Freelance Invoice Template

Do you need more Invoice Designs?

Customise your Invoice Template

About our Freelance Invoice Template

Freelancers are often very busy and do not have time to create different types of accounts. To keep track of your finances, you can use our invoice templates for freelancers, it will help you to create and submit invoices in a matter of seconds. Download freelancers invoice templates in PDF, Excel, Word, Google docs, and Google Sheet.-

Ways of Using Freelance Invoice Template

Vendor and freelancer work might be tricky. In addition to providing excellent service quality, they have to deal with administrative tasks and bookkeeping. It can be difficult for small business owners to find high-quality and functional software for doing paperwork. That is why we developed Saldo Invoice to simplify the billing process for self-employed people and create freelance or developer invoice to meet all your needs for accounting purposes.

No matter what kind of industry you are in, use a template of invoice for services and customize it for each client or job performed. The main minus of many other forms is that they are designed primarily for traders. Our best invoicing software for freelancers is suitable for any activity, as it makes it possible to specify absolutely any products and goods they have offered. You may choose the cost per unit or enable the built-in tracker to monitor your time to complete an order. Use job template for estimate is a blank copy of your estimate form completed after consultation and listing all the project.

Besides, our tool greatly simplifies the total amount calculation, taking various fees, taxes, shipping costs, etc. When completing the self employed blank invoice template, indicate whether any of the items are taxable, include fees and other duties, and fill in the full shipping information (if you offer it). The system will automatically calculate the total based on all the records.

So that freelance invoicing does not take much of your time, our generator memorizes your business details, people you cooperated with, payment methods, generated files, and much more. Thus, authorized users can complete documents faster since some information is automatically inserted into lines or available for selection from your database. Thanks to all this, you have the opportunity to create forms on the go. For clients to pay as soon as possible and on schedule, you should promptly submit structured and professional bills.

-

Pros & Cons of Creating Self-Employed Invoice Template

Invoicing freelance work has both a number of advantages and some disadvantages. Among the benefits of utilizing docs for self-employed are the following:

- Users have the opportunity to generate customized files whenever they need;

- You can write out papers on any device handy for you: smartphone, PC, tablet, or laptop;

- You may accept payments in any currency and by any methods, including online;

- When filling out, you save time and stay organized even in a large stream of tasks;

- There are lots of popular formats available: PDF, Word, Microsoft Excel invoice templates, and so on.

- The documents you issued always look orderly, presentable, and professional.

When using a sample invoice, an independent freelance worker may face several difficulties, which introduces the disadvantages of such an activity. All administrative and accounting tasks usually fall on your shoulders. You need to keep track of all things yourself and remind customers about payment in case of the delay. If you have any issues, look at the example of an invoice for freelancers and fill out the paperwork correctly.

-

Main Elements of Freelance Service Invoice Template

Working as a freelancer involves a variety of tasks. To get paid for all services provided in full, an independent contractor should create an invoice for freelance work, including the following details.

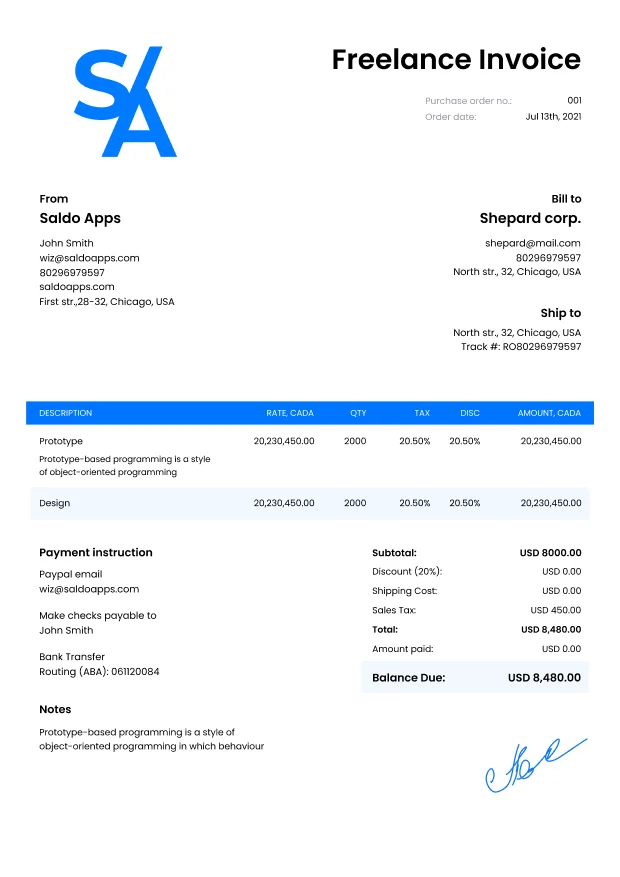

Main Elements of Freelance Service Invoice Template 1. Header The most visible part of self-employment invoices should have their output data: title, ID, creation date, and the due date for payment. You can also add your logo to make the file look more professional. 2. Participant Details Enter the customer’s and contractor's names, addresses, and contact details. It can be both personal and business details. If you also deliver goods, specify the shipping address separately. 3. Order Details List goods, services, materials involved, rate per hour or unit, hours spent or units, tax, and additional details. Add as many extra lines as needed to include all the work done in the invoice. 4. Extra Services Add the shipping cost to the order price or a discount to this order. Calculate the total amount due. If you use the Invoice Maker template, the system will calculate it automatically. 5. Payment Methods List all available payment methods, add instructions, and write the payment deadline again. It is not superfluous to remind your clients about late payment fees or early payment discounts (if applicable). What to Consider When Filling Out a Freelance Work Invoice Template?

With our freelance invoice generator, you get access to ready-made templates with fillable fields. Therefore, you can be sure that you don’t miss any critical information. Although our online solution simplifies the creation of payment documents, you should still follow some standard rules:

- Each invoice should have a unique ID in your document system. You can use plain serial digits or add order numbers, customer initials, and other distinctive characters and symbols. IDs should not be repeated, and they must be consistent.

- Make the order description as detailed as possible. Freelance work involves various activities and tasks, and clients want to be clear about what they are being charged for. Feel free to use the example of invoice for self-employed as a reference if your order is complex and includes both hourly billing and fixed cost materials.

- If your business is in an international format, consider local invoice requirements and include all applicable taxes.

- Be professional, avoid using slang and jargon, and make sure that there are no errors in the entries. Also, be polite and add a thank-you note to the document. It will help you leave a good impression and increase the chances that clients will get back to you.

- Don’t hesitate to specify late payment fees. You certainly want to build trust with your customers, but you also need to be able to protect yourself from scammers and forgetful payers. The prospect of fines motivates customers to pay on time.

FAQ

1. How do you invoice a freelance client?

To make an invoice for a client from freelancing, you need to specify exactly what services were provided and the cost of the work performed, as well as other details that were agreed upon by the parties before the start of work, then there will be no claims and payment will be received at the agreed time.

2. How to send a freelance invoice?

Prepare a filled freelance invoice with all information needed. Click the Download button and you will get a ready-to-send invoice for freelancing jobs. Save it to your device and send it as an additional file by email.

3. How do I write my first freelance invoice?

With our ready-made invoice template for freelancers, you don’t have to worry about forgetting to indicate important business details, all the required fields are already indicated, you just have to fill in the details about the services provided and send the finished template.

4. What should be included in a freelance invoice?

- your business information and the business information of your client

- invoice number

- list of provided services

- total amount to be paid

- all the additional information you want to include

-

FAQ

Can I use a freelance invoice template for one-time projects and ongoing contracts?

Yes, a freelance invoice template is versatile and can be used for both one-time projects and recurring contracts.What information should I include in a freelance invoice?

A freelance invoice should include your contact details, client’s details, a breakdown of services, hourly rates or flat fees, and the total amount due.How can I calculate taxes in a freelance invoice template?

You can include a separate section for taxes and calculate them based on your local tax laws and rates, or you can list taxes as a percentage of the total amount.Can I include payment options like PayPal or bank transfer details in the freelance invoice?

Yes, it’s a good practice to provide clients with various payment options, including PayPal, bank transfer, or other methods you prefer.Is there a standard format for due dates in a freelance invoice template?

Due dates in freelance invoices are typically specified in terms of days from the invoice date or a specific calendar date, depending on your agreement with the client.