Customer Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

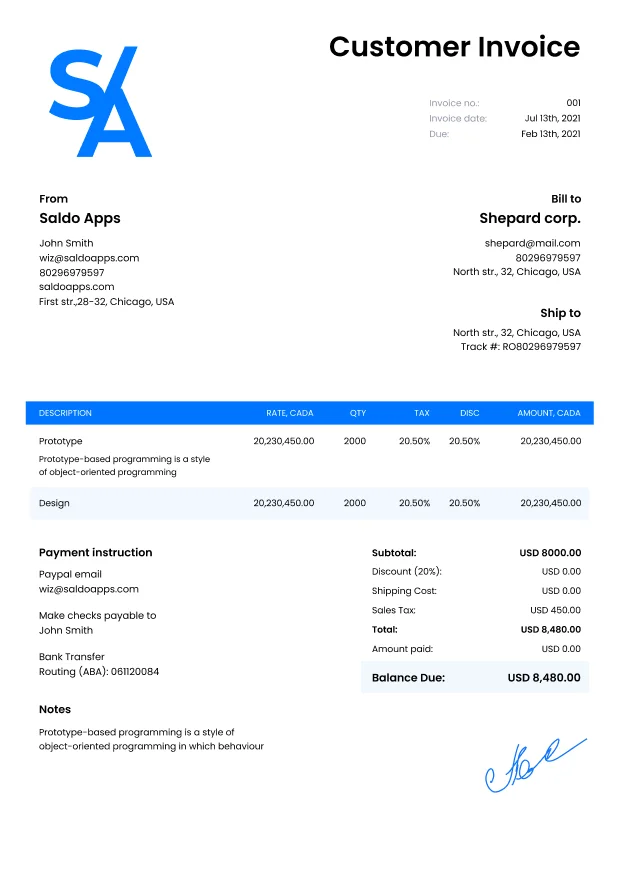

About our Customer Invoice Template

Every small business uses customer invoicing. Regardless of your business field, whether it’s the food industry, retail, or service sector, you should issue clients full, clear, and correct documents. Simplify this process with Invoice Maker’s customer invoice sample.-

How to Create a Customers Invoice

Whether you’re a one-person operation or a large company, creating invoices is an essential part of every business. In this article, we’ll explain how to create professional-looking and accurate customer invoices in just minutes using Invoice Maker.

1. Create a template

You can use an existing invoice template or create your own from scratch. Templates are available in the Saldo Invoice app or website, and they’re easy to use – just fill in the blanks! If you want to keep your first few invoices simple, we recommend saving them as drafts before sending them out so that no one sees what they look like until after you’ve had time to perfect them.

2. Select the invoice type

- You can create different types of invoices in the app. The invoice type you select will determine the layout, fields, colors, and information that appear on your invoices.

- There are a lot of different types of templates. You can choose one by clicking on the “Invoice Templates” at the top of the page.

- You need a sample, which will meet your needs.

- Also, you can create Estimates, Quotes, Receipts, and Purchase Orders as well as invoices for other purposes, for example, invoice for rental property template or invoice with discounts.

3. Enter customer details

Once you have chosen your perfect template, it’s time the start entering the invoice date and your company name, and customer details.

Once you have chosen your perfect template, it’s time the start entering the invoice date and your company name, and customer details.- First, enter the customer’s name. You should be able to pull this from their invoice or other business documents. If not, ask them for it when they call with questions about the invoice later on in this process!

- Next, enter their address and phone number–if possible–to make sure that you have all of their contact information handy if needed during future conversations with them about payment or other issues related to this specific invoice/invoice batch (more on batches later).

4. Enter your business details

Next, you need to complete information about your company.

- In the ‘Your Business Name’ box, type the name of your company.

- In the ‘Address’ box’, enter the physical address where you’ll be shipping products to customers or receiving payments from them.

- In this box, enter also a phone number that clients can call if they have any questions about their invoices.

- And under all the main information, enter whatever info you want people viewing their invoice online to see–it could be anything from your Twitter handle (@AwesomeCo) all the way up through links back into your website itself!

5. Enter or select the invoice number and date

Enter the invoice number and date. The invoice number is useful for tracking purposes, while the date is when you want to send your customer an invoice. You can also choose to enter a due date for this specific invoice.

6. Add tax information

Tax information is used to calculate the amount of sales tax you charge and should be accurate and up to date. You can use it when calculating sales taxes on items that have different prices, such as when selling an item with multiple versions (for example, a product in different colors or sizes).

7. Fill in line items and descriptions

Once the invoice is created, you can fill in the line items and descriptions.

- Describe each line item. Describe the item and quantity, as well as its price and tax. For example, if an invoice is for one shirt with a retail value of $20, write in the”Description” > “Title” “Shirt”, then in the quantity box “1”, and Rate: “$20”. If there are two shirts on this invoice with a total value of $40 ($20 per shirt), write “2” in quantity and the amount will count automatically. You’ll also need to indicate whether or not any discounts were applied during checkout; if so, include them here.

-

Your Business Can Invoice Customers Quickly and Easily Using Invoice Maker

You can invoice customers quickly and easily using Invoice Maker. This app allows you to create professional-looking invoices in minutes, without any complicated setup or design work. You can even save templates so that they’re ready whenever you need them!

Our service is a cloud-based software that allows you to create professional invoices for your customers. It’s easy to use, and you can create invoices in minutes!

You can send your invoices via email or print them out if needed.

-

FAQ

What are the key elements that should be included in a customer invoice template?

A customer invoice template should include your company’s contact information, the customer’s details, a unique invoice number, a description of products or services, quantities, prices, and payment terms.Can I include late payment fees in a customer invoice template?

Yes, you can specify late payment fees and terms in the payment terms section of the invoice template to encourage prompt payment.Is it possible to send customer invoices electronically using this template?

Yes, you can send customer invoices electronically by saving them as PDFs or using an electronic invoicing system.Can a customer invoice template be used for both goods and services?

Yes, a customer invoice template is versatile and can be used for billing for both products and services.Are there any requirements for keeping records of customer invoices?

It’s important to maintain records of customer invoices for tax and accounting purposes. The specific record-keeping requirements may vary by jurisdiction.