How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

Any work should be paid. Unfortunately, there are situations when customers forget about it or intentionally do not transfer money for a completed order. How to be in such a situation? How to collect past due invoices? And what levers of pressure do you have at your disposal? You’ll find answers to these questions and effective solutions in this article.

Commercial invoices for contractors and freelancers are used to claim compensation for products provided. It’s issued after the work on the order is completed. Along with sending a file, it’s recommended to write an invoice follow-up email, specifying brief information regarding the order and the amount to be paid. Such a polite and gentle message encourages timely payment. After that, a recipient has a certain period during which money should be transferred to your account.

Suppose you still have not received the compensation due. In that case, you need to write a friendly overdue invoice letter with a reminder and clarification on whether everything is in order with a customer. It may well turn out that they simply forgot about the payment and not maliciously didn’t pay. If a recipient is still ignoring you, move on to more active steps. Send a strong letter for outstanding payment stating that you’ll begin to accrue interest for late payment and that if you don’t receive the money soon, you’ll apply legal actions.

By the way, there are tools to protect businesses from dishonest clients. So, for example, you can contact the third party in advance and use finance invoices to avoid losing the funds.

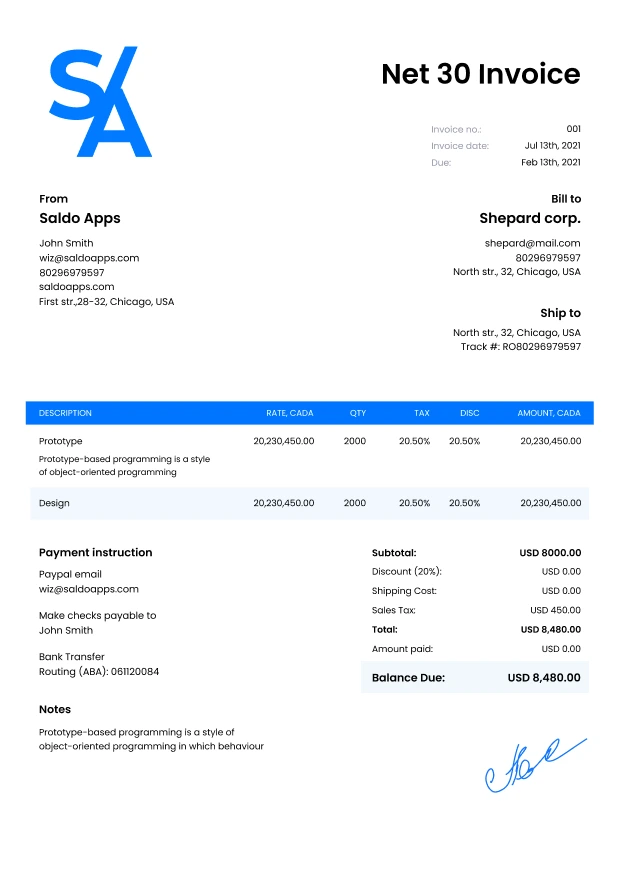

So, what is an outstanding invoice? It’s a document that has expired, and you still haven’t got payment from a client. Of course, you do not want to allow such situations, so you need to gently remind an orderer to transfer funds to you before the end of the agreed period. Whether generated manually or using SaldoInvoice, your invoice should clearly state the time during which you are waiting for payment. It may be indicated by a specific date or given as, for example, “Net 30, 45, etc.” The second option shows that a recipient has 30 or 45 days to make a payment from the moment the invoice is issued.

To motivate orderers to pay quickly, offer them a discount. Your contract and the Excel, PDF, or Google Docs template invoice should reflect such an offer. For example, the phrase “5/15 Net 45” means customers will receive a 5% discount if they transfer money within the first 15 days.

When the payment deadline has expired, and the money has not arrived, it’s time to write a reminder. When compiling an unpaid invoice past due invoice letter, it’s essential to use the correct terminology. Avoid jargon and slang, attach copies of late invoices to each text if a client has lost the previous ones. It’s a good idea to ask leading questions in a letter, such as when you should expect funds to arrive. It’ll force a recipient to write you a reply.

Do not send letters randomly; it’s better to stick to a certain schedule. Remind clients about payment a couple of days before the end of the period, then a week or two after the deadline. After that, write them a 30 day past due letter with a persistent reminder of the debt, then 60 and 90 days past due letter with a notice of legal actions on your part.

Collecting past due invoices can be quite nerve-wracking if you don’t know what to do and how to compose reminders. Here is a template for a general debt letter:

To: [the client’s legal name]

Subject: [your company’s name and invoice ID]

Dear [client’s name]

I hope you are doing well!

As I haven’t received your payment, I wanted to remind you that the invoice [its issue date, ID, and sum due] is 14 days overdue. Could you please specify when I can expect payment from you? If you’ve got any issues or questions, just let me know.

I’ll be waiting for your response.

Best regards, [your name and title]

It is essential to maintain direct contact with customers and save all correspondence. In the event of litigation, you’ll be able to prove that you did everything possible to get paid on time.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…