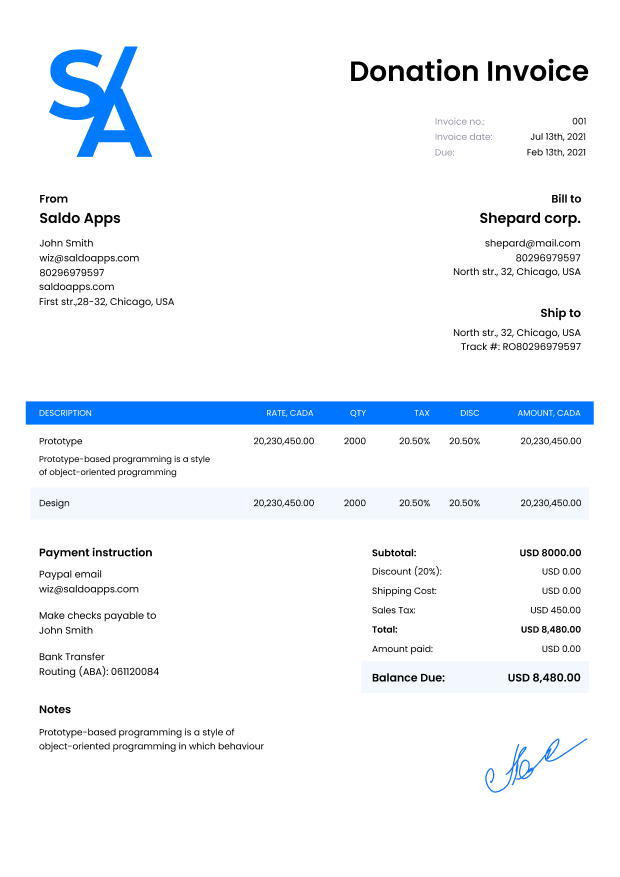

Donation Invoice Template (Non-Profit)

Do you need more Invoice Designs?

Customise your Invoice Template

About our Donation Invoice Template

If you’re a non-profit organization invoice template, then you probably know how difficult it can be to create an invoice for donations. We’ve created an easy way for you to do just that! Our free donation invoice sample has all the features and customizable sections needed for any donation receipt, whether it’s from one person or thousands of people. Simply download our template and customize it with your own information and logo–then send out those receipts!-

Non-Profit Invoicing Made Easy with Donation Invoice Template

One of the most important aspects of running a successful non-profit is keeping track of all your income and expenses. If you want to be able to do this, you’re going to need an invoice template that’s easy to use and understand.

What is an invoice for a donation?

A donation invoice template is a document that uses the format of an invoice to track the amount of money donated by a donor to an organization. It’s important for invoice for non profit to keep track of their donations, but it can be difficult when you have so many people giving small amounts at different times. A donation invoice template helps organize this information and make it easier for you to report back on what your organization has received over time.

The most important thing about this type of document is that it’s not just used for tracking purposes: it’s also legally binding! If someone makes a donation through one of these templates, then they will expect tax benefits from doing so (for example if they claim it as charitable contribution).

-

How to Create a Donation Invoice

To create a donation invoice, follow these steps:

- Create a document in Excel or Word.

- Make several fields for entering information.

- Enter the name of your organization.

- Enter an invoice number for this transaction (this will be used to identify each invoice).

- Enter the date on which you are sending this invoice.

- Enter how much money was raised by this event or campaign in its entirety, including any fees charged by third parties like payment processors or crowdfunding platforms.

- Add description fields as needed – for example, if it’s an event ticket sale where attendees paid for admission at the door rather than online beforehand.

-

How to Create a Donation Invoice from a Sample

Or you can make it faster and easier!

- Fill in the fields with the information.

- Check all the points of your invoice template and make sure to fill in all relevant details.

- Save the file as PDF and send it to the customer.

Done! Your invoice is perfect.

Our free donation invoice template is a simple-to-use and easy-to-download PDF document that can be used for any donation you receive. The template includes all the information necessary to create a professional, customizable invoice for your non-profit organization.

It’s important that you keep track of all donations received so you can use them in future fundraising efforts and report them accurately to the IRS (if required). Our template allows you to do this by providing fields for donor name, address, phone number(s), amount donated along with an area for comments about their experience with your organization or event if applicable.

When to use a non profit invoice template for nonprofit organizations

If you are a non-profit organization and need to create an invoice for your donors, then using a donation invoice template is the best way to go. This will save you time and energy, as well as give you more room for creativity.

If you are a non-profit organization and need to create an invoice for your donors, then using a donation invoice template is the best way to go. This will save you time and energy, as well as give you more room for creativity.

You can use these templates to create professional looking invoices that will impress potential donors and clients alike!

A sample invoice for charity donation for nonprofit organizations can be used in various situations, but it is primarily utilized when an organization receives a donation from an individual or a business. The invoice template helps the nonprofit keep track of the donation amount, the donor’s name and contact information, and the purpose of the donation. This information is essential for the organization’s record-keeping and tax purposes. Additionally, using an invoice template ensures that the non profit invoice for donation sends a receipt to the donor for their donation, which can help build trust and foster ongoing support from the donor. Nonprofits should use a donation invoice template consistently to streamline their donation management process and provide transparency to their donors.

This donation invoice template is a great way for nonprofits to keep track of their donations and make sure they’re getting paid for their work. The format of this invoice can be customized to fit your organization’s needs, so feel free to make any changes necessary before sending it out!

-

FAQ

What is a donation invoice template for non-profit organizations?

A donation invoice template for non-profit organizations is a document used by non-profit organizations to provide donors with a formal record of their contributions. It includes details such as the organization’s information, donor details, donation amount, purpose of the donation, and any applicable tax information.How can non-profit organizations use the donation invoice template?

Non-profit organizations can use the donation invoice template by downloading it from our website and customizing it with their organization’s name, contact information, donor details, donation description, and any other relevant information. The template can then be saved and used to issue invoices to donors for their contributions.How do I properly fill out a donation invoice for a non-profit organization?

Ensure the donation invoice includes the donor’s name, donation date, donation amount, and a detailed description of the donation (monetary, goods, services). Also, include your non-profit organization’s details, such as name, address, and tax-exemption status or ID. It’s crucial to mention whether the donation is tax-deductible and provide any required legal language about charitable contributions.Can I include my non-profit organization’s logo on the donation invoice template?

Yes, you can include your non-profit organization’s logo on the donation invoice template. Adding your logo helps create a professional and branded invoice that represents your organization effectively. Customize the template by inserting your logo in a prominent position, such as the header or footer.Are donation invoices issued by non-profit organizations tax-deductible?

In many countries, donations made to non-profit organizations are eligible for tax deductions. However, the tax-deductibility of donations can vary depending on the specific tax laws and regulations of each country. It is recommended that donors consult with their tax advisors or local tax authorities to determine the eligibility of their donations for tax deductions.