them close for auditing, budgeting, and all your bookkeeping needs. Digital storage options make this a breeze.

-

Real Receipt vs. Fake Receipt

Now, let’s uncover the secrets behind spotting a real receipt versus a fake one. Here’s your cheat sheet:

- Format Matters. Real receipts stick to the script, following a standard format with consistent branding. Any deviation from this should instantly raise a red flag.

- Logo Logic. A genuine doc proudly displays a crisp, clear logo. On the flip side, fake receipts often come with blurry logos that make you squint harder than trying to read tiny print.

- Party People. In real receipts, names, addresses, and contact details are as up-to-date as your Instagram feed. On fakes, you may spot too many errors.

- Invoice Insights. Real docs always reference the original invoice. If the invoice ID is missing or MIA from your database, you might be dealing with a fake.

- Order Details. Real receipts spill all the details about your purchase — what you bought, how much, and what you paid in taxes. But fake ones? They’re about as detailed as a fortune teller’s vague predictions.

- Print Quality. Good printing is a sign of a real receipt. The colors are bright and vibrant. If the doc looks faded, it’s most likely fake.

Keep an eagle eye on these telltale signs if you want to be able to sniff out a fake file in the blink of an eye. The best part is you can do it all for free! So go ahead, create free receipt samples that are as real as they come.

Original Fake Format Usually, businesses use unified templates for all their documents with the same branding format. Any deviation from the standard format should be viewed with suspicion. Logo The company logo is clear, not blurry, and of good quality. A fake receipt looks like a bad photocopy, is blurred, or has altered shapes. Parties' data Names, addresses, and contact details are always up-to-date and written without errors. The parties’ information is outdated or indicated with errors/typos. Invoice ID Receipts should always refer to the original invoices and have their numbers. The original invoice ID is not indicated at all, or it is not in your database. Order details The order description is always full, with a list of goods or services, volume, quantity, prices, and applicable taxes. To avoid being disclosed, fraudsters do not break down the order at all. Print quality (for hard copies) Printed documents are of high quality and have vibrant colors. Companies use standard paper or watermarked variants. The print quality is poor, some letters and symbols are faded, and watermarks and other distinctive features are missing. Trust and efficiency are paramount in the business transaction scene. Our receipt template guarantees both and offers a reliable record of every purchase. Customized for online use, it’s a reliable helper that always gets the job done. Generating receipts online is a breeze, for it saves you heaps of time and hassle. Tested and loved by businesses, it adds a professional touch to transactions, as well as boosts customer confidence, and speeds up operations. Don’t settle for less — choose our template and watch your business soar.

Making the Most of Online Receipt Templates

These days, online templates are like the all-in-one tools for business transactions. They make it super easy to create a receipt online and keep a record of every sale. Our template isn’t just practical — it gives your business a professional touch. Plus, with digital copies that are easy to share and store, you’ll never lose track of important paperwork again. So why miss out on all these fine perks? Make the most of our online template in every way possible.

Create a Receipt Online With Our Generator: It’s Easy!

Crafting a receipt has never been easier, thanks to our handy generator! No more days of wrestling with complicated formats. We’ve got you covered. Below, we’ve shared a guide for coping with the task of creating a receipt online with ease:

- Pick Your Perfect Template. No more settling for generic designs. Explore our collection tailored for various industries. Whether you’re a hip café or a trendy boutique, there’s a template that fits your business like a glove.

- Input Your Transaction Details. Adding the nitty-gritty details of your sale is as simple as pie. Just fill in the purchase amount, item descriptions, payment method, and any special notes.

- Personalize With Branding. Add your company logo and tweak the design to match your style, from colors to fonts. The doc will scream “you” louder than your morning coffee order.

- Double-Check & Share With Ease. A quick once-over guarantees everything’s shipshape. Then, with a mere click, you can share a top-notch file with your customer in a flash.

Remember, every receipt you send is a mini billboard for your business. With our generator, making receipts is as easy as ordering your favorite takeout — and just as satisfying!

Speed Up Your Workflow With Our Receipt Sample

Automating document creation isn’t just about convenience. It’s a real game-changer for productivity. Having a sample receipt at your fingertips guarantees each invoice is complete, even during the busiest hours. By sticking to a consistent template, you both speed things up and present your brand in the best possible light, every single time you make receipt samples.

Key Components of Our Receipt Maker

Crafting the perfect receipt isn’t just about jotting down numbers. It’s an art form that speaks volumes about your professionalism. Our receipt maker makes sure every detail is spot-on, which leaves no room for confusion. Here are the main components:

- Document Title. Clearly label it — no cryptic titles, please!

- File Specifics. Include the essentials: ID, invoice number, and dates.

- Parties Involved. Name, contact, address — let’s avoid mystery guests.

- Transaction Breakdown. Include a detailed list of what you bought. Show each item and how much it costs.

- Payment Details. Whether it’s cash, card, or digital, we’ve got it covered.

- Final Amount. No hidden fees or surprise charges, just the bottom line.

- Additional Insights. A little note or a “thank you” goes a long way in customer relations.

Guidelines for Completing a Blank Receipt

Below, we’ve shared some expert-approved guidelines to make sure you fill out receipts like a pro:

- Consistency Is Key. Keep things consistent from start to finish. Make sure the information on your receipt matches what was originally stated on the invoice. Consistency breeds trust, after all.

- Reiterate Order Details. Even if you’ve mentioned them in the invoice, don’t skimp on repeating the order details on the receipt. That way, you are giving your customer a gentle reminder — let’s face it, we all need one sometimes.

- Link Back to the Original Invoice. Don’t forget to connect the dots! Attach a link back to the original invoice. This creates a paper trail that’s as reliable as a bloodhound on a scent.

- Always Review. Before sending that doc out, give it a thorough once-over. Even the best tools can’t catch every mistake, so a manual review is always a good idea.

- Consider Going Digital. These days, storing files electronically is the way to go. No more digging through stacks of paper when you need to find something really important. Plus, it makes financial audits a breeze.

-

FAQ

What makes online receipt templates different from traditional paper receipts?

Online files are digital versions that you can fill out and send electronically. They offer convenience and flexibility compared to traditional paper documents, allowing you to generate, customize, and share receipts with ease.

Are online receipt templates secure?

Yes, digital samples are secure to use. They usually adhere to industry-standard security protocols to protect your data and guarantee safe transactions.

Can I customize online receipt templates to match my brand’s identity?

Absolutely! One of the perks of using digital files is the ability to personalize them. You can add your company logo, choose colors that resonate with your brand, and even incorporate custom messages to reflect your brand’s unique personality.

Are there different formats available for online receipt templates?

Yes, our e-samples come in various formats: PDF, Word, Excel, Google Docs, and Google Sheets. Feel free to choose the format that works best for you and your business.

Do I need any special software to use online receipt templates?

No. Most of them are designed to be user-friendly and accessible from any device with an internet connection. No need to download any special software to use them.

Can I store digital copies of receipts generated from online templates?

Absolutely! It’s a common practice to store digital copies of files. And it comes with a few perks, too. It helps with record-keeping, makes it easier to track expenses, and makes sure that you have backups in case you need them for reference or audits.

How do I make sure that my receipts adhere to legal rules?

Online receipt templates often come pre-designed with fields for must-include information required by law e.g., the date, amount, and transaction details. When you use these documents and fill out all the necessary information accurately, you can make sure that your receipts meet legal requirements.

What if I make a mistake on a receipt generated from an electronic template?

No worries! Most online receipt templates allow you to edit or make corrections easily before finalizing and sending them to your customers. Just double-check everything thoroughly and make any necessary corrections before sharing the files.

Can I use online receipt templates for international transactions?

Absolutely! These documents are versatile and can be used for transactions with clients worldwide. They offer exceptional flexibility and convenience, which makes them ideal for businesses operating on a global scale.

Are online receipt templates free to use?

Our digital templates are available for free, but other services may offer additional premium features for a fee.

Can I access my receipt templates from multiple devices?

Absolutely! You can create and manage your receipts in a buttery-smooth way on your computer, tablet, or smartphone.

Are there templates available for different industries?

Yes, indeed! SaldoInvoice offers a variety of templates tailored to specific industries. You can be in retail, hospitality, consulting, healthcare, insurance, or any other sector. Via our service, you are guaranteed to find forms designed to suit your business needs.

What if I need to issue refunds or adjustments on a receipt?

No problem at all. Our forms allow you to make adjustments or issue refunds whenever necessary. You can edit the receipt to reflect any changes in the transaction details and resend it to your customer with the updated info.

Are your online receipt templates environmentally friendly?

Of course! Opt for digital receipts instead of paper ones to help reduce paper waste and minimize your environmental footprint. Plus, digital files are easier to manage and store. That saves you from cluttering up your office with piles of paper.

Do you take any steps to protect my data?

Definitely! Our platform uses encryption technology to shield your data and guarantee its privacy and security. Additionally, we follow strict data protection rules e.g., GDPR to protect your sensitive info.

Are your online receipt templates compatible with accounting software?

Yes, they are. Our platform integrates effortlessly with popular accounting software. This allows you to speed up your financial management process and automatically sync your receipts with your accounting records.

How can I spot a fake receipt?

Real ones are sharp, with clear logos and all the purchase deets. Fakes? They’re like a bad photocopy — blurry and missing crucial info.