How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

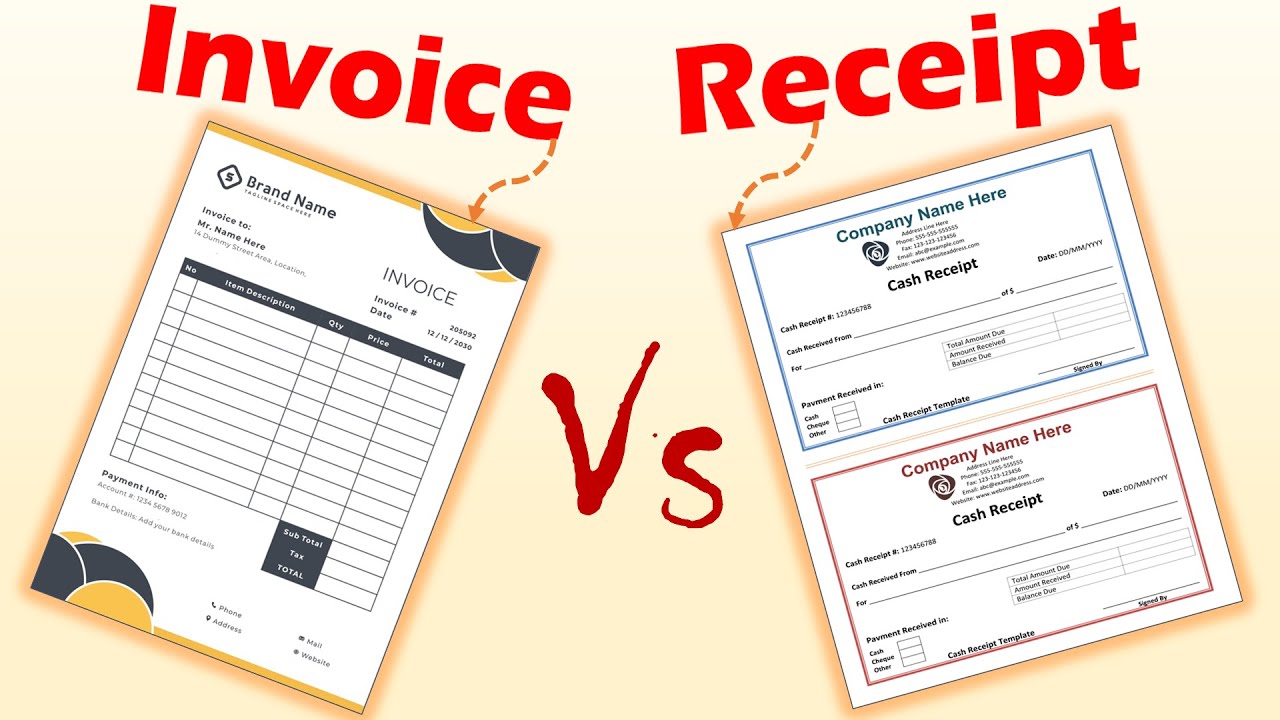

Small and large businesses need to maintain correct and clear documentation. It’s especially true for sales and transactions, which should have a written confirmation. As a freelancer and self-employed, you do paperwork on your own. You need to navigate in business terms. In this article, you’ll learn the receipt template and invoice definitions and understand when to send each of them.

Receipts are one of the most common documents in our daily life. Every day, you make purchases in stores or on the Internet and receive proof of payment. Unlike other forms, the receipt of sales is issued to a buyer after they’ve deposited money for goods or services. They can be written out on paper or electronically. These files are essential for entrepreneurs and their customers to solve accounting issues and control budgets. They can also help resolve conflict situations.

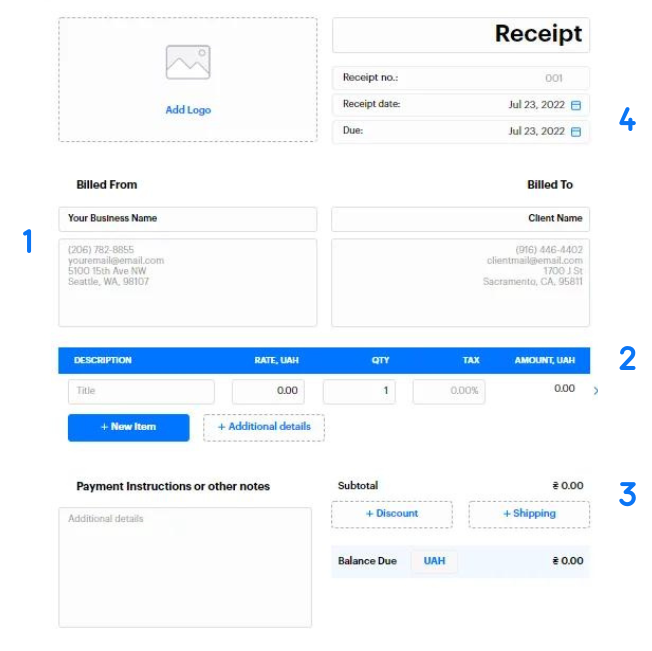

If you compare a sample of invoice and receipt, you’ll see that the second is less detailed. There are no special requirements for it regarding the availability of specific info. However, remember that the more data in it, the faster you can resolve controversial issues. So, what should be in a receipt? Typically, it includes:

If you wish, add a payment method and brief information regarding the return of goods here. As you can see, payment and receipt are related to each other.

Now that you know how to write receipts for payment let’s move on to invoices. Unlike the previous item, they are issued as a request for compensation after an order has been done. After receiving it, a client should transfer the agreed amount to the contractor’s account within the specified time frame. To make even complex invoices easy use invoice template google sheets.

Is an invoice the same as a receipt? No, invoices are official docs, which are pretty strict in some countries. If you work with foreign orderers, clarify what you need to include in a document to comply with local laws. When creating securities using Invoice Maker by Saldo Apps, provide the following information:

What is the invoice number on a receipt? The invoice number (or ID) is indicated in a receipt so that both parties involved know what exactly the money was paid for. It’s important information for bookkeeping, accounting, and tax reporting ?

What are the terms of invoice payment ? Your clients should be informed up front about your expectations for their payment and the available payment options by reading the information you include on your blank invoice template.

As you can see, an invoice and receipt are really different in terms of content and purpose. Despite this difference, both of these forms are required for your company to function properly.

| Invoice vs. Receipt | |

|---|---|

| A request for payment | Proof of payment |

| Before payment is made | After payment is made |

| Explains to clients how much they owe and when that money is due | Legal proof that a customer paid for the purchase of a product or service |

As part of a contract with a client, you provide them with services or products in the agreed amount and for a specified cost. After completing an order (or a certain stage of it), you should use PDF, Excel, or Word templates for invoices. So you record the fact that items were rendered and officially demand compensation from a customer.

In turn, an orderer, after receiving an invoice, should transfer the total amount within the time specified in a paper. After getting money, provide them with a receipt as proof of payment. You can send it to them electronically or on paper. If you have lots of clients, manually doing it might be tricky. It’s better to simplify your task by using automated systems that send documents after receiving compensation.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…