How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

There are certain standards that every company should adhere to in any industry. For example, if most of your competitors give customers a 90-day payment deadline, it’s not profitable for you to offer more “stingy” terms. But what about freelancers, for whom such a gap between payments can be harmful? To avoid downtime, you can resort to small business invoice factoring. It’s a handy tool with which you enhance your money flow. SaldoInvoice explains how works factoring services for small business and what its pros and cons are.

Here is the invoice factoring meaning in simple terms. It implies the transfer of bills to be paid by clients to a third party. In exchange, you get the opportunity to receive most of the amount that a debtor should deposit into your account in a short time. In fact, you get access to factoring business loans, although this money is not a traditional loan from a technical point of view.

Depending on the conditions of a particular service provider, invoice factoring rates and interests may differ. As a rule, the sum you get on hand varies from 70% to 90%. Fees may also vary and range from 1% to 5% monthly. You can receive the agreed amount from a factoring agency within two days instead of waiting for payment from a client for several weeks or months.In case your business is in dire need of money, you could apply to a bank for a traditional loan. However, you will most likely be required to leave a deposit.

Moreover, it takes quite a long time to verify your company and review your application.

In the case of invoice factoring, no credit check is needed. The basis for the funds’ provision is the availability of correctly completed bills. Therefore, use an invoice template Google Doc, Sheet, PDF, Excel, or Word formats not to miss important information.

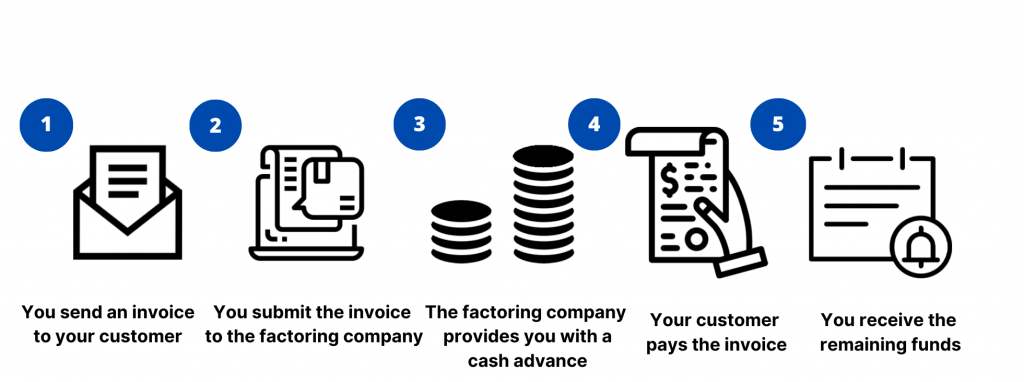

This tool works quite simply:

Even with this approach, there is still the possibility that a client will not pay on time. Factoring agencies protect themselves from such risks and charge higher fees or require payment from you.

For small businesses, invoice factoring offers many significant benefits:

Along with the listed pros, you, as a small business owner, should be aware of the contras this financial instrument has:

| Advantages | Disadvantages |

|---|---|

| Immediate | Can be expensive |

| Speedy | Reputation may suffer |

| Quick access to cash flow | Problems if the customer does not pay |

| Does not affect debt-to-equity ratio | Can make client relationships more difficult |

Before using this tool, you should consider all factoring pros and cons. The benefits of invoice factoring for small businesses are huge, but the downsides can negatively impact their operations.

Aside from the benefits that have been already mentioned, invoice factoring provides owners of small companies with the following advantages:

Despite this, several downsides are associated with this practice:

It is common for small businesses to struggle when managing cash flow. Invoice factoring is one of the possible solutions to this problem as it allows you to gain immediate access to cash and eliminate the time it takes for customers to send in their payments. As a result, this money can be readily used as payroll and to cover operational costs, which will enhance your financial stability.

Here are some helpful tips for choosing and using factoring services:

Overall, it is important to ensure that customers are aware of the factoring process and are comfortable with it. This will prevent any misunderstandings and potential damage to your relationship.

As a result, it is very hard for a small business to figure out on their own whether this method will benefit them or not.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…