How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

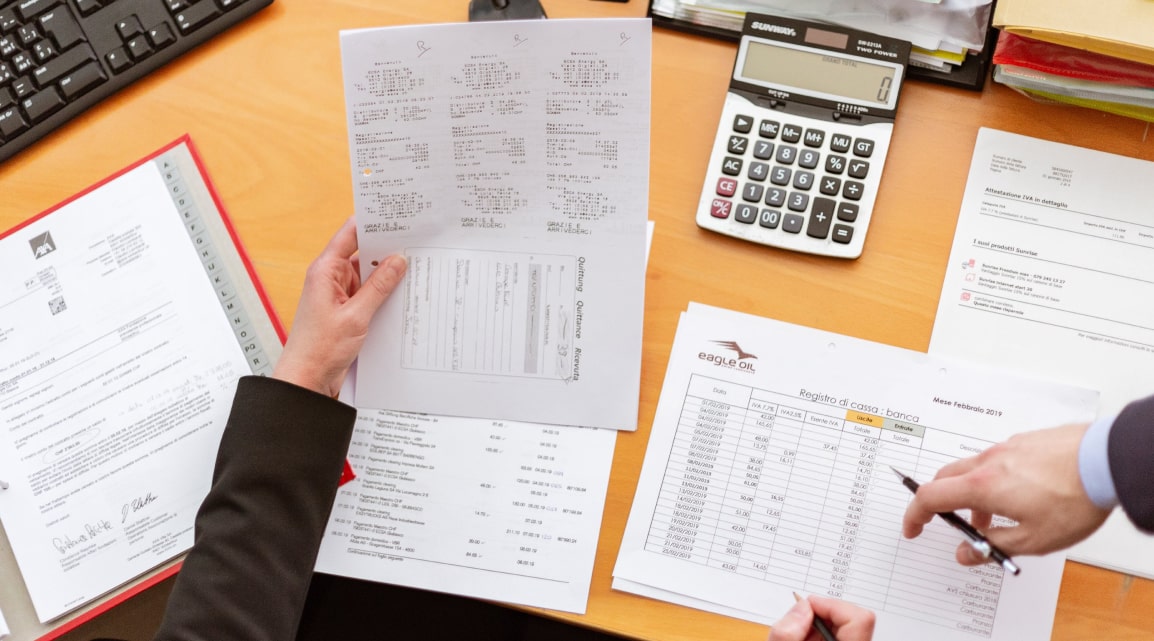

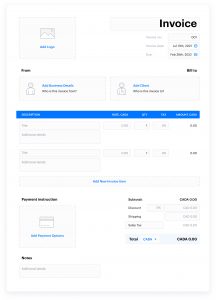

Invoices are documents created by a supplier of goods or services to request payment from an orderer. Freelancers, vendors, independent contractors, and other self-employed people use this type of paper to be compensated for the tasks completed. You can create forms yourself or opt for ready-made templates with empty fields for filling on the Saldo Invoice app. Typical blank invoice samples contain the following blocks:

As already mentioned, an invoice is a document that a contractor creates and transfers to a customer. If you are a client who orders products and pays for them, such a document will be called a “bill” for you. As you can imagine, we are talking about the same file; its name depends on the perspective. A client is required to provide compensation for the services or goods they get having received a generated invoice. They have a certain time to transfer the agreed amount to the provider’s account. That is how to bill customers.

Bill and invoice accounting is necessary so that both parties to an agreement can plan their budget and calculate and pay taxes. To simplify these tasks, standardized forms are used, in which it is easy to find the details they need. Despite it, you can modify a file and specify additional information or, conversely, exclude some fields depending on the specific situation.

Any business can use the two names given in the article. What is a business in accounting? This term denotes various entities that operate for their profit. They can both provide goods and services and receive them. In the first case, the documents used will be called invoices; in the second — bills. That is, it all depends on whether you are a sender or a recipient.

Is an invoice the same as a bill ? Some major differences between invoices and bills apart from each other. An invoice and a bill are documents that bequeath the same information about the amount owing for the sale of products or services, but the term invoice is generally used by a business looking to collect money from its clients, whereas the term bill is used by the customer to refer to payments they owe suppliers for their products or services.

Is an invoice the same as a bill ? Some major differences between invoices and bills apart from each other. An invoice and a bill are documents that bequeath the same information about the amount owing for the sale of products or services, but the term invoice is generally used by a business looking to collect money from its clients, whereas the term bill is used by the customer to refer to payments they owe suppliers for their products or services.

Besides such a simple difference in the name of the same file, there are also minor differences in purpose. Invoices, as a rule, are highly professional forms that are used in B2B sales and contain detailed information about customers, contractors, provided goods, and available payment methods. They also indicate whether items are taxable, and if so, what percentage of the tax is added to the total. Usually, an orderer has some time (a week, 15, or 30 days) to deposit funds for the work performed. Let’s read clear from a table about invoice vs bill:

| BILLING VS.INVOICING | |

|---|---|

| One time use | Can be re-occuring |

| Paid by the customer | Paid by a client |

| Transactions completed in one go | Used to request payment |

| Bills confirm the payment | Invoices need receipts to confirm the payment |

| Bill may not include detailed customer | Invoice usually include detailed client information |

The term “bill” often has a more general meaning. Such a paper generally contains less data than its counterpart. It lists the goods provided, their price, total amount, and sometimes taxation. Typically, bills are issued in restaurants, hairdressers, and similar places (i.e., B2C sales) and require immediate payment from a recipient. A “check” is another word for a bill.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…