How to Apply a Discount to an Invoice

How to Apply a Discount to an Invoice A good discount is what your customer…

As you can see, there are a lot of invoicing purposes, and they are all essential for doing business. You should write out such documents for each sale. If you have a lot of orderers, this kind of work can be a headache. Fortunately, Saldo Invoice makes your task easy. Using this service, you can fill out and send papers wherever you are. If you are logged into your account, the system will automatically fill in your data and help you quickly enter customer contacts and a list of provided goods and services based on the orders you completed earlier. Using our editor, you can select any sample you need, like a template pro forma invoice, and adjust it to fit your needs.

While many people talk about invoice meaning in business, some forget that they also have a lot of value for customers. They help with personal bookkeeping, budget planning, and keeping track of how much more to pay. Besides, using these documents, clients can claim tax credits they paid in trades. As a responsible business owner, you should provide your orderers with the necessary papers.

Based on the listed purposes, we can conclude that it is vitally important for companies to use prepared invoices in their activities. By and large, all documents generated by entrepreneurs in one way or another are needed for accounting. You should know all the sales details no matter what you do, which is what financial records provide.

Printing invoices, coupled with contracts and other written agreements, bind customers and suppliers to certain obligations. Having these documents in hand, you can prove that you have fulfilled all the conditions on your part. It will protect you from dishonest customers, scammers, potential lawsuits, and financial losses.

Also, since any business has to pay income and other taxes, the analysis and storage of payment documents are obligated. You can calculate the required amounts, make deductions, and request exemptions based on the securities confirming transactions.

Most software for small business invoices offers a convenient reporting system based on the files you create. You can find out which services or products are in high demand and which customers have been the most active over the past months. It allows you to analyze your work, plan further development and set up marketing campaigns.

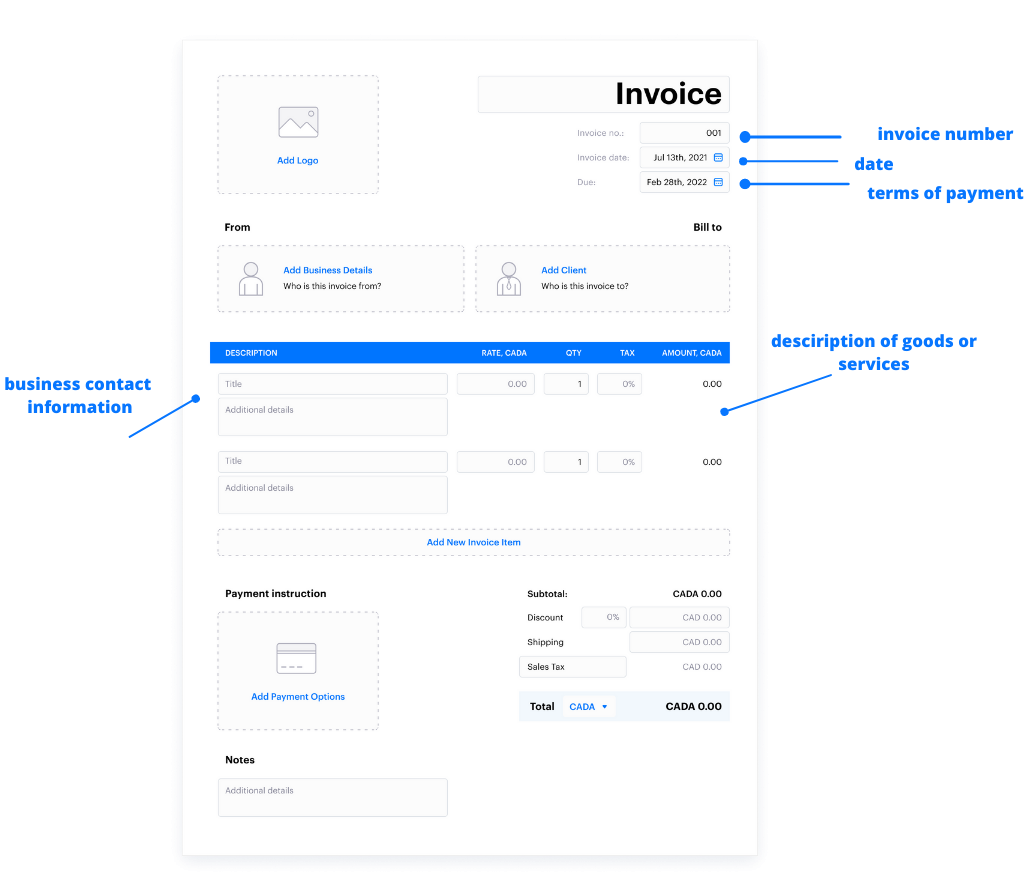

Your invoices should include the following information for record-keeping and tax purposes:

The standard answer to this question from the IRS is three years. However, there are situations when this period needs to be extended to four, five, or more years. Much depends on the legal, scientific, and practical value of papers. Also, the situation can be complicated by various factors. For example, if the tax office suspects you of withholding information and decides to audit your company, all copies will have to be kept even longer.

In general, given all these circumstances, professionals recommend keeping documents for seven years. If you work with paper forms, you need a whole archive for it. So online services and mobile apps are the best way to invoice for a small business. There is enough space in a cloud for all your needs.

How to Apply a Discount to an Invoice A good discount is what your customer…

How to Add Taxable and Non-Taxable Items on One Invoice Invoicing is never as straightforward…

3 Reasons to Use Paperless Invoices It is 2024 out there, and machines have already…